- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

Watching My Debt

- Image by Getty Images via @daylife

I’m so excited. Yesterday, I transferred the final payment for my personal line of credit. This LOC was originally my overdraft protection LOC that had worked it’s way up to $6000 at 21%. Today, it is non-existent.

We started to pay down debt on April 15th, 2009. Since that time, we have paid off $22, 370.70 of our debt. That isn’t $22,370.00 in payments, that is a $22k reduction in our total debt! By my calculations, we have made approximately $28,000 in payments to get that reduction. Next week, we cross the line for 25% of debt eliminated. This is a good day.

Over the last 14 months, we’ve settled into much more responsible spending and saving habits. It no longer feels like we’re sacrificing our lifestyle. We’ve built up a useful emergency fund and set aside money for some things that we know are coming, like braces for my son. In 6 weeks, we are taking our first debt-less vacation.

Now, we start on the long slog to the end. We have 3 debts left to pay: Our last car loan(ever!), one credit card which was an accumulation of pretending we were making progress on our debt by combining many debts onto one card, and finally, our mortgage. The car will be paid by the end of the year. When summer childcare expenses are over, we’ll be making triple payments until it is gone. After that, we have a long, slow couple of years paying off the credit card.

It hasn’t always been easy, but right now, it feels good to look at the progress we’ve made.

Update: This post has been included in the Carnival of Debt Reduction.

Human Interaction

Life may be like a box of chocolates, but it is certainly not a game of Sorry, where one person wins at the expense of all others. It is entirely possible for everyone to win in most voluntary interactions.

For example, if my company gives me a $10,000 raise, it would seem like I win and they lose. I’m getting more money, at the expense of their bottom line, right? Maybe. But what if that raise spurs me on to make an extra $100,000 for the company? That makes it a good investment and a Win/Win scenario.

When I’m dealing with one of my side-business customers or an advertiser, I’m definitely pushing for the Win/Win. Of course I want them to pay me as much as possible, but I also want their repeat business, which won’t happen unless they walk away happy. If I insisted that each of my customers pay the absolute top dollar, I may come out ahead in the short-term, but what about next month or next year? It’s much better for both of us if we can find a happy middle ground.

The four basic forms of interaction are:

1. Win/Lose. This is where I win and you lose. Haha! The problem with a Win/Lose is that the loser isn’t going to come back to play next year. He’s not happy and he’ll probably tell his friends how unhappy he is. This is also the interaction that people are mistakenly assuming when they complain about excessive executive interaction. The CEO is making a million dollars while the folks on the assembly line are stuck with $15 per hour? It’s entirely possible that, if the CEO weren’t doing his job, nobody else would have one. That is, like it or not, Win/Win.

2. Lose/Win. This is where I give up everything, hoping you’ll eventually throw me a bone. It’s a cowardly interaction that won’t work well when dealing with someone playing #1. I’ll keep giving, you’ll keep taking. You go home happy, I go home sore. When it’s done, I won’t do business with you ever again.

3. Lose/Lose. Nobody wins. We fight so hard to get what we want, forcing the other side to give up as much as possible, while they are doing the same. At the end of the day, the hatred is flowing so strong, there’s no possibility of a relationship.

4. Win/Win. Yay! Everybody wins! Everybody’s happy! This will involve some compromise, but hopefully we can reach the happy middle ground where we are both smiling. If I’m looking for a deal that involves you paying me $1000 per month, is it better for me to push to get exactly that, or let myself get talked down to $750? If the $1000 is more than you can afford, so you quit with hard feelings after one month, the ongoing $750 is much, much better for both of us. It is actually in my greedy self-interest to give up that 25% to build our relationship.

Winning doesn’t have to be done at the expense of others. If you do it right, we all win.

Mortgage Race, Part 2

As I mentioned last month, Crystal and I are in a race to pay off our mortgages. The loser(henceforth known as “Crystal”) has to visit the winner. Now, since–judging by the temperature–Crystal lives in Hell, I think it would be good for her to visit in the winter. There something about the idea of going ice fishing, staring at a hole in the ice while sitting on a 5 gallon bucket, cursing the day I was born.

Today, she threw down the gauntlet again. She has apparently decided that, since her prerequisites are met, she’s going to win. Sure, she’s closed on her house and built her savings back up to $20000, but it doesn’t matter. I’ve sent a small army of arson-ninjas to keep her from getting ahead. They are so small, they can only carry tiny matches and single drops of gasoline, so the damage they can do is tiny, but it will add up. Just a word of advice: if you hire an army of arson-ninjas, go for the upsell and get ninjas that are at least 2 feet tall. Anything less is just inefficient.

When I announced the race last month, my mortgage balance was $26,266.40. Today, it is $25,382.53. In three days, there will be another $880 applied to the principal.

In February, our renters will move in and we’ll conservatively have another $650 to pay. When that starts, our balance should be around $23,000. Adding a portion of the rent payment should mean we pay off the house in May 2014. However, when I bring in our side hustle money, that will bring us back to September 2013.

Crystal’s projected payoff is July 2013, so I’ll have to hustle.

Net Worth Update

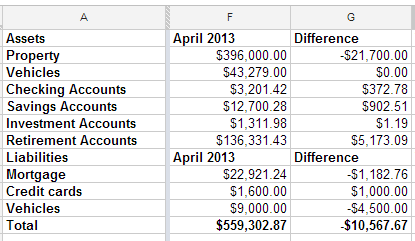

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

Flatbed Trucks: Why Buy When You Can Rent?

This is a guest post.

The goal of any business is to maximize profits while limiting expenses. Yet sometimes, a business may need a certain piece of equipment for a special project or other task. For example, a flatbed truck may be needed sometimes, but not enough times to justify spending the money to buy one. When this is the case, renting the truck becomes the smart option.

Renting a flatbed truck is perfect when working with heavy, oversized or irregular shaped cargo. Many times these trucks may only be needed for one or two days, perhaps only a few hours. When this is the case, renting a truck makes perfect sense. Any town and city has numerous rental truck options from which to choose, with the most popular brand being U-Haul. Flatbed trucks come in a variety of sizes, ranging from 8-22 feet in length. They can be rented for several days or only a couple of hours, depending on one’s needs. If necessary, the trucks can also be rented on a weekly or monthly basis.

A truck hire can also be very cost-effective for a business. Buying a flatbed truck can cost a business $40,000-$50,000 or possibly more, depending on the size of the truck. As with any new vehicle purchase, as soon as it’s driven off the dealer’s lot it begins to depreciate, therefore giving a business owner an investment whose value is less and less as time goes by. By renting a truck only when necessary, it saves a business substantially in terms of making a capital investment. Rental prices vary among different businesses, with most averaging $50-$100 per day depending on the truck that’s rented. Generally, the bigger the truck the more it costs to rent. There are usually no hidden charges or fees associated with renting trucks, so long as they are returned on time, in good condition and with the same amount of fuel they had when they left the rental lot. Also, the person who rents the truck is not the only person allowed to drive it. Most rental places allow up to three other people to be added to the driver’s list for an additional fee, often averaging around $10.

Most truck rental places allow reservations to be made online, and payments can be made with credit cards. Reserving online and paying with a credit card allows a business to take advantage of discounts, for most businesses will offer discounts for reserving online. Those who drive flatbed trucks only need to be at least 18 years old with a valid driver’s license, and the trucks do not require any special licenses to operate.

Many companies also provide 24/7 roadside assistance for renters, so if the truck breaks down while being used it can be picked up and replaced at no charge. With all these benefits, it makes far more sense for a business to rent a truck for its occasional needs rather than purchase one for a task now and then.