My post 4 Ways to Flog the Inner Impulse Shopper is up in Free Money Finance’s March Money Madness tournament. Please take a moment to vote for me(Flog).

Thank you. That is all.

The no-pants guide to spending, saving, and thriving in the real world.

My post 4 Ways to Flog the Inner Impulse Shopper is up in Free Money Finance’s March Money Madness tournament. Please take a moment to vote for me(Flog).

Thank you. That is all.

A friend–let’s call him me–recently had a bit of a hangup with a business relationship.

On a long-term project, there were some unavoidable setbacks. My friend decided to work through them, hoping to get everything back up to speed…before the customer noticed.

It’s a funny thing, but customers like to look at status reports on long-term projects. A couple of months after the biggest problem, the customer called my friend wanting an in-person status update. They told him to be prepared for an uncomfortable conversation.

Crap.

Now, the setbacks were truly unavoidable. Things came up that were entirely outside the realm of my friend’s control, but he had to deal with them anyway. When the problems were laid out in front of the customer, it went from uncomfortable to a discussion on how to expand the business relationship.

Transparency for the win.

Bad things happen. Anybody who doubts this is clearly not equipped to deal in the adult (that’s adult in the “grown-up” sense, not adult in the “porn” sense) world. Companies know that bad things can happen to derail a project. They are going to be more interested in how you get the project back on track than anything else.

When things go wrong, be open about it. Your customers/family/friends/one-night-stands will appreciate not having to wonder what’s going on.

I’ve got most of my bills set up on auto-pilot, so I don’t have to worry about getting the payments in on time. It’s a huge time saver, but it occasionally comes with a downside.

A couple of weeks ago, I was reviewing our bills and saw this on our insurance statement:

| 2002 FORD | $51.07 |

| 2005 CHRYSLER | $47.40 |

| 1994 MERCURY | $1.64 |

| 2008 DODGE | $39.96 |

| 1986 HONDA — ANNUAL | $17.76 |

There are two problems with this.

1. We sold the 1994 Mercury a few months ago. Then, we forgot to tell the auto insurance company. We probably only wasted $6 on storage insurance, but it could have been worse.

2. We have 2 drivers in the house and 3 vehicles to drive, and the highest premium is on the vehicle getting driven the least.

We haven’t decided what we are going to do, yet.

Here are our needs:

The Dodge is a Caliber, which is small. I don’t fit comfortably in the front seat for a long period of time, and I’ve got no idea how my son manages to fit in the backseat behind me, next to two car seats without complaining. It gets great gas mileage.

The Chrysler is a Pacifica, which fits out family perfectly, as long as there are no extras. It gets crowded with a dog and luggage for a trip, but it’s doable. We get gas mileage higher than the car is rated, but it doesn’t have a towing package. Even if it did, the car can’t handle a trailer full of horse.

The Ford is an F150 we bought new. It’s less roomy in the backseat than the Caliber, but better in the front seat and it can tow anything we need. Also the worst gas mileage of the lot.

The Honda is a motorcycle. I could haul both of the girls if I bungie-strap them to the backrest. Sucks in the winter.

Our choices seem to be:

A. Sell the Caliber. Drive the truck. Not perfect for hauling lots of kids, but it can work.

B. Sell the truck. Drive the Caliber. Screw the horses. (Not literally. Jeez, you have a dirty mind!) This still isn’t great for family outings, but works for a commuter.

C. Sell the truck. Sell the Caliber. Buy a mini-van. We’re looking at the GMC Acadia or the Chevy Traverse. Both are built on the same body, have third row seating that can fit an adult comfortably, and are rated high enough to tow a trailer full of horse. If we sold the car and the truck, and cash out an inherited IRA that has to be cashed out over the next few years anyway, we can come up with $22,000. That will buy a 1-year-old Traverse outright or get us within a few thousand of a similar Acadia.

I think C is the best long-term solution for our family. What do you think?

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

A few days ago, I asked a coworker if she wanted to go out for lunch. She said she’d have to check her bank account before she decided.

What?

If you have to check your bank balance to know if you can afford something, you can’t afford it. It really is that simple.

Now, strict budgets aren’t for everyone, but everyone should know how much money they have available to spend. If you don’t know what you have to spare, you need to set up a budget.

Period.

After you’ve done that, you can ignore it, with the exception of knowing how much you have available to blow on groceries, entertainment, and other discretionary purchases.

If you don’t know where your money needs to go, how can you determine how much you can spend on the things you want?

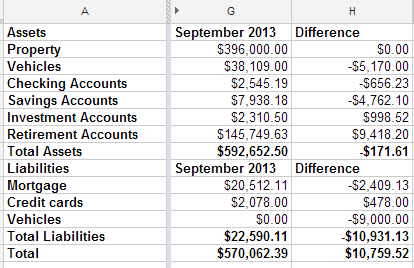

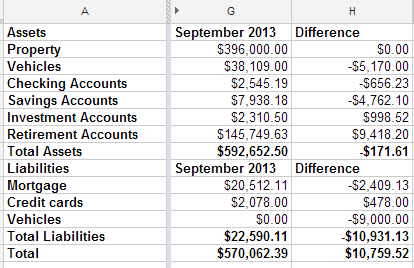

Time to update my net worth. Here are the highlights:

We paid off the Tahoe we bought last fall, but the value of my Pacifica fell $5,000 since April. That made me sad.

In August, we had $1000 worth of car repairs and $5500 for braces. We had most of the money saved for braces, but had to juggle some savings accounts around to cover it. We didn’t have enough money in our car repair fund to cover the repairs. Between the two, we beat up our credit card a bit more than usual last month. I’m not happy about it, but I’m confident we’ll catch up this month. My current goal is to get that paid off by the end of September. If I do, I should be able to avoid paying any interest on the balance.

All in all, it’s not bad progress. Our assets dropped $171.61, but our liabilities dropped $10,931.13, so our net worth is up $10,000. You won’t catch me complaining about that.

What’s going to happen in the future? We’re going to remodel both of our bathrooms this winter. We’re hoping to buy a pony before spring.

I’m excited to see our budget evolve over the next few months.

My wife is working and my kids are all in school. With the way our schedules work, we’ve pulled the youngest two out of daycare, so that expense is gone. And there are a couple of other things in the works that I’ll be sharing when they are finalized. If things progress the way they are looking, we’re going to spend the winter living off of my income, and saving her’s. That makes me feel like putting on an ant costume and kicking grasshopper’s butt all over town.