- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

Why I chose a prepaid credit card

This is a guest post.

You can’t get credit without a credit card, and you can’t get a credit card without good credit. This is a dilemma that many people find themselves facing, whether they are trying to re-establish their credit or build credit for the first time. In fact, this is the dilemma that I found myself in. My solution was to get a prepaid card, and here’s why.

The Real Deal with Prepaid

Prepaid credit cards have earned a mixed reputation over the years. While it’s true that they usually have more fees than a regular credit card, they also offer a financial solution for people who don’t have good credit. And you should also keep in mind that they don’t charge interest because the cash that you are using is yours to begin with. The important thing to remember about prepaid cards is that they are a means to an end; once you rebuild your credit, you’ll find it much easier to apply for a card with better rates and fewer fees.

In addition, prepaid cards offer several advantages. The most important one for me was the convenience of having a card that I could use to make purchases. Prepaid cards look and work exactly like regular credit cards (you don’t have to enter a personal identification number to use them), so the only one who knows it is prepaid is me. And while I use cash for everyday purchases, there’s no avoiding the need for a card when you have to shop online or pay for gasoline at the pump, for example. Most digital merchants only accept payments from cards linked to large financial brands like Mastercard and Visa, and my card gives me a way to buy what I need from whoever has it in stock. In addition, my prepaid card offers me a way to keep track of all of my purchases electronically, which is helpful since I am trying to keep a closer eye on my budget.

Prepaid cards also offer security. Cash can easily be lost or stolen, but if you lose a prepaid card, you can easily get a replacement. More importantly, your balance is protected by a replacement guarantee from your bank, which comes in handy if you ever have to dispute fraudulent charges.

Perhaps the most convenient factor of a prepaid card, though, is how easy it is to get one. You don’t have to have a bank account in your name to receive a prepaid card. However, if you do have an account, you can easily link it to your prepaid card.

Changing my spending habits and getting out of debt hasn’t been easy for me, but one way for me to show creditors that I am getting better at managing finances is to build my credit with my prepaid card. It’s also a way for me to eventually be able to make big purchases that are necessary, such as a car, and hopefully one day, a home. Prepaid isn’t for everyone, but if you find yourself considering this option, it’s worth a second look.

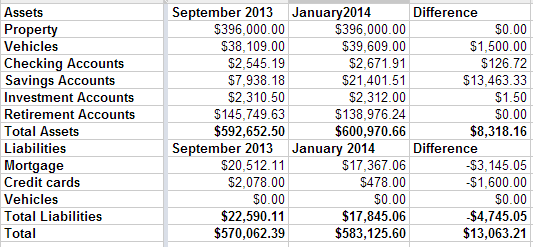

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Twinkies: A Failure of Unionization

Twinkies may survive nuclear warfare, but the iconic sweet treat ultimately couldn’t withstand the might of the unionized workforce. Faced with mounting losses and overwhelming debt, due in no small part to the relentless demands of the various unions representing the nearly 19,000 employees, Hostess Brands filed bankruptcy for the second time in January 2012 and ultimately requested permission to liquidate it’s assets in November of last year when a buyer failed to materialize. While many factors played a part in the demise of the maker of such all-American snacks as Ding Dongs and Ring Dings, as well as childhood favorite Wonderbread, there is no denying the fact that costs imposed by union contracts were a major factor in the shuttering of this once-beloved company.

Certainly America’s changing eating habits, increased competition from such companies as McKee Foods, makers of Little Debbie snack cakes, and rising commodity costs all contributed to the ultimate demise of Twinkies. There is no doubt, though, that union contracts inhibited the company’s ability to adapt and make the necessary changes to remain profitable. Not only were employee costs out of control, ridiculous union rules made it nearly impossible for the company to make money. These are just a few of the rules that hampered Hostess’ management:

- Twinkies and Wonder Bread could not be delivered on the same truck.

- Drivers could only deliver one product, even if they did not have a load and a load of another product was waiting to go out.

- Drivers could only drive. They had to wait for loaders to fill their trucks.

- Likewise, loaders could only handle one product. Their contract prohibited a Twinkie loader from helping out if the Wonder Bread loaders were shorthanded.

Yes, management agreed to these terms, but often they were forced to do so in order to prevent a costly strike. In fact, it was a labor strike that lead to the decision to liquidate.

Unions are meant to protect workers from dangerous working conditions, overbearing management and unfair labor practices. Ensuring a living wage and decent benefits is another of their responsibilities. However, it is evident that in this case, the unions became as much an enemy of the Hostess employees as of the company’s management. As a result of their unwillingness to compromise and make wage and benefit concessions, almost 20,000 people no longer have a job that needs to be protected. In the end, the unions drove not only the company but themselves out of business.

Not to fear, however. Two private equity firms acquired Hostess’ assets last fall and are beginning to turn the company around. Production of Twinkies began again in June, and the gooey sponge cakes returned to store shelves on July 15. The workforce has been dramatically reduced and will not be unionized. In the end, probably the only winner in this battle is America’s sweet tooth.

Related articles

What to Take Away From John Cleese’s Divorce

If you haven’t been kept under a rock your whole life, you’re likely familiar with actor and comedian John Cleese. Part of the infamous Monty Python crew, he starred in films such as Monty Python’s Quest for the Holy Grail, and television shows such as Faulty Towers. However, are you familiar with what has happened to Mr. Cleese financially over the past few years?

When Cleese divorced his third wife she ended up with a divorce settlement that quite literally made her richer than him, despite the fact that they were married for only 16 years and had produced no children.

Divorce is, unfortunately, a fixture of modern society, and people of both sexes need to know how they can protect their personal finances in case of a divorce. After all, these days more than 50% of marriages end in divorce, so not preparing yourself financially for it is engaging is some rather wishful thinking. So how best to protect yourself and your personal finances, should you be unfortunate enough to have to go through one?

If you are the higher-earning party, get a pre-nup prior to marriage; this simply cannot be overemphasized. Cleese himself, already married to wife number four, incidentally, was told that he should have her sign a prenuptial agreement, he initially didn’t want to, despite having just been taken to the proverbial cleaners. He only reluctantly had one written up when his legal team essentially insisted. Even though prenups can be challenged or modified in court, if you are the party bringing more assets to the relationship, it is irresponsible of you not to solicit a prenuptial agreement from a potential spouse.

Another thing to keep in mind is that you should protect assets you have in joint accounts with your spouse, and also begin to actively monitor your credit, if things become acrimonious between you two. This way, you will prevent them from absconding with the totality of your shared funds, or ruining your credit if they are feeling malicious. If you need further information on how to do this properly, speak with a qualified financial planner.

So if you find yourself considering marriage and either have significant assets to protect or suspect you might have them in the future, you owe it to yourself to look into the legalities surrounding prenuptial agreements, and other thorny issues related to personal finance. Failure to do so can end up seriously impacting your life in a negative way, should you ever be faced with a vindictive or greedy spouse; protect yourself!

Related articles

Does Amanda Bynes Need a Conservatorship?

The publicly documented downward spiral of Amanda Bynes may be reaching its breaking point. She has been on psychiatric lockdown for the past three days, and her parents are petitioning for conservatorship in California

on the grounds that they believe she is suffering from acute schizophrenia. They claim that the troubled starlet is unable to make safe decisions regarding her own well-being, not to mention the safety of others. The issue is complex, but the former childhood star has demonstrated that she meets the criteria to have external guardians instated to protect her from unpredictably irrational behaviors.

This was not the first criminal case against Bynes; she is also dealing with hit-and-run allegations in California. It was also not her last interaction with the police. Most recently, the actress doused an elderly woman’s driveway in gasoline and set it ablaze. She accidentally covered a puppy in the flammable liquid, so she ran down the block looking for something to save the animal from catching fire. After ransacking a convenience store, officers accosted her. The exchange resulted in the psychiatric hold that has been placed on Bynes.

Unfortunately, grounds for conservatorship can be exceedingly challenging to meet. Clear proof of mental illness needs to provided, and the standards are rigidly strict; however, if anyone has showcased the fanatical craziness that constitutes a lack of personal responsibility, it is Amanda Bynes.

Her schizophrenia is no longer dormant. The actress has become obsessed with plastic surgery, and she has deformed her face with cheek piercings. She uses online social networks to decry public figures for their ugliness. Victims of this attack include even Barack and Michelle Obama. Furthermore, she makes offensive sexual remarks towards rappers, and she wants to be a hip-hop artist herself. She has spent fortunes on a wig collection, and she employs a different style at every court appearance. The actress even used one as a disguise for an incognito trip to a trampoline emporium.

Anyone that has seen her Nickelodeon program would not be shocked to learn that she was schizophrenic. The role had her switching between dozens of identities for different skits, and she even played a character that was, in effect, obsessively stalking the star herself. “The Amanda Show” was neurotically fast-paced. Ultimately, the entire program can now be viewed as an eerie foreshadowing to the budding of a latent psychological disorder. If the legal standards of insanity are not met, then she will be free to wreak havoc on herself and others.