- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Budgeting tips – sticking to your budget

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.

Paying for Rat

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

Anna Chapman and Edward Snowden: How to afford a long-distance romance?

Recently Russian spy Anna Chapman tweeted a proposal to fellow spy Edward Snowden, as in a marriage proposal. News reports covering the Internet event report that Chapman would not reveal whether she was serious but asked reporters to use their imaginations. So it is yet to be seen whether there will be spy marriage ahead for the two notorious leakers. What is true, however, is that no nuptials can take place at the moment, even if Anna Chapman were serious and Edward Snowden. That is because the United States has revoked Snowden’s U.S. passport, and marriage ceremonies cannot take place in the airport where Snowden is trying to buy time. So how can Chapman and Snowden afford a long-distance relationship? Follow this quick guide of tips for helping the spies survive what could be a long road ahead!

Finding Deals

Anna Chapman has the most mobility right now, so she should be looking out for cheap flights to where Snowden is hiding out. A long-distance relationship can be expensive, so that is why finding deals on air travel is key. She can drop into the airport for a quick rendevouz. Why not?

Saving Money

These two potential spy lovers and super team need to save their money at every turn. Hiding out in secrete is costly, so they should create a special account that they both can add to for getaway and meeting expenses. Meeting at the airport is going to get old after a while, so they need to find a safe space where they can enjoy one another and sustain their relationship. Long-distance relationships are known for their difficulty because a couple spend so much time trying to reconnect every time they see one another.

Pick Your Fights

Long-distance relationships have little room for petty fighting. You see each other so infrequently that you have to cherish the time you have together. Instead of talking spy business, Anna Chapman and Edward Snowden should make sure they are focusing on each other by getting to know each other and focusing on the small things that make them happy together. Petty fighting will destroy a long-distance relationship. Chapman and Snowden should part each meeting feeling good about the other instead of feeling frustrated.

Kiss and Makeup

The key to long-distance relationships is always to kiss and makeup before leaving. No matter what the spies face together or apart, they cannot let their professions and media scrutiny come between them. Instead, they need to focus on their love and passion. Make sure to share a passionate kiss before leaving each meeting so that the memory of love and admiration is fresh on the mind. With a little effort in the romance department, Chapman and Snowden will be well on their way to creating harmony in their relationship. Moving from shallow levels to more deeper levels, however, is going to take time.

Related articles

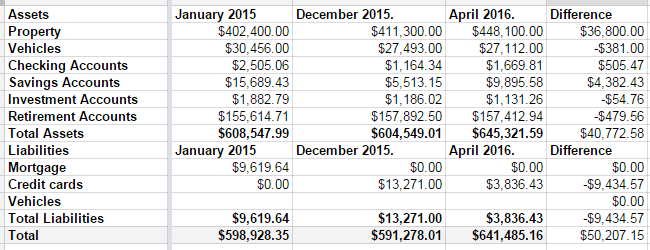

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

More Debt

Even though we just paid off our credit cards in August and have started competing to pay off our mortgage, we opened a new debt account on Monday.

We’ve been shopping for a new(to us) car for a while. Simply put, we’ve outgrown our current vehicles.

As I said last week, these are our needs:

- We have 5 people in our family. My 13-year-old son is bordering on 6 feet tall and shows no sign of not growing.

- Every weekend, we have at least 1 extra kid, sometimes 2.

- We still have a giant(24 foot) boat that we won’t be selling until spring.

- My wife wants to lease a couple of ponies next summer, which will mean a horse trailer to haul them in.

We were looking for a GMC Acadia, which would meet our needs, but after talking to my brother–an Acadia owner–and the dealer, we decided it wouldn’t be the best fit. It would be marginal for towing the horses and the back row of the older models isn’t as roomy as the new one I sat in.

Saturday, we went to test drive an Acadia, which is where we had the conversation with the dealership. We ended up test-driving a Chevy Tahoe instead of the Acadia. With the options and mileage, it bluebooks for $27531, but they were using it as an online price leader and had it priced at $25000. Maybe I missed something, but the thing ran well, handled great, and the engine sounded good. As a way to get people on the lot, it worked.

Our plan was to put $5000 down, and see about trading in our Dodge Caliber and Ford F150. We brought the Caliber with us. Its bluebook value is $9,969. They offered us $5500, so we went home.

Sunday, we decided to sell the car and truck ourselves. We texted the salesman and offered $24,500. He accepted, we got a new truck that will fit our family and our needs.

With taxes, fees, and our down payment, we now have a car loan for $21564. Our plan is to sell the Caliber for $9500 and the F150 for $6800. That will leave $5354. We have a beneficiary IRA that has to be cashed out relatively soon, so we’re planning to do that early in January to push the tax burden to next year, which will end the loan.

Effectively, we’re paying about $300 in interest to give us a chance to move our assets around to take advantage of an SUV meeting our needs for $3000 under blue book. Yes, we could have waited until the assets were ready, but this truck wouldn’t have been there, so we jumped on it.