- Time to steal my son’s Wii. RT @fcn: Dang, watch Hulu on your Wii… http://bit.ly/9c0U8F #

- RT @FrugalDad: 29 Semi-Productive Things I Do Online When I’m Trying to Avoid Real Work: http://bit.ly/a4mcEI via @marcandangel #

- With marriage, if winning is your goal you will always lose. via @ChristianPF http://su.pr/2luvrz #

- RT @hughdeburgh: “There is no worse death than a life spent in fear of pursuing what you love.” ~ from http://FamiliesWithoutLimits.com #

- @chrisguillebeau The continental US can be done in 6 days on a motorcycle, but it’s not much of a visit. in reply to chrisguillebeau #

- Ugh. Google’s a twitter competitor now. #

- Took this morning off. Just did 45 pushups in 1 set/135 total. #30DatProject #

- RT @Moneymonk: To solve the traffic problems of this country is to pass a law that only paid-4 cars be allowed to use the highways. W Rogers #

- RT @SimpleMarriage Valentine’s Week of Giveaways: A Private Affair http://ow.ly/1oolpT #

- Your baseless fears do not trump my inalienable rights. — Roberta X http://su.pr/2qBR3P #

- RT @WellHeeledBlog: Couple married for 86 years(!!) will give love advice via Twitter on Valentine’s day: http://tinyurl.com/ybuqqtu #bp Wow #

- 193 pushups today, including1 set of 60. Well on my way to a set of 100. #30DayProject #

- @prosperousfool Linksys makes wireless repeater to extend the range of a router. in reply to prosperousfool #

- RT @MyLifeROI: Is anyone else unimpressed with Google Buzz? #

Credit Cards: How to Pick a Winner

We live in a decidedly credit-centric culture. Whip out cash to pay for $200 in groceries and watch the funny looks from the other customers and the disgust from the clerk. It’s almost like they are upset they have to know how to count to run a cash register.

If someone doesn’t have a credit card, everyone wonders what’s wrong, and assumes they have terrible credit. That’s a lousy assumption to make, but it happens. For most of the last two years, I shunned credit cards as much as possible, preferring cash for my daily spending. Spending two years changing my spending habits has made me comfortable enough to use my cards again, both for the convenience and the rewards.

Having a decent card brings some advantages.

Credit cards legally provide fraud protection to consumers. Under U.S. federal law, you are not responsible for more than $50 of fraudulent charges. many card issuers have extended this to $0 liability, meaning you don’t pay a cent if your card is stolen. Trying getting that protection with a wallet full of cash.

The fraud protection makes it easier to shop online, which more people are doing every day. At this point, there is no product you can buy in person that you can’t get online, often cheaper. How would you order something without a credit card? Even the prepaid cards you can buy and fill at a store will often fail during an online transaction because there is no actual person or account associated with the card. The “name as it appears on the card” is a protective feature for the credit card processors and they dislike accepting cards without it.

If you’re going to use a credit card, you need to make a good choice on which credit card to get. There are a few things to check before you apply for a card.

Annual fee. Generally, I am opposed to getting any card with an annual fee, but sometimes, it’s worth it. If, for example, a card provides travel discounts and roadside assistance with its $65 annual fee, you can cancel AAA and save $75 per year. A good rewards plan can balance out the fee, too. I’m using a travel rewards card that has a 2% rewards plan. That’s 2% on every dollar spent, plus discounts on some travel purchases. In a few months, I’ve accumulated $500 of travel rewards for the $65 fee that was waived for the first year. The math works. A card that charges an annual fee without providing services worth several times that fee isn’t worth getting.

Interest rate. This should be a non-issue. You should be paying off you card completely every month. In a perfect world. In the real world, sometimes things come up. In my case, I was surprised with a medical bill for my son that was 4 times larger than my emergency fund. It went on the card. So far, I’ve only had to pay one month’s interest, and I don’t see the balance surviving another month, but it’s nice that I’m not paying a 20% interest rate. Unfortunately, as a response the CARD Act, the days of fixed rate 9.9% cards seems to be over.

Grace period. This is the amount of time you have when the credit card company isn’t charging you interest. Most cards offer a 20-25 day grace period, but still bill monthly. That means that you’ll be paying interest, even if you pay your bill on time. To be safe, you’ll need to either find a card that has a 30 day grace period, or pay your balance off every 15-20 days. Some of the horrible cards don’t offer a grace period of any length. Avoid those.

Activation fees. Avoid these. Always. There’s no card that charges an activation fee that’s worth getting. An activation fee is an early warning sign that you’ll be paying a $200 annual fee and 30% interest in addition to the $150 activation fee.

Other fees. What else does the card charge for? International transactions? ATM fees? Know what you’ll be paying.

Service. Some cards provide some stellar services, include concierge service, roadside assistance, and free travel services. Some of that can more than balance out the fees they charge. My card adds a year to the warranty of any electronics I buy with it, which is great.

Credit cards aren’t always evil, if you use them responsibly. Just be sure you know what you’re paying and what you’re getting.

What’s in your wallet?

Unsecured Personal Loans: Advice for First-Time Borrowers

One of the most difficult decisions you will have to make when applying for an unsecured personal loan is figuring out how much you should borrow and for how long. It is important to understand that the more you borrow, the more you will save. How? Lenders will usually enforce higher interest rates for smaller loan amounts. Therefore, applying for more than you need is a great idea only if you can resist the urge of spending those additional funds. A good idea would be to take those extra funds and invest them into an appealing high interest money market or CD.

Determining how much you can afford

If you are not looking to borrow more than you need, we suggest utilizing the following input: Create a budget including all of your daily living expenses and monthly bills. Subtract the total of all your expenses from your monthly net income. The amount left over is not going to be what you can afford towards payment of an unsecured personal loan. Why? You don’t want to leave yourself without any emergency money. You never know when you may need some extra cash for an unforeseen situation like a car or home repair. 75% of the amount left over should be designated for monthly personal loan payments.

Determining how much to borrow

Evaluating the total intent of your loan is critical when calculating how much to borrow. For example, if you are planning a vacation, you will need to not only factor in the cost of the flight and the hotel, but also the costs of eating, drinking, sight-seeing, etc..

Determining how long to borrow

A loan term is the total length of time you have to repay your loan. Typical terms for unsecured personal loans range from 12 – 72 months. It is essential that you comprehend that the greater the duration of your term, the more costly your loan is going to be. With a longer term, your monthly loan payments are going to be lower, but the amount you pay in overall interest fees is going to be greater. But, it may make sense for you to make use of a longer term. For example, suppose the plumbing system in your new home stops working and needs to be immediately repaired. However, you moved in less than one year ago and have zero equity in the house. And, you are having a difficult time satisfying your existing monthly monetary obligations. For this type of situation, it makes sense to satisfy your immediate financial needs so that you can get your plumbing repaired without having to put too much additional strain on your wallet. Saving money is good, but keeping your sanity is better!

Determining where to apply

Your local bank is probably the first option that comes to mind. Don’t limit yourself. Take advantage of the internet. Online lenders, like Choice Personal Loans, compete with local banks by offering extremely competitive rates and terms for their unsecured personal loans. They even offer no credit loans for those looking to establish their credit history.

Cheap Conference Calls

Sometimes, a conference call can make you thousands of dollars. Whether you’re pitching a product, or planning a new service to offer, sometimes you need to be able to talk with a team.

Business owners rely on many technological tools to conduct business day to day. Online business conferencing is one of the more popular services that owners have come to rely on. There are lots of online websites that provide free conference calling services that will save the small business owner some cash. Some of these sites offer permanent free calling for life and others offer free calling for a limited time only.

Free Conference Calls

There are a number of free conference call services out there. For most, you can use the site and get unlimited free conference calling 24 hours a day and seven days a week. This is a permanent full time offer and no credit card is needed with the best of the service. You can often conference with up to 96 different users at the same time and spend at least six hours on each call. That is more than enough time for the average business owner to conduct all of their all business with fellow participants.

Skype

Skype is another company that has a free business conferencing service for all Skype users. There is no fee for conference calls as long as all of the users have downloaded Skype. Anyone that wishes to use their mobile phone to join in can be added by purchasing Skype Credit. Payments can be made online or through payment processing services like PayPal. This is a cheap way for a small business owner to connect with team members via conference call.

Go To Meeting

GoTomeeting.com is the most well known of the companies providing conference calling services. The company offers its GoToMeeting, GoToWebinar, and GoToTraining that provide unlimited usage for business owners. Basic plans start at $15 a month which is a bargain for owners that have frequent conference calls with employees and customers. At the high end of their offering is GoToTraining at $150 per month. GoToMeeting has a lot of features including the recording and playback of all meetings. This is a useful option for any attendee that misses a meeting and needs to catch up.

These are just a few of the options available to the business owner who is on a budget and looking for a way to stay connected with his employees.

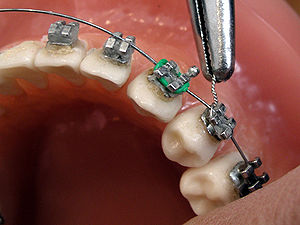

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

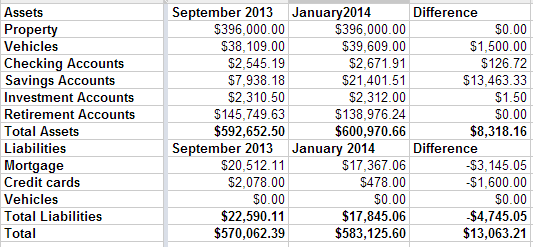

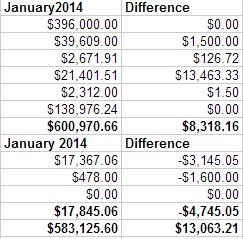

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.