- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Saving Money: The Warranty Fund

Last weekend, my DVD player died.

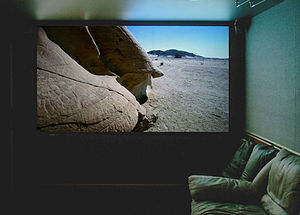

No big deal, right? We watch a lot of movies. We get a lot of enjoyment out of watching a lot of movies. Movies are fun for us. We’ve got a projector and a movie screen in our living room. Movies are our biggest pastime. Naturally, losing the movie machine hurts.

The thing that hurts the most is that this hasn’t been a good month for us, financially. My wife gets paid hourly, with semi-monthly paychecks. This means that, in a short month(like February!), her second paycheck is small by a few hundred dollars. When her company switched to that nonsensical plan, I watched for a few months, then set our budget to match the smallest paycheck she received. They haven’t been using this ridiculous plan for a full year, yet.

February caught me by surprise.

I know, it shouldn’t have. According to my research, there has been a February in every single year since well before I was born. I should have been expecting it. Oops.

So, to recap: our favorite pastime was dead and money was a little bit tight. There was no money to shake out of the budget to cover a new DVD player and there was no way we’d hit our emergency fund for something as frivolous—if enjoyable—as movies.

What to do?

About a year ago, I decided to start a warranty fund. There are things we can’t easily afford to replace, so we pay for warranties on some of them. For example, our cell phones have a repair plan, and that plan has saved us more than it has cost us. We have a repair plan for some of our appliances, and that, too, has saved more than it has cost us. My goal was to self-warranty my stuff. I wanted an account that had money that served no purpoase but to help me avoid paying for warranties.

I set up another ING Direct savings account and scheduled an automatic deposit. It’s only set to deposit $25 per month, but over a year, it was enough to replace our home theater system, with some left over. It is, quite simply, money to use when our stuff breaks.

With no warning, and no time to prepare, we still had enough money socked aside to handle one of life’s little surprises, without wrecking our plans.

How do you prepare to replace the things that are going to break?

The Value of Hiding Money From Your Spouse

I have a confession, but it’s probably not going to be a big shocker if you read the title of this post.

I hide money from my wife.

Some of you just started screaming at your monitor that I’m a horrible person.

That’s cool.

You’re wrong, but the fact that I got that reaction out of you makes me smile.

Ok, I might be a little bit horrible, but not because I hide money.

My wife has an admitted shopping problem. If she thinks we’re broke, she shops less. That’s a win and allows me to save up for our long-term goals and provide for our financial security.

I don’t lie about it. If she asks how we’re doing, I tell her. At least in general terms.

But I didn’t tell her about my annual bonus, until we had a bunch of car repairs come up that would have swamped our emergency fund.

I also haven’t told her about the cash I’ve been stockpiling.

A couple of years ago, the power went out here for four days. It wasn’t just our house, it was 75% of everything within 5 miles of our house.

When the power came on in some places after a day or two, the phone lines were still down, which meant gas stations couldn’t process credit cards.

Quick, look in your wallet and tell me how much cash you have on you….

Most people live on their credit or debit cards.

Could you buy food or water if your plastic was gone?

I could that week, but not for long, so I started taking the cash payments from my side hustle and putting it aside. I’d come home, give my wife a little cash, keep a little cash for myself, and put at least 80% of it away. I absolutely refuse to touch that money for anything.

Part of the “set it aside and forget about” means not revealing its existence. It would be too easy to dip into it to pay the pizza guy or when we go to Rennfest.

So I don’t talk about, and it gets to sit all by itself in the safe, comfy and warm. It’s my security blanket, and nobody gets to touch my binky.

Why do you need a trailer?

As I mentioned before, we recently bought a Chevy Tahoe. When we bought it, we had a Ford F150 and a Dodge Caliber that we could have traded in, but decided to sell on our own, instead.

About a month ago, we sold the truck. If you’ve never owned a truck, you probably don’t realize how handy they are to have. From hauling brush to moving furniture to donating large amount of crap to Goodwill, we used our truck.

We’ve also been on a mission to replace all of our old crappy stuff with nicer things, without spending a ton to make that happen. We’ve been selling stuff on Craigslist, then taking that money to buy other stuff we’re finding good deals on.

We found a 4×8 utility trailer for $300. It came home with us. The first thing I heard was “Why do you need a trailer?”

Now, we could have made do with delivery fees or rental trucks, but that seemed silly to me.

- We recently replaced our living room couches. One of our cats had mistaken one of them for a litter box. No amount of enzyme cleaner gets that smell out of a couch cushion. Shortly after that, my fat a** popped two of the springs out of the bottom. Bad couch. We found a good deal on brand new replacements, but the delivery fee would have been $80.

- My wife found a beautiful entertainment center last week that matched the corner entertainment center we already have. We don’t need another entertainment center, but after convincing the seller to sell us the side units without the center unit, we have glass-doored bookshelves that exactly match the largest piece of furniture we own. Without the trailer, we would have had to rent a truck to get them home.

- Tomorrow, we’ll be taking the last load of stuff out of my mother-in-law’s house. Without the trailer, that would be several trips in the car.

We’ve had the thing for 3 weeks and it has almost paid for itself in time and money. I think that makes for a good investment. I don’t expect to buy a new living room set every month, but it’s nice to be able to deal with large things when the need arises.

Making Up Stories

Saturday night, as I was walking out of the pizza place, I saw a beautiful young brunette standing on the sidewalk talking on her cell phone.

As I walked past, I heard, “I could pay my rent if they’d just give me my last paycheck! They owe me like $200.”

That’s it.

Have you ever heard a tiny piece of a conversation and used that to build a back story in your own mind?

I do that all of the time.

In fact, I’m going to do that now.

First, what can I know from those two sentences?

- She was unemployed. She was more worried about her last paycheck than her next one.

- She had worked for a scummy, fly-by-night, something-or-other. Good companies don’t withhold paychecks.

- She had no emergency fund. If she had one, $200 would be an inconvenience, not a disaster.

- She rented, and had roommates. This conversation occurred in the parking lot of a pizza place in a reasonably affluent suburb. For $200, she wasn’t living alone. Whether she rented a room or shared an apartment would be a mere guess.

Those items can–I believe–be taken as fact, given the evidence at hand.

Now for the conjecture:

- She was a waitress. A $200 final paycheck probably means her hourly wage was low. Besides, pretty, young, unskilled girls often become waitresses. It’s one of the few ways to make good money without a degree of any kind.

- The restaurant wasn’t a chain. Chain stores have lawyers and procedures. They don’t withhold final paychecks.

- She invites drama into her life. When you work for a company that makes a habit of shady practices, like withholding final paychecks out of spite, you know it happens. It’s not a surprise. If you continue working there, you are just waiting in line for your turn to have problems.

- She wasn’t close to her family. In an emergency, $200 from Mom & Dad is nothing. In my mind, she only has one parent and isn’t close to that parent, but that’s purely invention.

- Her friends are in the same boat. Short-term planning, no reserve cash, no room to let a friend couch-surf for a couple of weeks.

- Next month, she’ll be having the same problems, but she’ll find someone else to blame. Her ex owes her money, or her roommate stole the last of her cash.

That’s my entirely unsupported guess of a young stranger’s life story. My opinion isn’t flattering, but how could it be, when $200 is enough to make the young woman panic?

Have you ever played this game?

Best of Money Carnival #87, the Gold Rush Edition

- Image via Wikipedia

Welcome to the Best of Money Carnival #87, the Gold Rush Edition.

On January 24th, 1848, gold was discovered in Coloma, California by construction overseer James W. Marshall. The following year, one hundred thousand people moved to California to either strike it rich, or profit from those who were trying to strike it rich. The gold rush began 163 years ago today.

10. N.W. Journey presents Business use of Home Deduction posted at Networth Journey and says, “How to deduct your business home expenses.”

Some people recommend stockpiling gold so you’ll have something of value to spend after society as we know it collapses. Does anyone know how to make change from a gold bar for a loaf of bread?

9. Darwin presents Present Value of Money Explained – MBA Monday posted at Darwin’s Money and says, “One of the most important financial concepts is also one of the most misunderstood. Make sure you understand the Present value of Money – with these real life examples. It will save you thousands!”

In 1854, a 195 pound gold nugget was found at Carson Hill in California. It was valued at $43,534. That would be worth $3,160,357.20 today.

8. RJ Weiss presents What Your Optimal Income? posted at Gen Y Wealth and says, “An exercise to find your optimal income level.”

Q: Which weighs more: a pound of feathers, or a pound of gold? A: A pound of feathers. Gold is weighed using Troy Weight, which only has 12 ounces per pound.

7. BWL presents How To Select A Financial Advisor posted at Christian Personal Finance and says, “Find out how to select the best financial adviser for you.”

Until the onset of modern electronics, which use gold because it doesn’t corrode or tarnish, gold had no practical value of its own. Its entire value resided in the fact that it was pretty and relatively scarce.

6. Miss T presents 10 Ways to $ave Energy Comfortably | Prairie EcoThrifter.com posted at Prairie Eco-Thrifter and says, “How great is it to save money and the planet at the same time?!”

Q: Which weighs more: a ounce of feathers, or a ounce of gold? A: A ounce of gold. Troy Weight has fewer ounces that avoirdupois, but each ounce weighs more. There are 31.1 grams in a Troy ounce, but only 28.4 grams in a standard ounce.

5. Craig Ford presents Employers Look at Credit Reports | Ludicrous or Smart Business? posted at Money Help For Christians and says, “Should employers be able to see your credit report?”

Outside of collectible or government-issued coins, gold is priced according to it’s spot price, which fluctuates constantly. Dealers will generally pay a percentage under spot when buying gold, then sell for a percentage over spot. Always know the spot price of gold before you agree to buy or sell any.

4. MoneyNing presents Tax Time: Do I Have to Report that Income? posted at Money Ning and says, “Did you receive any income last year? Do you really have to report everything?”

Gold is the 58th most rare natural element, out of 92.

3. Silicon Valley Blogger presents I Just Lost My Job! How I’m Downsizing My Household Expenses posted at The Digerati Life and says, “I share my story of job loss and what ideas I have for paring down my expenses in order to cope with this loss of income. In the meantime, I’m doing what I can to find a new job!”

Only 20% of the gold from the Gold Rush deposits has been reclaimed. The rest is still out there.

2. The Financial Blogger presents 5 Reasons Why You Need A Partner In Your Business posted at The Financial Blogger and says, “A post outlining the benefits of a business partner.”

As of the end of 2009, more than 160,000 tons of gold have been mined, most of which was done in the latter half of the 20th century.

And the winner is…

1. Amanda L Grossman presents Frugal Lessons from People Who Survived the Great Depression posted at Frugal Confessions – Frugal Living and says, “Have you ever met someone who was alive during the Great Depression? They are changed people. The Great Depression left a great impression on their thoughts, their styles, and their habits. I am fascinated by this time period, and researched the question of what frugal habits these people developed to survive.”

I’d like to thank everyone who participated. Next week’s host is PT Money, so don’t forget to submit your entry!