LRN got hacked this morning. Thankfully, I backup weekly and subscribe to my own RSS feed. 20 minutes to total restoration.

Twitter Weekly Updates for 2010-05-01

- RT @Dave_Champion Obama asks DOJ to look at whether AZ immigration law is constitutional. Odd that he never did that with #Healthcare #tcot #

- RT @wilw: You know, kids, when I was your age, the internet was 80 columns wide and built entirely out of text. #

- RT @BudgetsAreSexy: RT @FinanciallyPoor "The real measure of your wealth is how much you'd be worth if you lost all your money." ~ Unknown #

- Official review of the double-down: Unimpressive. Not enough bacon and soggy breading on the chicken. #

- @FARNOOSH Try Ubertwitter. I haven't found a reason to complain. in reply to FARNOOSH #

- Personal inbox zero! #

- Work email inbox zero! #

- StepUp3D: Lame dancing flick using VomitCam instead or choreography. #

- I approve of the Nightmare remake. #Krueger #

Saturday Roundup

I just noticed this didn’t post on time.

There are a few ways to get more out of this site.

Live Real, Now by email. You get a choice between having all of the posts delivered to your inbox, or just occasional updates and deals. Both options get my Budget Lessons, free of charge.

RSS subscription. You can have every post delivered to your favorite newsreader.

Twitter. I’m @LiveRealNow. You can get my snark and pseudo-wisdom 140 characters at a time. Ooh!

Facebook. Everybody has a fan page, right?

Now, for the part you’ve all been waiting for…

This week’s roundup:

It’s time to buy school supplies again. Don’t let it break the bank.

Chewbacca on a squirrel, fighting Nazis.

A pizza peel with a conveyor belt. The pinnacle of pizza-making awesomeness.

Have you ever looked into the psychology of a restaurant menu?

Carnivals I’ve participated in:

Carnival of Personal Finance #267 at Beating Broke posted A Budget Isn’t Enough.

Wealth Informatics hosted the Festival of Frugality and posted Payday Loans Suck.

Canajun Finances hosted the Best of Money Carnival and posted Life Altering Lessons I Learned From My Debt.

What Can Cause Damage to Your Credit?

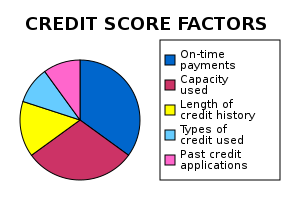

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

Sammy’s Story, Part 3

If you haven’t been following along with Sammy’s story, please take a few minutes to do so here and here.

After Sammy gave me the sketches of his landscaping plan for my mother-in-law’s yard, we sat down to work out a proposal. Keep in mind that he’s never run a business and I’ve never run a landscaping business, so it was a bit of a learning experience for both of us.

We finally came up with a proposal for $1200, which included laying a plastic border around the yard, mulching the border, removing some trees and stumps, sanding and painting a swing and barbecue pit, and hard-raking the yard. He asked if $400 of that could be applied to the car he bought from us. I said yes, which was a mistake.

Sammy’s plan was to hire guys from the Salvation Army and at-risk kids, giving them a chance to improve their situations. As it turns out, a significant percentage of those folks don’t really want to work to improve their situations. The guys from the Salvation Army were all vetted by one of the counselors, but still only worked out about half of the time. The kids quit wanting to work when they found out it involved…work.

That was an expensive lesson that caused a bit of a cost overrun. If the crew that finished the job would have started it, we’d have been done weeks ago. What should have taken 3-4 days ended up taking a month. Not a 40-hour per week month, but it was still a month.

As we came closer to our garage sale, Sammy had the great idea to tackle the front yard, too. He wanted to make it pretty as an advertisement for the people coming to the sale. That inflated the cost.

We used the stacks of bricks that came with the house for the border instead of the plastic roll. Another price boost, since it involved digging deeper and laying freaking bricks.

The plan was for us to pay $800 out-of-pocket for the work, plus $3-400 in tools and equipment to help launch the business, plus materials. We ended up paying a bit under $3000 for everything. Between the labor problems and an expanding project, the price got a bit higher than either of us had anticipated.

At least the yard looks nice.

Transparency

A friend–let’s call him me–recently had a bit of a hangup with a business relationship.

On a long-term project, there were some unavoidable setbacks. My friend decided to work through them, hoping to get everything back up to speed…before the customer noticed.

It’s a funny thing, but customers like to look at status reports on long-term projects. A couple of months after the biggest problem, the customer called my friend wanting an in-person status update. They told him to be prepared for an uncomfortable conversation.

Crap.

Now, the setbacks were truly unavoidable. Things came up that were entirely outside the realm of my friend’s control, but he had to deal with them anyway. When the problems were laid out in front of the customer, it went from uncomfortable to a discussion on how to expand the business relationship.

Transparency for the win.

Bad things happen. Anybody who doubts this is clearly not equipped to deal in the adult (that’s adult in the “grown-up” sense, not adult in the “porn” sense) world. Companies know that bad things can happen to derail a project. They are going to be more interested in how you get the project back on track than anything else.

When things go wrong, be open about it. Your customers/family/friends/one-night-stands will appreciate not having to wonder what’s going on.