- Working on my day off and watching Teenage Mutant Ninja Turtles. #

- Sushi-coma time. #

- To all the vets who have given their lives to make our way of life possible: Thank you. #

- RT @jeffrosecfp: While you're grilling out tomorrow, REMEMBER what the day is really for http://bit.ly/abE4ms #neverforget #

- Once again, taps and guns keep me from staying dry-eyed. #

- RT @bargainr: Live in an urban area & still use a Back Porch Compost Tumbler to fertilize your garden (via @diyNatural) http://bit.ly/9sQFCC #

- RT @Matt_SF: RT @thegoodhuman President Obama quietly lifted a brief ban on drilling in shallow water last week. http://bit.ly/caDELy #

- Thundercats is coming back! #

- In real life, vampires only sparkle when they are on fire. -Larry Correia #

- Wife found a kitten abandoned in a taped-shut box. Welcome Cat #5 #

Twitter Weekly Updates for 2010-05-17

- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

Human Interaction

Life may be like a box of chocolates, but it is certainly not a game of Sorry, where one person wins at the expense of all others. It is entirely possible for everyone to win in most voluntary interactions.

For example, if my company gives me a $10,000 raise, it would seem like I win and they lose. I’m getting more money, at the expense of their bottom line, right? Maybe. But what if that raise spurs me on to make an extra $100,000 for the company? That makes it a good investment and a Win/Win scenario.

When I’m dealing with one of my side-business customers or an advertiser, I’m definitely pushing for the Win/Win. Of course I want them to pay me as much as possible, but I also want their repeat business, which won’t happen unless they walk away happy. If I insisted that each of my customers pay the absolute top dollar, I may come out ahead in the short-term, but what about next month or next year? It’s much better for both of us if we can find a happy middle ground.

The four basic forms of interaction are:

1. Win/Lose. This is where I win and you lose. Haha! The problem with a Win/Lose is that the loser isn’t going to come back to play next year. He’s not happy and he’ll probably tell his friends how unhappy he is. This is also the interaction that people are mistakenly assuming when they complain about excessive executive interaction. The CEO is making a million dollars while the folks on the assembly line are stuck with $15 per hour? It’s entirely possible that, if the CEO weren’t doing his job, nobody else would have one. That is, like it or not, Win/Win.

2. Lose/Win. This is where I give up everything, hoping you’ll eventually throw me a bone. It’s a cowardly interaction that won’t work well when dealing with someone playing #1. I’ll keep giving, you’ll keep taking. You go home happy, I go home sore. When it’s done, I won’t do business with you ever again.

3. Lose/Lose. Nobody wins. We fight so hard to get what we want, forcing the other side to give up as much as possible, while they are doing the same. At the end of the day, the hatred is flowing so strong, there’s no possibility of a relationship.

4. Win/Win. Yay! Everybody wins! Everybody’s happy! This will involve some compromise, but hopefully we can reach the happy middle ground where we are both smiling. If I’m looking for a deal that involves you paying me $1000 per month, is it better for me to push to get exactly that, or let myself get talked down to $750? If the $1000 is more than you can afford, so you quit with hard feelings after one month, the ongoing $750 is much, much better for both of us. It is actually in my greedy self-interest to give up that 25% to build our relationship.

Winning doesn’t have to be done at the expense of others. If you do it right, we all win.

Mortgage Race, Part 2

As I mentioned last month, Crystal and I are in a race to pay off our mortgages. The loser(henceforth known as “Crystal”) has to visit the winner. Now, since–judging by the temperature–Crystal lives in Hell, I think it would be good for her to visit in the winter. There something about the idea of going ice fishing, staring at a hole in the ice while sitting on a 5 gallon bucket, cursing the day I was born.

Today, she threw down the gauntlet again. She has apparently decided that, since her prerequisites are met, she’s going to win. Sure, she’s closed on her house and built her savings back up to $20000, but it doesn’t matter. I’ve sent a small army of arson-ninjas to keep her from getting ahead. They are so small, they can only carry tiny matches and single drops of gasoline, so the damage they can do is tiny, but it will add up. Just a word of advice: if you hire an army of arson-ninjas, go for the upsell and get ninjas that are at least 2 feet tall. Anything less is just inefficient.

When I announced the race last month, my mortgage balance was $26,266.40. Today, it is $25,382.53. In three days, there will be another $880 applied to the principal.

In February, our renters will move in and we’ll conservatively have another $650 to pay. When that starts, our balance should be around $23,000. Adding a portion of the rent payment should mean we pay off the house in May 2014. However, when I bring in our side hustle money, that will bring us back to September 2013.

Crystal’s projected payoff is July 2013, so I’ll have to hustle.

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

Net Worth Update

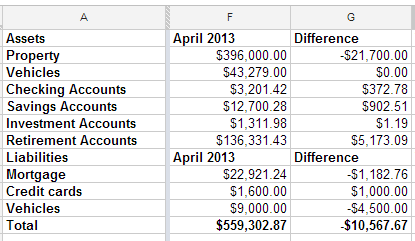

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.