- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Paying for Rat

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

Perez Hilton: The Cost of Living in New York City

Ahhh, New York City. The Mecca of all that is glamorous, rich, luxurious and exciting. To some, the good life. So, you’re ready to pack your bags and head for the big city? Slow down there, big dreamer. The cost of

EVERYTHING in the city is higher than the national average, meaning your 70K per year needs to be 166K in New York City to keep your current lifestyle. Let’s talk about the basics here: lodging, food and entertainment:

If rent has not broken you, you must also eat! I mean, you won’t be eating MUCH after paying rent, but you will need a nibble here and there. It will come as no surprise that the restaurants in New York City are pricey. Celebrity favorites such as the Four Seasons, Le Cirque and Nobu are over $50.00 PER PERSON. I just choked on my Diet Coke. Eateries such as McDonald’s and local Mexican restaurants are abundant, but they too are higher priced than elsewhere. Your best bet? Learn to cook. Eat leftovers. Use coupons. Pair those coupons with sale items. Find a generous and rich companion. Skip meals.

As far as entertainment goes, I’m afraid at this point, your only entertainment will be browsing the web for supplementary forms of income. Seriously, unless you are in the 1%, utilize the many forms of free entertainment that New York City has to offer. A jog through Central Park, window shopping or a walk through the city all offer ample opportunity for fun free of charge. Sadly, Broadway plays and designer shopping must be left to the rich and famous.

In conclusion, one can lead a good, but not extravagant, life in New York City on a normal income. Be prepared to work hard, save hard and live frugally. Unless you’re living on money that is coming from an investment or dividend, you shouldn’t expect anything more. Listen, New York City is exciting, good grief, it’s the “city that never sleeps,” but it isn’t cheap. Of course, the people I know who have lived there for a short stint of time had little money and have since moved on – with no regrets and countless memories from that season of life.

Related articles

Anna Chapman and Edward Snowden: How to afford a long-distance romance?

Recently Russian spy Anna Chapman tweeted a proposal to fellow spy Edward Snowden, as in a marriage proposal. News reports covering the Internet event report that Chapman would not reveal whether she was serious but asked reporters to use their imaginations. So it is yet to be seen whether there will be spy marriage ahead for the two notorious leakers. What is true, however, is that no nuptials can take place at the moment, even if Anna Chapman were serious and Edward Snowden. That is because the United States has revoked Snowden’s U.S. passport, and marriage ceremonies cannot take place in the airport where Snowden is trying to buy time. So how can Chapman and Snowden afford a long-distance relationship? Follow this quick guide of tips for helping the spies survive what could be a long road ahead!

Finding Deals

Anna Chapman has the most mobility right now, so she should be looking out for cheap flights to where Snowden is hiding out. A long-distance relationship can be expensive, so that is why finding deals on air travel is key. She can drop into the airport for a quick rendevouz. Why not?

Saving Money

These two potential spy lovers and super team need to save their money at every turn. Hiding out in secrete is costly, so they should create a special account that they both can add to for getaway and meeting expenses. Meeting at the airport is going to get old after a while, so they need to find a safe space where they can enjoy one another and sustain their relationship. Long-distance relationships are known for their difficulty because a couple spend so much time trying to reconnect every time they see one another.

Pick Your Fights

Long-distance relationships have little room for petty fighting. You see each other so infrequently that you have to cherish the time you have together. Instead of talking spy business, Anna Chapman and Edward Snowden should make sure they are focusing on each other by getting to know each other and focusing on the small things that make them happy together. Petty fighting will destroy a long-distance relationship. Chapman and Snowden should part each meeting feeling good about the other instead of feeling frustrated.

Kiss and Makeup

The key to long-distance relationships is always to kiss and makeup before leaving. No matter what the spies face together or apart, they cannot let their professions and media scrutiny come between them. Instead, they need to focus on their love and passion. Make sure to share a passionate kiss before leaving each meeting so that the memory of love and admiration is fresh on the mind. With a little effort in the romance department, Chapman and Snowden will be well on their way to creating harmony in their relationship. Moving from shallow levels to more deeper levels, however, is going to take time.

Related articles

My Mortgage is Smaller Than My Credit Card Balance

It’s been one heck of a spring summer for my family, financially speaking, and it turned out to be a bit more than we had budgeted for.

Here’s what we’ve done on top of our regular spending, so far:

- Remodeled both of our bathrooms(at the same time!) ($6000-ish)

- Summer camp for two kids ($500)

- Swimming lessons for three kids ($350)

- Replaced the entire air conditioning system in my car ($1600)

- Finished paying for our current round of ballroom dancing lessons($400)

- New mattress on our bed($1200)

- My wife is off work for the summer. Part time and sporadic hours when it’s not the school year.

Taken in reverse order…

Mattress

The wire frame on our mattress broke. I wish that was a complement to my prowess, but nothing was happening when it snapped. Sleeping with a jagged piece of steel poking you sucks, to say the least.

Dancing

Ballroom dancing is something my wife and I both enjoy, and it’s good exercise, so we decided to keep it up. We are officially in training for competition-level dancing, but now that our favorite place to dance is closed, we may not continue. The lessons are paid for through next spring, though.

Air conditioner

My A/C system “grenaded”. Basically, the insides decided to disintegrate and go flowing through the rest of the system, mucking it all up. And making the car undriveable. On the plus side, this hard-to-find leak I’ve been ignoring in favor of annual $75 A/C recharges is fixed, now.

Swimming, not dying

My youngest kids have never had swimming lessons and my oldest isn’t a strong swimmer. Helping my kids not drown is a good thing.

Camp

We put the down payment on camp back in February, then promptly forgot about paying for the rest of it until the deadline hit. I paused while typing this to add it to my budget so I don’t forget for next year.

The remodel

We had, at one point, $9500 set aside for the remodel, but I raided that account a few times if we went over on our monthly spending. Then, when we got the estimate, we neglected to include one of the subtotals together when we agreed to it, so the job cost more than I was expecting from the start. We still got a great price, though.

Until the tub surround didn’t come in a color we liked and could get in less than 6 weeks. So, we upgraded to porcelain tile.

And the ceiling started peeling.

And we decided to get nice fixtures, so it would be a bathroom we loved enough to demonstrate physically, for years to come.

And we noticed the basement bathroom floor tiles were loose.

So much money just poured out of my credit card.

At the moment, we have approximately $8,000 on our credit cards. That’s the highest balance we’ve carried in years. This month was the first time I’ve paid interest on a credit card since August 2012.

What’s our plan for the credit cards?

- I get a $500 bonus every month. Getting this bonus is almost entirely under my control.

- We gave our renters(two of our closest friends) a good introductory rent until their current lease expires. Their rent triples at the end of the month.

- I stopped paying double mortgage payments.

- We have some money in our emergency fund.

- We should have about $1000 left in the remodel account when the job is finished.

That’s $1500 as an immediate payment, plus about $2300 per month on top of our normal spending to pay off the cards.

That means we’ll be down to about $4300 in two weeks. When my wife gets her first full paycheck at the end of September, we’ll have the cards paid off.

Then comes the challenge of catching back up on the mortgage. Until yesterday, we were projected to pay off our house on December 1. Our current balance is $4660, with a mandatory monthly payment of $470.58. That’s about 10 months of payments. We were making an extra $520 interest payment each month, which brought it down to the December payoff date. For the next 3 months, we’re only going to be paying roughly the minimum, which means we’ll have to pay a bit over triple for November and December to be done with it this year.

I think we can do it.

How do we avoid this in the future?

With our renters paying full rent now, our goal is to pretend Linda isn’t getting paid when her work picks up again in September. We want to save or invest everything she makes, on top of the current savings. Not all of that will be long-term, and not all of it will be spendable. That saving will include things like braces for the younger kids, vacations that are more than just long weekends, and maxing out both of our retirement accounts.

That should still let us pad out our emergency fund to 4 months of expenses by spring, which is a pretty good cushion for us.

I hope. I haven’t done the math.

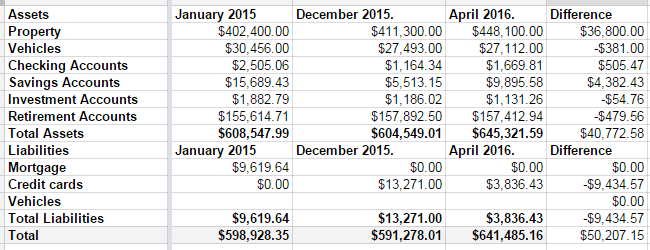

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.