- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

Is It Time For a New Car?

So far this summer, we’ve sold a 1984 Cadillac, a 1994 Mercury Sable, and a 1976 Lincoln Continental.

That’s most of the vehicles we inherited in April.

Now, we’ve got a 2005 Chrysler Pacifica, a 2001 Ford F150, a 2009 Dodge Caliber, and a 1986 Honda Shadow.

According to Kelly Blue Book, the Caliber has a resale value of $10,065 and a trade-in value of $8470.

The F150 is worth $6,418/4,923.

The Pacifica is worth $7,738/$6,093.

The bike is worth about $1,500.

We own all of them, free and clear, right now.

With our current situation, the F150 and the Caliber aren’t working. We have 3 kids. The oldest is 12 and pushing 6 feet tall. He barely fits in the backseat of either and is forced to wedge himself against a car seat if we take either of these vehicles anywhere. Even the front seats don’t have a lot of leg room, and I’m not exactly short or small.

We are also a popular place to hang out and almost always have an extra kid or two on the weekends. Right now, that means we take two cars if we have to go somewhere.

On top of that, my girls ride in a saddle club on borrowed horses. We are planning to buy a horse trailer and (shudder) lease a couple of ponies next summer.

So, our requirements are:

- Seat 7-8 people

- Full-sized 3rd row

- Towing capacity of at least 5000 pounds

- More than 20mpg highway

- Comfortable front seat

Based on our initial research, the Chevy Traverse meets our needs. Depending on the configuration, it seats 7 or 8 people with a full-sized 3rd row, has a 5200 pound towing capacity, and is rated for 24 mpg on the highway. Locally, there is a 2010 model with 50,000 miles for $19,000, which is dead-on with blue book. For another $1500, we can make it all wheel drive and 2011, which is below blue book. Consumer reports rates it pretty high, but Edmunds has some mixed reviews.

We should be able to sell the F150 and the Caliber for $12-13,000. That only leaves about $6,000 left, which we should have after the remodel on our rental property. I’m almost positive we’ll pull the trigger on a new car in the next month or two.

What do you think? Am I missing anything? Any experience with a Traverse? Have a better idea for something that meets our needs? Please leave a comment and help me out.

Credit Card Pitfalls You Have To Avoid

The idea of a credit card is appealing. You don’t have to have the money to pay for things; you can just use the card. It creates instant gratification and you start to get used to the idea of getting what you want when you want it. Unfortunately, this can be a disaster waiting to happen.

If you get in over your head and begin to negatively affect your credit rating, it is not the end of the world. By looking at things like bad credit credit cards at Money Supermarket you can start to make things right again. Watch out for these pitfalls that could cause you to stumble into a bad credit card situation.

Enticing Rewards

You see the commercial or advertisement online and reward credit cards make it seem like you will be drowning in points that can be redeemed for airline miles or gift cards. Initially, you may think that this is a great reason to sign up for a card. Then, you begin to use the card often in order to earn points.

The problem comes when you start spending just to get the rewards and you can’t or don’t make payments to return to a zero balance every month. You may end up with a hefty annual fee on top of everything else. Don’t let the temptation of getting a reward create a problem with your credit score.

Maxing Out the Credit Card

When someone hands you $5,000, you will be tempted to spend it. Why not enjoy the new money? The problem is that a $5,000 credit card balance needs to be paid back. Don’t fall into the trap of spending the entire line of credit immediately.

If you do run into some financial difficulty or you really need a credit card for something, you will have nothing left to use. If you go over the limit, you can be sure that there will be some fees that come along with it. Use it wisely. Charge something and pay it off.

Skipping a Payment or Paying Late

Once you have a credit card, everything is going to affect your credit score. If you miss a payment or pay late, you can be sure that this is going to show up against you. Aside from the damage to your credit score, most credit cards come with a substantial penalty in the form of a late fee that gets tacked onto the next payment.

Always pay on time. Pay in early if possible. Keeping up to date with your credit card will show up positively on your credit rating.

When Problems Arise

Even if you do your best to avoid these pitfalls, sometimes financial problems can be unavoidable. An unexpected emergency requires you to max out the card. You run into a problem at work and lose your main source of income.

If you see that your credit is starting to decline, it is always possible to build that score back up. Start over using bad credit credit cards to make a positive impact on your credit score. With this scenario, you get an opportunity to once again avoid these pitfalls and improve your credit.

Refinancing Your Existing Loan to Purchase An Investment Property

Many people are looking at the housing market slump right now as an investment opportunity. Here are a few of the things that you need to know before getting a new home loan or refinancing your existing loan in order to make that happen.

Amount You Want to Borrow

A lot of borrowers go shopping for real estate and have exactly no idea how much money they can borrow. One of the first questions that you need to ask before going real estate hunting is how much can I borrow. You can ask a bank, lender, or financial institution to give you a ballpark figure of the amount of loan that you would qualify for. This will make it easier for you to narrow down exactly what type of property you can afford and what areas you can concentrate on.

Amount of Interest You Will Pay

Too many people are overly concerned with the purchase price of the home that they are buying. They fail to find out how much interest they will have to pay back to the bank in order to make their home ownership dreams come true. This is where a home loan calculator can be really useful. You can find out exactly how much interest you will repay over a 10, 20, or 30 year loan time period. You can also change the interest rate and down payment amount on those calculators to see if you can secure a lower monthly payment.

Credit Score Needed to Qualify

It doesn’t matter if you are buying a home for the first time or refinancing an existing loan. Your credit score matters. You need to start doing some research now if you want to secure a loan with a really low interest rate. This involves taking the time to see what credit scores traditional lenders are looking for and doing the work necessary to qualify for this loan. Your credit score will make a big difference in determining if an investment property purchase is a profitable endeavor or one that winds up costing you money. It will depend heavily on what kind of loan your credit score allowed you to negotiate.

Make the Choice

Once you know how much you will need and exactly how much you will be paying out over the life of another mortgage, you can decide whether you want to refinance your current home loan to get another one. Adding on another huge debt to an existing one is a big risk. Make sure to think it through fully before jumping in.

Shaving for Real

- Image via Wikipedia

When you look at a safety razor, you see the mostly-unguarded blade. When you look in the mirror, you see your throat and you see this blade–by definition, razor-sharp–and you realize that you are about to put a knife to your own throat. Why?

Because shaving sucks.

For my 18th birthday, I received 2 Mach3 razors. I used them for more than 10 years. It certainly beat disposable Bics, but not by much.

I liked it, but only because I didn’t have anything good to compare it to.

I’ve start using an old-fashioned safety razor. Now, I can shave smoother and with less irritation than I ever could with a modern razor and it only takes a few extra minutes.

Why would you want to abandon modern technology to put a blade against your jugular?

Modernization isn’t always an improvement. There is something about reaching back in time a couple of generations and doing things, not only the way they used to be done, but the way they should be done. It’s the same feeling I get handling an old rifle or sitting in an antique car.

A real shave is 15 minutes of peace and focus. Lock the kids out of the bathroom and focus on the task at hand. The concentration will usually give you a chance to forget about the rest of the world for just a few minutes. This is pure meditation.

What do you need to shave like a real man?

Start slow and ease your way into it. Put a cup in the bathroom. If you shave with a modern razor, the easiest way to improve your shave is to use hot water. Put your shaving cream in the cup and add a bit of hot water. Mix that up and use it to shave. The hot foam will do wonders for your skin and the closeness of your shave. I did that and immediately start trolling antique stores looking for a good, cheap shaving brush.

A brush makes applying your shaving cream a small pleasure. Spreading the hot foam on your face with a brush gets in on all sides of each hair, softening it for the razor. Ideally, you want a badger-hair brush, but I’ve been perfectly happy with boar hair. I found one at an antique store for $5.

Shortly after acquiring my antique shaving brush, I decided to go even older-school and upgraded to an old-fashioned safety razor. I took my life, and my life-blood, in my own hands to shave for real. I went with a Merkur 23C Long Handle Safety Razor. It’s a basic razor with a longer handle, because I have large hands and long fingers. Don’t worry about getting an adjustable razor. There’s no point. It cost $29 at West Coast Shaving*.

How do you avoid killing yourself while getting ready for work?

It’s all a matter of technique.

- Dampen your cheeks with hot water to soften the hair. I prefer to shave immediately after I shower.

- Run hot water over your brush. Get it thoroughly soaked, then shake off the excess water. You want it hot and wet, but not dripping.

- Briskly brush the soap disk until the brush picks up as much soap as it can. It may or may not form a lather in the cup.

- Put the brush on your face and whisk it around. I use a quick circular motion to build up a lather on my cheeks. This works the hot soap into each hair. Keep brushing it onto your face until it forms peaks.

- Pick up your razor. I run it under some hot water, just so the cold metal isn’t a shock after the hot foam. From here, you need your full attention on what you are doing.

- Shave.

When you are shaving there are a few things to keep in mind.

- Take your time.

- Never, ever, ever, ever turn the blade while it is in contact with your face. You will bleed. Once the blade touches your face, it goes in a straight line.

- Keep the edge of the blade as close to parallel with your face as possible.

- The goal is hair reduction, not removal.

I make 4 passes when I shave. First, I shave from the top down. Next, from the back towards my nose and mouth. Then, from the front to the back. Finally, I shave against the grain from the bottom to the top. This results in a closer shave than anything I’ve ever had with a modern razor.

When I think I’m done, I dip my fingers in some warm water and run them around my face, in all possible directions, to see if I missed a spot.

When the hair is gone, wipe of the remaining cream and splash cold water every place the razor touched. This closes the pores and will help prevent infections and razor bumps.

The last step is aftershave. Aftershave disinfects your face. It also prevents infections and makes you stink nice.

There you have it: the secret to a baby-butt-smooth shave and 10-20 minutes of masculine meditation. If you are looking for a present for someone, you could do a lot worse than a real razor set.

*I have absolutely no affiliation with WCS. I am just very happy with the service and the product.

Net Worth and other stuff

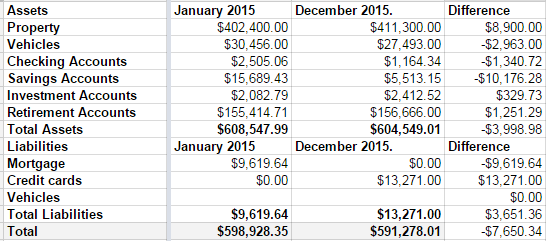

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.