- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Budget Lesson, Part 4

Part 4 of the Budget Lesson series. Please see Part 1, Part 2, and Part 3 to catch up. The Google Doc of this example is here.

The final category in my budget is “Set-aside funds”. These are the categories that don’t have specific payout amounts and happen at irregular intervals. When my car is paid off, there will be a car fund added to the list, instead of a new car payment.

- Parties – We throw two parties each year; a Halloween party and a summer barbecue. We also have three children who have varying expectations and needs for their birthday parties.

- Gifts – I don’t buy presents for my friends, and the number of relatives I buy gifts for has decreased dramatically over the years. I do, however, buy birthday and Christmas presents for my wife and kids and I participate in some form of gift exchange with my brothers and their wives. Combined, we set aside about $100 per month for parties and presents.

- Pet Care – We have four cats and a dog. This is to cover cat litter and food the bunch. We have too many pets, but we can’t give them away. They are family. However, there is a moratorium on new animals for a few years. Two cats and a dog are our hard limit.

- Car Repair – Cars break. Tires wear out. This isn’t a surprise, and it certainly isn’t an emergency.

- Warranty Fund – We are building up our own “Warranty Fund“, to replace appliances when they break. I’d rather have the interest accruing than see this as a line-item fee on any of my bills.

- Medicine/Medical – Kids get sick and prescriptions need to be filled. We figure our monthly prescriptions plus one office visit per month, but the money accrues in this fund. On low months, we have more, so we can cover the visits during flu season.

- In The Hole – This isn’t actually a fund we set aside. If, for some reason, we go over budget one month, it gets entered here to immediately pay ourselves back for the over-spend. This month, this number is $170, which is how high we went over for Christmas. Since we have all of the “Set asides” and non-monthly bills stored in the same account, there was no actual debt, just this “paper” debt to ourselves. This serves the combined purposes of a mild punishment for overspending and a method to get back on track.

That is my entire budget laid out. As the series continues, I’ll be examining how I have lowered the bills, how I could lower them more, and how I’ve screwed them up.

Checking Account for Punk

Punk is 13. He’s a good kid. He’s bright, well-mannered, hooked on MineCrack.

We just opened his first checking account.

It started when a friend called. He works at a bank and owed a banker a favor, so he asked me to open a new checking account. I’m overbanked, so we decided to open an account for Punk. He wouldn’t even have to know.

After we filled out the paperwork, I started thinking about it.

He’s been money-conscious since he figured out basic math. We’d offer to buy a $5 toy and he’d scour the toy aisles looking for the best deals, weighing the pros and cons of all of his options.

When he wants to buy something now, he doesn’t come to me without a compelling argument why I should let him.

He gets himself to school in the morning, and almost always does his homework without prompting.

He’s a pretty responsible kid. Teenagers are–by definition–stupid, but I generally trust his judgment.

We decided to let him have access to the account, then promptly forgot about the whole thing.

Last night, he asked if he could buy some package for some MineCraft server. That handy reminder made me actually take the steps to activate his debit card and have “the talk”. Money, not sex.

I taught him how to use a checkbook register and told him that if the balance on the bank’s site ever disagrees with his register, I was taking the card away.

I explained the pain of overdraft fees.

I taught him a bit about credit card fraud and how to avoid it.

I handed him the packet of documents and told him he has to read them all. All of them. My roommate laughed at me over that requirement.

From there, he opened a Paypal account, attached his card to it, and has free rein.

It’s his money, he can make these decisions. It’s low stakes, so there’s no need to stick my nose into it unless he asks. Even if he totally messes up, it can’t hurt too bad at this point, and he’ll learn an important lesson when his next meal isn’t on the line.

Next, we’ll take him down to get a state ID, so he won’t have a problem using the card in a store.

Welcome to adult finances, Punk.

What do you think is the right age for a checking account?

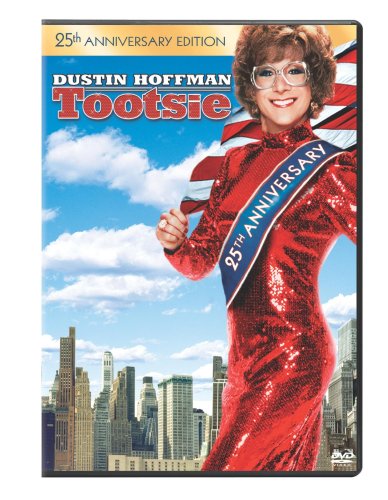

Tootsie – Does Beauty Have to be Expensive?

Many remember Dustin Hoffman dressed in drag in the classic film Tootsie, a movie that he now says made him realize how many women he’s missed out on meeting in life simply because he judged them by their looks. Every year women spend thousands of dollars on beauty products and cosmetics, hoping to increase their appearance and become attractive enough to the outside world. Although there are various degrees of beauty, it undoubtedly is usually determined by the amount of money spent to enhance features and upkeep the overall look.

The length of a woman’s hair often creates a more attractive look in the U.S., which is difficult to achieve with flat irons and curlers that create breakage and brittle hair from the heat. Women are now resorting to having hair extensions installed every three to five months to achieve beautiful hair that has a fuller texture and longer length, costing an average of $700. They can resort to shorter hair that saves a large amount of money, but they’re ultimately compromising a large part of their looks.

There’s a reason that celebrities appear more beautiful than the rest of the population, as their high school photos often show them to look like typical people. By spending thousands of dollars on personal trainers, stylists, and makeup artists, their appearance is immediately enhanced with the finest tools and products on the market. They are also able to have help with experts who have more knowledge on what creates the best look for their features.

Although beauty does not have to be expensive (just look at exotic women in Columbia and Brazil who are anything but high maintenance), it unfortunately is a requirement in the U.S. where rich housewives rule the reality shows and runways. True beauty is often defined by breast and waist sized, which few women can live up to, resulting in thousands of dollars spent on breast implants and liposuction, often impossible to attain otherwise.

Beauty may be in the eye of the beholder, but few men will argue that Angelina Jolie is unattractive or that Heidi Klum looks homely. The majority of men can agree when a woman is beautiful, and few women catch attention with a homemade manicure and dyed hair that came from a box. Perhaps going au natural will become a new trend in the coming years, but for now it’s expensive to be a woman, and even more costly to be a beautiful one.

Related articles

Budget Lesson, Part 2

Today, I am continuing the detailed examination of my budget. Please see part one to catch up.

This time, I’m going to look at my monthly bills. These are predictable and recurring expenses, though not all of them are entirely out-going.

Let’s dig in: [Read more…] about Budget Lesson, Part 2

I Accidentally Bought a Bus

Last weekend, I was having dinner with my friend and business partner. After our carry permit class, we try to get dinner, unwind from the class, debrief, and figure out how to improve our business.

Over the course of this discussion, the idea of owning a bus came up. It was part of an impractical-but-useful solution to one of our larger expenses. My partner mentioned that he had a friend who owned a bus, so I asked him to find out how much he was asking.

A few days later, he called me and said simply, “We bought a bus.”

Oops.

What year?

“I don’t know.”

How big?

“Huge!”

Does it run?

“It used to. It probably still does, but they lost the key.”

Crap.

So we own a bus. It’s a 1987 Ford B700. It’s 20,000 pounds empty, has a 429 motor that doesn’t leak oil, and an air horn.

Under the hood, it’s got a couple of issues. There are some melted vacuum tubes leading to a vapor box. The vapor box is used to cheat obsolete emissions standards and doesn’t do anything productive. There’s also some belts missing. The belts drive an air pump that pushes clean air into the exhaust system, again, just to cheat emissions standards that we don’t have anymore. Nothing necessary–or even useful–is broken.

Part of the $1000 we paid for the bus went to a locksmith who came and made us a key.

The interior of the beast is 3/4 converted to an RV. There are 4 folding bunks in the back, minus mattresses. There are two RV sofas that fold down to beds, plus seating for another 12 people. No kitchen or bathroom facilities.

We’ve done some research and come up with a few choices for this impulse purchase:

- Flip it. We should be able to at least double our money quickly.

- Finish the RV conversion already in progress. This wouldn’t turn it into a fancy motorhome, but it would make a great deer shack on wheels. I figure we could make this happen for about $500 and turn it into a $3500 toy to sell. Or take deer hunting.

- Turn it into a full RV. This would be more expensive. My estimate is a $5-6000 investment to make it a $10-12000 RV. It would take most of the summer to do, which means we wouldn’t be selling it until spring. I quit wanting to do this when I saw the bus in the light. There’s not a lot of rust, but it’s more than I’d want to fix to make the outside look as good as the inside, in my head.

- Party bus. What’s a better way to spend a Saturday evening that shepherding a drunken bachelorette around with her friends? It’d take about $2000 to outfit the bus, plus insurance, plus licensing, plus the fact that drunken bachelorettes are obnoxious.

- Auction. We got an estimate for a $3000 sale, minus a 20% commission.

- Stunt-jumping. I saw a video of a guy jumping a bus over 20 motorcycles. I could do that. I’m sure one of the race tracks around here would pay good money to have us do that one weekend. Afterward, we’ll melt the bus for scrap.

- Sell the engine and scrap the body. That should bring us at least $1500.

We jumped into this with no real plan, but there are a few ways we could make our money back. I’m expecting a healthy profit on a pretty short timeline.

What would you do if you owned a bus?