This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

We had a garage sale last week, as a wrap-up to the April 30 Day Project. We got rained out halfway through the first day of our 3-day sale, but we still managed to clear $1500. We held the sale in our neighbor’s garage because it had more space and better visibility.

Wednesday night, while carrying boxes over, I missed the step to their property from our driveway and crashed while carrying three boxes. That’s a twisted ankle and a bleeding knee. Naturally, while I’m hopping and swearing, everyone is concerned that I’m okay. The worry-warts. Anyway, it hurt, so we stopped setting up while we still had a few boxes left in the basement.

[ad name=”inlineleft”]Thursday morning, I decided to show them all. At 5:30AM, before anybody else is strongly considering the possibility of maybe thinking about getting ready to hit the snooze button, I decided to get the rest of the boxes ready. They’d all wake up, worried about how I’m feeling, asking if I’m to stiff to carry boxes. The best way to show them they don’t need to worry would be to have all of the boxes dealt with before they woke up. So I started. Up and down the stairs, with a stiff, twisted ankle, gloating to myself about how tough I was…BOOM, down the stairs. I was on my back, sliding down the stairs. I caught a stair-tread in the small of my back and another on the point of my tailbone. Mommy?

After I stopped twitching on the floor at the base of the stairs, I managed to get the last of the boxes ready. Instead of sympathy, I spent the rest of the weekend getting asked if I needed an inflatable doughnut to sit on. There are places I’d prefer not to have bruised.

Unpacking the boxes made me glad that everything was priced. We spent 6 weeks going through our entire house–every room, every dresser, every drawer–to eliminate the clutter. As something went into a box, it got priced, so we didn’t have to do it all at the last minute. That is the most important time-saving step for a garage sale. Price it as you pack it. You don’t want to waste hours pricing stuff while tripping over potential customers.

Another preparation tip to do early: Find tables! Ask around. You’d be surprised at who has a dozen folding tables collecting dust in his basement. It’s better to borrow that to rent. The best price I found was $17.50 to rent an 8′ X 30″ table for a week. We didn’t have to do that, but we thought we would have to. I borrowed a few, found a few, and built a few out of sawhorses.

The week before the sale, we placed an ad in the paper. When I placed the ad, the paper called to suggest we change it from running the weekend before to running just the days of the sale. I agreed, to a point, but their Sunday circulation is miles ahead of the weekday circulation, so why pay to run an ad nobody will see on Thursday? I ran it Sunday through Tuesday, because I wanted the Sunday ad and we got 3 consecutive days in the price. Did I actually know better than the paper’s sales-weasel? Who knows? I think I made the right decision.

The Sunday before the sale, I posted an ad on Craigslist. Interesting fact: little old ladies use Craiglist to plan their garage-sale adventures.

Two days before the sale, we made signs. Bright pink signs with brighter yellow starbursts. They were all simple. “Mega Sale! 8-5” followed by an arrow and our address. Simple, easy-to-read, and bright. The morning of the sale, after the ibuprofen kicked in, I put the signs up. When you make signs out of paper, always include a crossbar. It rained a lot the first day of the sale, so the signs wilted. The second morning, I went out with some duct tape and crossbars and fixed them all.

The day before the sale, we got cash and change. We had $50 in 1s and 5s and $25 in silver change. No pennies. Nothing was priced to make us need them.

The morning of the sale, we set up two canopy tents in the driveway and pulled the prepared-and-filled table out under them. We finished stacking as much as we could on the tables and called it “open”. There were a few boxes we couldn’t put out due to the rain. We simply ran our of room. At noon, $65 into the sale, we decided enough was enough and shut down–cold, wet, and miserable. Lunch and a nap made the day better.

Later, I’ll discuss the other parts of our successful sale.

Note: The entire series is contained in the Garage Sale Manual on the sidebar.

Update: This post has been included in the Money Hacks Carnival.

I work daily to raise my kids to be more financially responsible than I have been. One of the most difficult pieces has been to explain the benefits of delayed gratification to my children. It’s hard enough, as an adult, to take delayed gratification to heart. For a child? It seems to be almost impossible.

My son wants an XBox 360 Elite. Good for him. He wants to renegotiate the terms of his allowance to get it faster. Currently, every other time he gets an allowance paid out, it goes into his bank account, to be mostly untouched. The other times he can do as he pleases with his money. We are enforcing a 50% long term savings plan. Now, with a medium-term goal in mind, he wants to keep all of his money, and only put gift money into the bank account.

Should we let him tap his bank account for a shiny new bauble? It’s been building for a while, so it’s delayed, right? I don’t think that would accomplish much. Like any other 10-year-old, his interests change often.

Should we let him change the terms of our agreement, speeding a medium-term goal at the expense of his long-term savings? My wife and I haven’t had a chance to discuss this, but my initial reaction is not to allow it. His savings has the potential to turn into a decent car in a few years, if he wants. That would be a car he knows he earned.

Last week, when we were at the store, he asked if he could borrow some money to buy a game. I don’t expect him to carry his money around everywhere, so I would have allowed it, if he would have had the money at home. He didn’t. His plan was to pay me what he did have as soon as we got home, then work his butt off for a few days to earn enough extra to pay it back. I won’t be a credit agency for my kids, so I said no. He was disappointed, but, by the time he had earned the money, he no longer wanted the game. I consider that a win, but I don’t know that he learned any lesson other than “Dad’s a jerk.”

Someday, when his life launch is smooth due to a lack of debt-dependence, he’ll look back on these lessons and smile.

I hope.

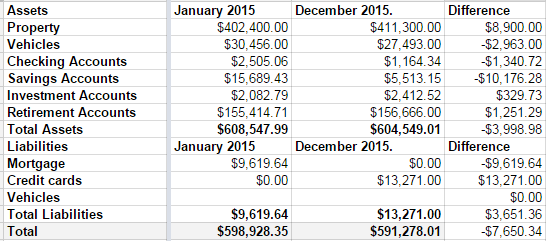

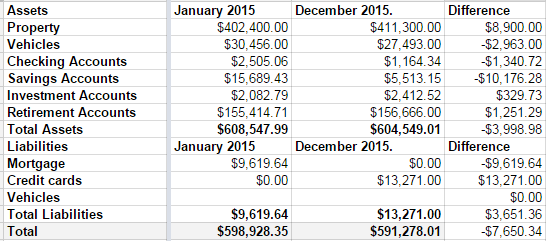

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

Getting out of debt is primarily a matter of changing your habits. We’ve all heard people swear by skipping your morning cup of coffee to get rich, but that’s just a small habit. Much more important are the big habits, the lifestyle habits. Here are 5 habits to cultivate for financial success.

“Beware of little expenses; a small leak will sink a great ship”– Benjamin Franklin

As Chris Farrel wrote in “The New Frugality“, being frugal is not about being cheap, but finding the best value for your money. When my wife and I had our second baby, we couldn’t justify spending $170 on a breast pump, so we bought the $30 model. It was quite a bit slower than the expensive model, and was only a “single action”, but for $140 of savings, it seemed worth the trade. Six weeks later, it burned out so we bought a new one, still afraid to justify $170 on quality. This thing took at least 45 minutes to do its job. When it burned out 6 weeks later, we decided to go with the high-end model. This beauty had dual pumps, “baby-mouth simulation” and it was fast. The time was cut from a minimum of 45 minutes to a maximum of 15. That’s 3 hours of life reclaimed each day fro $140. Six months of breastfeeding for each of two kids means my wife regained 45 days of her life in exchange for that small amount of money. At the rate of 6 weeks per burnout, we would have gone through 8 cheap pumps, costing $240. The high-end unit was still going strong when we weaned baby #3. Buying quality saved us both time and money. I wish we would have gone with the good one from the start. Sometimes, the expensive option is also the cheap option.

“Maturity is achieved when a person postpones immediate pleasures for long-term values.” -Joshua Loth Liebman

Being a mature, rational adult is hard. It means accepting delayed gratification over the more enjoyable instant variety. We save for retirement instead of charging a vacation. It takes a lot of restraint to put off buying the latest toys, clothes, gadgets, cars or whatever else is currently turning your crank until you actually have the money to actually afford it. It means planning your future instead of looking like a surprised bunny caught in a spotlight every time your property taxes come due. (Who knew that the year changed every year? Do they really expect annual payments annually? Geez! There’s so much to learn!) It means thinking about your purchases and buying what you actually need, actually want, and will actually use instead of resorting to retail therapy whenever you feel like a sad panda. The only benefit to mature, rational management of your finances is that, given time, you will have the security of knowing that, no matter what happens, you will be okay. That’s a huge benefit.

“Do not bite at the bait of pleasure, till you know there is no hook beneath it.” – Thomas Jefferson

If it hurts, you won’t do it. You have to learn to take pleasure from from things that won’t make you broke and you have to learn not to hate putting off the things you can’t afford. Take pleasure in the little things. Enjoy the time with your family. Presence means so much more than presents. So many people never learn how to enjoy themselves. Take the time to experience life and enjoy doing it.

Update: This post has been included in the Carnival of Debt Reduction.

I’m not a huge fan of New Year’s resolutions. Generally speaking, if you don’t have the willpower to do something any other time of the year, you probably won’t grow that willpower just because the last number on the calendar changed.

Seriously, if you’ve got something worth changing, change it right away, don’t wait for a special day.

That said, this is the time of the year that many people choose to try to improve…something. Some people try to lose weight, other people quit shooting meth into their eyeballs, yet others(the ones I’m going to talk about) decide it’s time to get out of debt.

Now most people are going to throw out some huge and worthless goals like:

The problem with goals like that is the definitions. What is “some”, “more”, “better”, or “less”? How do you know when you’ve won.

It’s better to take on smaller goals that have real definitions.

Try these:

But Jason, I hear you saying, where am I going to find $1000 to save? Well, Dear Reader, I’m glad you asked. Next time though, could you ask in a way that others can hear so my wife doesn’t feel the need to call the nice men in the white coats again?

Let’s break that goal down even further.

Instead of saving $1200, let’s call it $100 per month. That’s a bite-sized goal. Some people don’t even have that to spare, so what can they do?

Let’s make that resolution something like “I’m going to have frozen pizza instead of my regular weekly delivery.” If your house is anything like mine, that brings a $60 pizza bill down to $15 for some good frozen pizza for a savings of $45. If you order pizza once a week, that’s $180 saved each month, double your goal. That’s a win with very little suffering.

Now, you can take that extra $80 that you hadn’t even planned for and throw it at your credit cards. That’s a free payment every month. Before you know it, you’ll have your cards paid off and a decent savings account.

Then you can thank me because I made it all possible.