- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

Saturday Roundup

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

2012: The Year the World Ended

December 21st marks the day that Mayan calendar-makers decided was far longer than they needed to waste their time carving

days into stone.

More importantly, it marks the beginning of the week before my birthday. No self-respecting civilization would end the world just a week before my birthday.

This is traditionally the time that people look back at the previous year, and make resolutions they don’t intend to keep in the following year.

Who am I to buck tradition?

In 2011, I became a bit of a workaholic.

This site has taken off a bit. I’m not about to retire off of the proceeds, but it has turned into a nice little side income. Thank you for that.

I launched a marketing company. We do web design/development, social media work, and search engine marketing. It’s strictly a part-time gig right now, but it’s growing and taking up most of my free evenings and weekends.

I’ve been working 50-60 hours a week at my day job.

The plus side? I’ve also paid off almost $20,000 of my debt in 2011, bringing my total to $47,535 left.

It’s been a lot of work, but the harder I hustle, the sooner I can stop hustling.

What’s in store for 2012?

On the work front, I plan to cut my weekly load down to 40-45 hours again. Life it to short to work all of the time.

I want to expand my new company to the point that my day job is optional. I’m projecting that by spring. Call it June 1st.

Here, I want to double the size of my audience. I don’t just want random people popping in, I want to grow an engaged audience. That means more comments and more discussion. Expect to see more along those lines.

I’ve also got a couple of products under development. By year-end, I’d like to have them both released.

On a personal level, my biggest goal is to carve out a regular chunk of time to spend with my wife. Working all of the time has cut into our quality time together. I want to find a way to schedule date nights at least twice a month. It will cost more money, but that’s part of why I’m working so much.

Financially, I want to kill the last of my credit card debt. That’s down to about $17,000. We’ll need to keep working at it, but it’s a reachable goal. That means we still don’t get cable, I still avoid buying books every week, and my kids still have to live with not getting every whim fulfilled.

To recap: I’m going to work smarter, grow my side projects, and make this site better for you. In the process, I’m going to kill the last of my unsecured debt, and drag my mortgage down to it’s last gasping breaths.

Here’s to the end of the world….

No Brakes

Growing up, I was mostly poor, but I didn’t realize it. The electricity was never shut off and I never missed a meal, but there was rarely money for anything extra. Clothes were only purchased immediately before school started. Shoes were always at least one size too big. Hand-me-downs were a way of life. With very rare exceptions, new toys were given on birthdays and at Christmas. As a Christmas baby, this was unfortunate. If I wanted something during the year, I had to buy it. I had an allowance on and off–more off than on–for a few years. So, I got my first job-a paper route-when I was six. Most of the toys I accumulated as a child, I bought.

Through all of this, my parents never said “We can’t afford it.” I was simply told that if I wanted something, I could either save my money or wait for Christmas. I never saw my parents paying bills, but they got paid. I never saw a checkbook get balanced, but it did. There were only a few times money management was ever mentioned, even in passing.

Naturally, when I moved out on my own, I expected money to take care of itself, just as it had the entire time I was growing up. That wasn’t terrible until I got married, bought a house, built an addition and decided a needed a new car. There was nothing in me to apply the brakes. I can count the number of missed payments I’ve had on one hand-with fingers left over. I can’t begin to guess the number of purchases, both large and small, that I should have skipped but didn’t.

Shortages growing up coupled with absolutely no budget training turned into financial irresponsibility as an adult.

My wife grew up with almost the exact opposite training. She was also poor, but the household budget was clearly in evidence and generally taken to an extreme. Her training involved getting “the best bang for the buck”. If an item was on sale and could potentially be useful, her mother bought five. I don’t mean five similar variations. That’s five identical products, same size, same color. She still has a display box full of screwdrivers with interchangeable tips. It looked useful and it was on sale, so she bought them all.

Through all of that, the bills were always paid.

This training has made it difficult for my wife to turn down a sale price. If something is on sale-or worse, clearance-there is an excellent chance it will be coming to our house. Once again, there are no brakes.

Shortages growing up coupled with almost two decades of watching every sale turn into a purchase has turned into financial irresponsibility growing up.

Neither one of us were prepared to handle the financial aspect of being an adult. That is something we intend to improve on for our children. We intend to give them the ability to brake themselves.

Slow Carb Diet: How to Avoid Going Bat-**** Crazy

I received an email recently, asking “what kinds of things are you eating so that you don’t go bat-**** crazy?”

First, some background.

On January 2, 2011, I started Tim Ferriss’s Slow Carb Diet and, as of 2/18/2011, I have lost 30 pounds. The first 11 or so were water weight, but I’ve still been losing 4-5 pounds per week. This diet has a few—but only a few—rules.

- Eat nothing white. That means no sugar(including fructose), no flour, no potatoes, no rice(even brown), and no milk(or any dairy). Beer is white.

- Breakfast is high-protein.

- Cheat day once a week. On cheat day, there are no rules after breakfast.

- Meals should consist of 40% protein, 30% vegetables and 30% legumes(beans or lentils).

- If you get hungry between meals, you didn’t eat enough at the last meal.

That’s it. The rules are simple and don’t require that I refer back to the book for anything.

Here is a typical day for me on this diet:

For breakfast most mornings, I have 3 eggs and 2-3 sausage links. I bought brown-and-serve sausages so this takes 10 minutes to cook in the morning.

On the way to work, I have a diet soda if we have any in the house. If not, I skip it. I like pop, but I’ve broken my caffeine addiction completely.

For lunch, I will either have leftovers from the night before or some stir-fry with beans and whatever protein is convenient. I’ve been keeping pre-cooked brats(wurst, not kid) or polish sausages as a convenience food.

Several times a week, I make some stir-fry. I use a basic, flexible recipe.

- Chop whatever vegetables are on hand. We usually have onions, broccoli, a variety of peppers, and mushrooms. If I have celery, asparagus, or almost any other vegetable. Lettuce works poorly in a stir-fry.

- Put some oil in a hot pan. I prefer sesame oil, but I’m not picky. I’ll use whatever oil we have on hand.

- Cook the vegetables, stirring constantly. Cook them in the order of how long they take to cook. Onions are usually first. Celery tends to be last.. While they are cooking, I sometimes sprinkle ginger powder over the top.

- If you are getting sick of eating beans, toss them into the stir-fry, cooked. They mash and disintegrate, giving you the benefit and some flavor, without the mouth-feel.

- When the vegetables are cooked to your satisfaction, put them in a bowl. They will keep in the refrigerator for a few days.

I tend to cook the meat separately, as that lets me vary the meal more. I’ll make some chicken or steak ready to toss in the stir-fry before I re-heat it.

I vary the seasonings, vegetables, and oil to get different flavors I rarely make the same stir-fry twice. The real trick to keeping the food satisfying is to experiment with seasonings. They make a huge difference between bland and yummy. Seasonings can make or break a meal all by themselves.

If I don’t have any stir-fry or leftovers, I’ll bring some salad and a polish sausage. Most salad dressing is sugar-based, so I either go light on the dressing, or use balsamic vinegar. I try to avoid doing this more than once every couple of weeks. It’s boring and doesn’t taste that great. It’s okay, but that’s all.

I try to always have cooked beans or lentils in the refrigerator. They provide a significant part of my calorie intake. Beans are kind of a necessity. Vegetables taste better, but are a low-calorie, bulky food. You can’t stay full all day on nothing but lettuce. Beans get old. I’ll usually toss a few spoonfuls of salsa to change the taste. When I cook lentils, sometimes, I’ll cook it in beef broth with fried onions and garlic to make a tasty change.

For dinner, I have whatever vegetables we are cooking for the kids, a scoop of beans, and a protein that usually isn’t cooked for the family.

The protein source varies based on whatever was on sale when we went grocery shopping. It can be steak, chicken, or anything else. This week, we bought 16 chicken drumsticks. We spread them out on a cookie sheet and seasoned them 3 different ways, just for variety. Some got garlic salt, some got Italian seasoning, and some got a Greek rub. After an hour in a 350 degree oven, we had a delicious meal.

If I feel a need for a snack, or a craving for sweets, I just take a spoonful of peanut butter. It helps.

Exercise

I’m not doing any major form of exercise. I wanted to test the diet on its own merits, first. What I am doing is some timed exercises shortly before and 90 minutes after I eat, when I remember. The exercises are resistance-based and 60-90 seconds in duration. The purpose is to crank up my metabolism before the food gets introduced into my body, and then keep it up and running for a while afterward.

I use a mid-level elastic rehab strap, doubled-over twice. I do 75 chest extensions about 5 minutes before I eat. Most days, I forget to do them again 90 minutes later. There are any number of other exercises that would work, including air squats or push-ups.

Supplements

I am not your doctor. In fact, I am not a doctor in any capacity. Similarly, I am not a nutritionist, a dietitian, or even a board-certified snake-oil salesman. I have no qualifications here, in any way, shape or form. Follow this at your own risk.

I take 5 supplements.

Policosanal. This is an herbal supplement that is supposed to help with cholesterol, which is a helpful thing to do when you are on a low-carb, high-protein diet. More importantly, a side effect is weight loss. Hurray for helpful side effects!

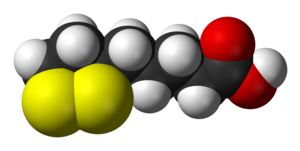

Alpha-lipoic Acid(ALA). This is an antioxidant that helps your body produce vitamins C and E. It is also supposed to inhibit triglyceride and fat storage. To quote from the book, “ALA helps you store the carbohydrates you ea in your liver as opposed to in fat.”

Decaffeinated Green Tea Extract. This inhibits your body’s ability to store carbs as fat and it accelerates fat cell death. The second bit means it should help prevent the rebounding so many dieters experience.

Garlic Extract. This assists with cholesterol management and the inhibition of fat regain.

B Complex. I take a B complex vitamin with vitamin C. The B vitamins help balance out some of the things the rest of the supplement regimen does to cellular metabolism while giving your overall metabolism a boost.

I take the whole mess in the morning and again before bed. Shortly before lunch and dinner, I take the ALA, green tea extract and garlic extract.

Ice

As a pure body-hack, I ice my upper back every night. I have an ice-pack sheet that I place on my upper back for 30-45 minutes each night before bed. This lowers my core body temperature, forcing my body to work harder to maintain 98.6 degrees. That burns calories. An additional benefit: getting cold makes you tired, which helps with my chronic insomnia.

This combination of factors has resulted in my losing an average of .7 pounds per day, without meaningful exercise. It’s a violation of a number traditional dieting principles, but it’s working. Is everything I’m doing necessary? Useful? Possibly not. Over the next few months, I’m going to be experimenting with dropping individual pieces of the plan, to see if my rate of loss drops for any of it.

For now, it’s working, and doing so at a rate I like. Dieting usually sucks, because the results are so slow. This is much more satisfying.

Chromecast: Saving Money on Cable

Google has decided to jump into the competition of content streaming by introducing its very own streaming device, the Chromecast. Following in the footsteps of other dominant content streaming devices and services such

as Apple TV or the Roku, Google hopes to allow casual video watchers the ability to watch streaming content on their TV instead of on a tablet or smartphone. With penny pinching being on everyone’s minds as prices increase for everything ranging from food to gas, cutting costs on entertainment expenses by eliminating cable is a wise decision.

Chromecast is designed to allow you to stream your content at a low cost without requiring you to buy a smart TV. Once it is connected, you can stream video or audio content from your phone, tablet or computer directly to your television. One of the key benefits of Chromecast is that it can be controlled with multiple devices, not just Google’s. It can be controlled with an iPhone, iPad or Android-powered tablet or phone. You can also project content that you have open in Google’s Chrome browser on your computer to your TV screen. Unfortunately, you’re completely out of luck for the moment if you use a BlackBerry or Windows device since they trail behind Android and iOS in popularity.

Since Chromecast is relatively new, only a few apps currently support the “cast” ability that projects your content to the screen. The device runs a barebones version of Google’s own Chrome operating system. When you press “cast” through an application the content is sent directly to your television. It doesn’t merely mirror your device’s screen, so you can still play games, surf the web or check your email while watching your TV.

Control of the Chromecast is also simple since you can select what you want to watch, adjust the volume and control playback directly from your device without having to adjust to a new interface or have another remote floating around the house. Another selling point is that family and friends can utilize your Chromecast without needing to jump through any set up hoops along the way.

Ditch the costly cable service and get with the times by utilizing streaming devices and services.