- Guide to finding cheap airfare: http://su.pr/2pyOIq #

- As part of my effort to improve every part of my life, I have decided to get back in shape. Twelve years ago, I wor… http://su.pr/6HO81g #

- While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed ou… http://su.pr/2n9hjj #

- In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed… http://su.pr/19j98f #

- Arrrgh! Double-posts irritate me. Especially separated by 6 hours. #

- My problem lies in reconciling my gross habits with my net income. ~Errol Flynn #

- RT: @ScottATaylor: 11 Ways to Protect Yourself from Identity Theft | Business Pundit http://j.mp/5F7UNq #

- They who are of the opinion that Money will do everything, may very well be suspected to do everything for Money. ~George Savile #

- It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach. ~Franklin Delano Roosevelt #

- The real measure of your wealth is how much you'd be worth if you lost all your money. ~Author Unknown #

- The only reason [many] American families don't own an elephant is that they have never been offered an elephant for [a dollar down]~Mad Mag. #

- I'd like to live as a poor man with lots of money. ~Pablo Picasso #

- Waste your money and you're only out of money, but waste your time and you've lost a part of your life. ~Michael Leboeuf #

- We can tell our values by looking at our checkbook stubs. ~Gloria Steinem #

- There are people who have money and people who are rich. ~Coco Chanel #

- It's good to have [things that money can buy], but…[make] sure that you haven't lost the things that money can't buy. ~George Lorimer #

- The only thing that can console one for being poor is extravagance. ~Oscar Wilde #

- Money will buy you a pretty good dog, but it won't buy the wag of his tail. ~Henry Wheeler Shaw #

- I wish I'd said it first, and I don't even know who did: The only problems that money can solve are money problems. ~Mignon McLaughlin #

- Mnemonic tricks. #

- The Wilbur and Orville Wright Papers http://su.pr/4GAc52 #

- Champagne primer: http://su.pr/1elMS9 #

- Bank of Mom and Dad starts in 15 minutes. The only thing worth watching on SoapNet. http://su.pr/29OX7y #

- @prosperousfool That's normal this time of year, all around the country. Tis the season for violence. Sad. in reply to prosperousfool #

- In the old days a man who saved money was a miser; nowadays he's a wonder. ~Author Unknown #

- Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~Norman Vincent Peale #

- RT @MattJabs: RT @fcn: What do the FTC disclosure rules mean for bloggers? And what constitutes an endorsement? – http://bit.ly/70DLkE #

- Ordinary riches can be stolen; real riches cannot. In your soul are infinitely precious things that cannot be taken from you. ~Oscar Wilde #

- Today's quotes courtesy of the Quote Garden http://su.pr/7LK8aW #

- RT: @ChristianPF: 5 Ways to Show Love to Your Kids Without Spending a Dollar http://bit.ly/6sNaPF #

- FTC tips for buying, giving, and using gift cards. http://su.pr/1Yqu0S #

- .gov insulation primer. Insulation is one of the easiest ways to save money in a house. http://su.pr/9ow4yX #

- @krystalatwork It's primarily just chat and collaborative writing. I'm waiting for someone more innovative than I to make some stellar. in reply to krystalatwork #

- What a worthless tweet that was. How to tie the perfect tie: http://su.pr/1GcTcB #

- @WellHeeledBlog is giving away 5 copies of Get Financially Naked here http://bit.ly/5kRu44 #

- RT: @BSimple: RT @arohan The 3 Most Neglected Aspects of Preparing for Retirement http://su.pr/2qj4dK #

- RT: @bargainr: Unemployment FELL… 10.2% -> 10% http://bit.ly/5iGUdf #

- RT: @moolanomy: How to Break Bad Money Habits http://bit.ly/7sNYvo (via @InvestorGuide) #

- @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- @The_Weakonomist At $1173, it's only lost 2 weeks. I'd call it popped when it drops back under $1k. in reply to The_Weakonomist #

- @mymoneyshrugged It's worse than it looks. Less than 10% of Obama's Cabinet has ever been in the private sector. http://su.pr/93hspJ in reply to mymoneyshrugged #

- RT: @ScottATaylor: 43 Things Actually Said in Job Interviews http://ff.im/-crKxp #

- @ScottATaylor I'm following you and not being followed back. 🙁 in reply to ScottATaylor #

The Virtues of Blow Money

When we initially developed our budget, we built it tight. Every penny was accounted for and had a place to go. I was so proud.

Unfortunately, there were some problems with habitual–even compulsive–shopping in our house. The change from “whatever we wanted” to “it’s not budgeted” was too much, too fast.

After a few months of arguments, we agreed to set up a “blow money” line item in the budget. That’s money that is absolutely unaccountable. When a purchase comes out of that fund, no questions are allowed. Whether it’s a new pair of shoes for her, or a new book for me, nobody gets to fight over it. Sometimes, it’s a nice dinner out, other times it’s another gadget for the entertainment center. It’s never a problem.

This provides two major benefits.

First, it balances the feeling of sacrifice. If my wife never gets to buy anything, while at the same time, she’s watching our friends and neighbors flaunt their rampant consumerism, it makes her feel like she is giving up the good life. We aren’t lacking for anything, but the trappings of middle-class “success” can be expensive. Having an opportunity to participate in that horrible rat-race lessens the feeling that we are missing out. Rationally, we know that the right thing is not to spend that money, but emotionally, it’s a necessity.

Second, it’s a safety valve. Our finances are under tight control, which can cause pressure. Finances are, after all, one of the leading causes of divorce. Having a way to release that pressure makes everyone happier. Habitual shoppers experience shopping the same way drug addicts experience their “high”. That includes withdrawal. The safety valve turns this from a “cold turkey” method of quitting to a weaning of the addiction.

Another minor benefit is that the blow money can serve as an opportunity fund to bridge the gap between the discretionary budget and a desired purchase. Last week, we ran across a curio cabinet that exactly matches our living room, but we didn’t have it budgeted. Out comes the blow money, which, combined a portion of the discretionary budget and some negotiating, made the new cabinet affordable, without busting the budget.

This isn’t a system that works for everybody, but it keeps us on track.

How do you handle the stresses of a household budget?

Make Extra Money: A Niche Site Walkthrough

Make Extra Money Part 1: Introduction

Right now, I have 7 sites promoting specific products, or “niche” sites. When those products are bought through my sites, I get a commission, ranging from 40-75%. Of those sites, 5 make money, 1 is newly finished, and 1 is not quite complete. I’m not going to pretend I’m making retirement-level money on these sites, but I am making enough money to make it worthwhile.

Make Extra Money Part 2: Niche Selection

These three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”.

Making Extra Money Part 3: Product Selection

My niches site are all product-promotion sites. I pick a product–generally an e-book or video course–and set up a site dedicated to it. Naturally, picking a good product is an important part of the equation.

Make Extra Money Part 4: Keyword Research

If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results. Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

Make Extra Money, Part 5: Domains and Hosting

In this installment, I show you how to pick a domain name and a website host.

Make Extra Money, Part 6: Setting Up a Site

A niche site doesn’t amount to much without, well, a site. In this installment, I show you how I configure a site, from start to finish.

Make Extra Money, Part 6.5: Why I Do It The Way I Do It

Several people have asked me to explain why I use the plugins and settings I use. This explains the “Why” behind Part 6.

More to come….

Apple Launches iPad Air in November

With a lighter and thinner chasis, the newly announced iPad Air has a more powerful processor with a great new design and performance features that’s sure to continue Apple’s trend setting reputation. Apple senior vice president Phil Schiller is calling it the biggest leap forward for a full-sized iPad. We expect people have already started packing overnight bags for their long wait on the sidewalks outside the stores.

With almost a half million apps already available for the iPad, you have a great head start on things to do. Apps built into the iPad Air will include solutions for routine tasks, like web surfing and checking email. A number of previously apps that had to be purchased are now free, such as iMovie, Keynote, iPhoto, GarageBand and Pages. Popular apps for other Apple products, they have all been upgraded to work with iOS 7 and the iPad. Quickly put together an original song or detail a presentation anywhere. As a lot of apps are developed solely for Apple products, these can look stunning on their displays.

The iPad Air’s current launch date is November 1. It will come in black and gray or silver and white. It will start at $499 for a 16 gigabyte WiFi version. This is $100 more than previous generation launches, but supporters say the consumer is getting more screen real estate. The Cellular model will retail for $629. The iPad 2 will continue in the stores for $399.

Related articles

Selling on Craigslist

The vast majority of personal finance websites(including this one) focus on reducing your bottom line–cutting costs. The other end of the budget is at least as important. Have you tried raising your top line lately? Have you picked up a side hustle, sold an article, put ads on a website, or even sold some of your stuff? After we had our garage sale a few weeks ago, we were left with some furniture that was too nice to donate or discard, so we decided to sell it on Craigslist.

The key to selling your stuff on Craigslist is taking pictures. They don’t have to be good pictures, just something to let your customers know what they are getting. Take pictures, post the measurements and, if it’s electronic, the model number. Beyond that, a simple description will suffice.

Be safe when you are posting the listing. Don’t give your address and don’t post when you will be home. That’s just a job offer for burglars. When you talk to a potential buyer, never tell them there is nobody home. Tell them your roommate is the only one home and he doesn’t want to deal with the sale. Don’t give strangers on the internet an opportunity to rob you.

When you are meeting a buyer, pick a public place away from home, if at all possible. If you are selling furniture, it may not be possible, but it is for smaller items. Meeting in a busy gas station parking lot or even in front of the police department is a good way to stay safe. Secondary crime scenes are nasty things and inviting the wrong stranger in is offering one ready-made.

[ad name=”inlineleft”]Bring a friend. Preferably, an intimidating friend. Crime is less likely to happen if there is more than one person there. Bring a friend to a public place to meet the buyer to maximize your safety.

Don’t get ripped off. Craigslist scams abound. Bad checks, forged checks, and shipping scams are just some of the problems.

Only accept cash. It’s hard to forge a greenback.

One of the most common scams, after a bounced check, is the cashier’s check scam. You’ll get an email saying the item is great and payment is on the way. When the check clears, a relative of the buyer will come to pick up the item. Then, oops, their secretary made the check out for $3000, instead of $300. Would you mind sending the overpayment back by Western Union, minus $100 for your troubles? First sign of trouble: over-complicating a simple transaction. Second sign: not using cash. The cashier’s check will be forged. There is no way to verify funds on a cashier’s check, and the bank will post it as available well before it comes back bad. You will be able to spend the money, only to have the money disappear later. That means you can’t wait to see if the check clears before wiring back the overpayment. There is no way to recover your money.

If you get a response that includes a link, do not click it! Ever. No matter what the link looks like. Ever. No clickyclicky. It may be an innocuous link to your ad, but the link can be masked. Any other link is almost definitely a link to a virus-ridden website. Repeat after me: No clickyclicky.

If you get an email about Craigslist transaction protection or escrow, you are being scammed. Run away.

Craigslist can be great way to turn your junk into cash, but only if you actually get the cash. Keep yourself safe and scam-free.

Net Worth and other stuff

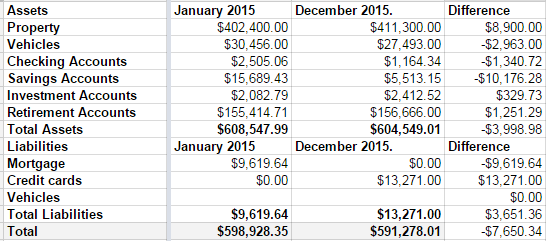

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.