Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

A few weeks ago, I discovered the queue at my public library’s website. The process is simple: Select your books, wait a few days, then pick them up. They are available from any library in the county, delivered to my local library. That’s awesome. Much more convenient-and cheaper-than Amazon.

So I moved a couple of pages of my Amazon wish-list into the library’s queue.

I must not have been thinking, because two days later, I got an email telling me that 19 books were ready to be picked up and 10 more were in transit.

In this county, each checkout is good for 21 days. For items that don’t have a waiting list, you can reserve 3 times. That’s 12 weeks for 29 books. Hopefully, I’m up to the challenge. Please keep in mind, I’m a father of three, two of whom are in diapers, and I’m married, and I have a full time job.

I have frugally blown every second of spare time for months.

Update: This was another post written in advance. When all of the books came in, I suspended my request list. Little did I realize, the suspension cancels itself after 30 days. That was 30 more books. Whee!

I had an email exchange with my close friend and business partner earlier this week.

“I get ideas but think they are probably stupid. Okay, I have some ideas. Again, I get scare you’ll think I’m reaaaally dumb.”

My response?

“No ideas are stupid. You start filtering **** like that, we’ll never find the ******* gold.

Brainstorming has no filter. You never know where a “stupid” idea might lead or what associations it might trigger.”

When you are trying to generate new ideas, applying a filter like “That sounds stupid” won’t get you anywhere. It’s idea suicide.

Could a discussion on the possibilities of becoming a lawn gnome distributor lead to becoming a successful manufacturer of combat gnomes?

Brainstorming involves turning off your stupid filters and running with it. Keep a recorder or a notebook handy and keep track of everything. Go off on tangents and see where they lead. Maybe they’ll lead to the gold.

The one thing you can’t do while brainstorming is criticize. If you start shooting down ideas, you are destroying the opportunity to find greatness. Even if an idea is impractical, build on it. There has to be an angle that becomes worthy of consideration. On the off-chance that there’s not, run with it anyway. It’s an exercise in creativity.

I regularly send my friend emails with potential business ideas. Most of them come to nothing, but once in a while, something clicks and we launch a successful venture together. If I were filtering ideas because they might be stupid, we might not have some of the projects we’ve got.

In addition to random & odd emails, I’ve got a notebook of some kind with me everywhere I go to record any passing idea I may have. In my car, I use a voice recorder. I periodically review everything I’ve noted and copy most of it into evernote.

Someday, those pieces may come together into a billion dollar idea.

How do you generate ideas? Do you bounce ideas off of friends or get drunk and shuffle a Trivial Pursuit deck into a Monopoly game?

I recently started a college fund for my kids. With my oldest getting ready to turn 10, this was a late start. However, when he was born, we were in no position to set aside anything extra.

I recently started a college fund for my kids. With my oldest getting ready to turn 10, this was a late start. However, when he was born, we were in no position to set aside anything extra.

At least, we didn’t realize we were at the time.

When our oldest son was born, I was 20 years old. I was working in a factory and hadn’t gone to college myself, yet. That’s a situation that makes it hard to justify a college fund. Financial planning and responsibility was to come at a later date.

So, how much do we have in this shiny new college fund? [Read more…] about The $10 College Fund

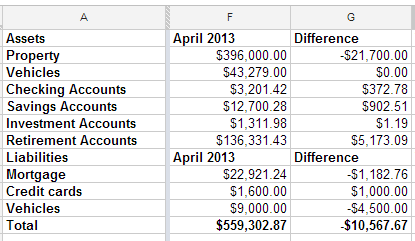

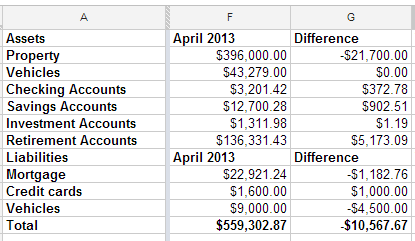

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?