- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

Let me check….

A few days ago, I asked a coworker if she wanted to go out for lunch. She said she’d have to check her bank account before she decided.

What?

If you have to check your bank balance to know if you can afford something, you can’t afford it. It really is that simple.

Now, strict budgets aren’t for everyone, but everyone should know how much money they have available to spend. If you don’t know what you have to spare, you need to set up a budget.

Period.

After you’ve done that, you can ignore it, with the exception of knowing how much you have available to blow on groceries, entertainment, and other discretionary purchases.

If you don’t know where your money needs to go, how can you determine how much you can spend on the things you want?

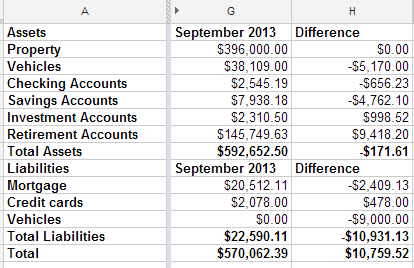

Net Worth Update

Time to update my net worth. Here are the highlights:

We paid off the Tahoe we bought last fall, but the value of my Pacifica fell $5,000 since April. That made me sad.

In August, we had $1000 worth of car repairs and $5500 for braces. We had most of the money saved for braces, but had to juggle some savings accounts around to cover it. We didn’t have enough money in our car repair fund to cover the repairs. Between the two, we beat up our credit card a bit more than usual last month. I’m not happy about it, but I’m confident we’ll catch up this month. My current goal is to get that paid off by the end of September. If I do, I should be able to avoid paying any interest on the balance.

All in all, it’s not bad progress. Our assets dropped $171.61, but our liabilities dropped $10,931.13, so our net worth is up $10,000. You won’t catch me complaining about that.

What’s going to happen in the future? We’re going to remodel both of our bathrooms this winter. We’re hoping to buy a pony before spring.

I’m excited to see our budget evolve over the next few months.

My wife is working and my kids are all in school. With the way our schedules work, we’ve pulled the youngest two out of daycare, so that expense is gone. And there are a couple of other things in the works that I’ll be sharing when they are finalized. If things progress the way they are looking, we’re going to spend the winter living off of my income, and saving her’s. That makes me feel like putting on an ant costume and kicking grasshopper’s butt all over town.

Olivia Wilde is Having a Baby: What are the first-month expenses?

Olivia Wilde recently announced her pregnancy with fiance Jason Sudeikis as she’s due with her first child in the coming year. Although the couple have declined to reveal their due date, they likely are expecting to set aside a budget for their baby, even with their high incomes. With forty percent of moms saying that having a baby is more expensive than they initially assumed, it’s important to look at the overall costs in the first month for plenty of preparation and financial planning.

Food

The first-month’s expenses can slightly range, depending on if the mother is using formula to feed the baby or is breastfeeding.

Breastfeeding is free and will not cost a dime, besides the breastfeeding supplies that cost an average of $15 in the first month due to nursing pads and milk storage bags for freezing.

Name-brand formula can be expensive, an average cost of $25 a week as the baby will be feeding on it several times a day, totaling about $100 in the first month. Generic brands of formula cost half the amount, an average of $12 a week.

Medical

Health insurance is one of the most expensive costs for newborn babies with 39 percent of mothers paying $1,000 with their childbirth. Some even pay at least $5,000. Health insurance will also likely increase to $200 a month for the child with co-pays that range from $30 to $100 per visit. Some health insurance will refuse to cover certain costs, which include vaccines and immunizations.

Daycare

Paid maternity leave is considered a luxury in the U.S. and is often unavailable for mothers who are self-employeed or do freelance work, making daycare a necessity. Daycare for newborns averages to $100 a month, but can be at least $1,000 for celebrities that use an in-home nanny.

General Care

Wipes will cost an average of $13 in the first month with a $5 increase in the water bill for the baby’s laundry and baths.

Diapers are one of the scariest expenses that are priced at $80 for basic Pamper diapers for newborns. Using cloth diapers are a one-time expense, so if provided by a friend or relative at a baby shower, they are free to use consistently and do not require much water or detergent to wash every other day.

Bath soap, detergent, and baby-safe shampoo will cost $30 a month to maintain the hygiene of your baby.

Although Olivia Wilde’s baby will be unique in its feeding habits and the materials for diapers used, the average cost in the first month will likely total $200 and can go as high as $4,000 for a celebrity. Many of the costs simply depend on the baby and are determined by the type of diapers used, the amount of doctor visits, daycare that may be needed, and whether the baby prefers breastfeeding or feeding on formula.

Related articles

John Luke Robertson Gets Engaged: The Benefits of Marrying Young

As I’m sure you’ve all heard by now, a young Mr. John Luke Robertson is engaged to be married at the ripe age of nineteen. While I’m positive you may be reeling in awe at how anyone could fathom being married at that age, the idea isn’t such a terrible one. The Robertsons have done more than build an outdoorsman’s empire; they’ve set the standard for wholesome values and American family dynamic. Even though I’m sure the two lovebirds won’t be dining on ramen and sharing a ramshackle apartment on the cheap side of town, they have the right idea. Let’s take a moment to explore why marrying young may not be such a bad idea for those of us less waterfowl adept.

As I’m sure you’ve all heard by now, a young Mr. John Luke Robertson is engaged to be married at the ripe age of nineteen. While I’m positive you may be reeling in awe at how anyone could fathom being married at that age, the idea isn’t such a terrible one. The Robertsons have done more than build an outdoorsman’s empire; they’ve set the standard for wholesome values and American family dynamic. Even though I’m sure the two lovebirds won’t be dining on ramen and sharing a ramshackle apartment on the cheap side of town, they have the right idea. Let’s take a moment to explore why marrying young may not be such a bad idea for those of us less waterfowl adept.

In the beginning, there was man. Man loved woman. Woman loved man. They found that they were so completely enamoured with one another that they couldn’t stand the idea of a moment apart and decided, “Hey, let’s spend every moment of or life together, forever.” There they are. Two young, ambitious people with the world ahead of them. Now what?

Likely, college is still looming for the two. Instead of struggling to work through school while paying for housing, they help each other. Two incomes mean half the burden and twice the savings. Instead of going out at night, they stay in studying, bonding, burning cookies and making lasting memories. After four years, that time spent at home has paid off. Instead of tarnishing their unblemished credit by applying for for small loans to stay afloat and likely defaulting, they’ve been paying off credit cards, paying on student loans, and thusly establishing good credit.

Speaking of homes, it’s about time for that. Thanks to the lack of partying and indecision, they left school with great GPA’s, promising careers, and a near perfect credit history. They purchase a home. Likely, a nice home with room to grow and most importantly, equity. Now that they’ve made the leap, the mortgage payment isn’t much more than the rent would have been and they can afford to pay a little extra toward the principle each month. Settling down so early has paid in dividends, via two incomes and ever increasing property value. Our couple has accomplished in five years what would take a single graduate closer to ten or fifteen to obtain.

They may or may not decide to have children. In the event that they do, the kids will have grown and left the nest before our couple has even reached 45. Diligently working and supporting each other, they have continued to save. The house is paid off and the kids are gone. Retired at 50, they own their home outright. They can relax and spend the rest of life enjoying it from a comfy porch swing. There is no struggle or financial burden. They are free, while others their age may still be living paycheck to paycheck and worrying about keeping a roof overhead.

You may still consider the idea of marrying young to be frivolous, but it is likely that at this point in your life you could have been twice as well off had you only settled down with that girl from high school who would have followed you to the end of the Earth. Following your heart may not only make you happy, it can make you stable, self sufficient and and financially secure. They don’t make a duck call for that.

Yakezie Beta Chapter Search

In an effort to promote the crap out of the Yakezie Beta Chapter, I’ve created a search specific to us. This will make it easy to find Beta Challengers to promote.

The current list in the search is:

Live Real, Now

http://www.YourSmartMoneyMoves.com

http://meinmillions.blogspot.com/

http://www.rentingoutrooms.com

http://www.yesiamcheap.com

http://SimpleVesting.com

http://untildebtdouspart.blogspot.com/

http://www.blondeandbalanced.com

http://jamesfowlkes.com/

http://www.mightybargainhunter.com

http://www.beatingtheindex.com

http://www.thepassiveincomeearner.com

http://www.prairieecothrifter.com

http://sustainablepersonalfinance.com/

http://www.toddswanderings.com

More will be added as I have time to dig through the forums. If you’re a Beta Challenger and don’t see your name, leave a comment below and I’ll get you added ASAP.