- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

Toxic People

You should never be in the company of anyone with whom you would not want to die.

-Duncan Idaho, from God-Emperor of Dune

Some people suck the life out of everyone they encounter. Whether it be through lies, unreasonable demands, emotional abuse or manipulation, or just a vile personalty, the people they meet are worse off for the encounter. The people they interact with every day are screwed.

My time is too precious to waste any of it unnecessarily on people who remove value from it. I like being with people who enrich my life, instead.

Unfortunately, since I’m not an advocate for the use of hitmen, not every toxic person is easy to eliminate from your life.

Toxic people come in 3 basic varieties: professional, personal, and family. There is some overlap between the categories.

The personal category is easiest to deal with. These people aren’t relatives or coworkers, so you won’t see them at family gatherings or at work. I’ve dealt with these people in two ways.

First, there is the direct approach. One former friend, who was really only a friend when it was convenient for him(a pure leech), got told that he wasn’t invited to one of our parties because I was inviting his ex-wife, instead. That was the last time he called me.

The second option is far more passive. I set up a contact group in my phone called “Life’s too short”. At first, I set it up with a fairly insulting ring tone, but I later switched it to no ring at all. I don’t know they’ve called until I check my voicemail. It’s far less direct, but also far easier than the direct approach.

Dealing with the toxic people in your family is more complicated. You’ll see them at holiday gatherings, or hear about them during unrelated visits. You probably have a lot of memories growing up with them, and may feel some level of obligation–deserved or not–to maintain contact. It’s hard to break a tie that you’ve had your entire life.

Can you fix their behavior? It’s worth trying to have a frank discussion about how they are treating you, or the things they are doing. If the problem is that they are constantly bringing over their methhead boyfriends, banning the drug addicts from your home, while still welcoming the relative may be an acceptable fix. If the problem is a constant need to belittle you, demanding they stop may work. If the problem is a lifetime of emotional abuse, it probably isn’t fixable.

Is banishment an option? Can you put that creepy cousin on the Life’s Too Short list? You’ll still have to deal with him at family gatherings, but you can always leave the room when he comes in, right? Don’t engage, don’t participate in any conversation beyond a polite greeting, and don’t offer any encouragement towards regular contact.

It’s possible that it won’t be possible to fix their behavior and that you won’t want to banish the offender. If, for example, the offender is your mother (Not you, Mom!), you may feel a sense of obligation to maintain contact, or even be a primary caregiver at times. This is a line nobody else can draw for you. At some point, the current bad behavior could overwhelm the past obligations. When that happens are you prepared for it? That can be a traumatic break.

The other option, as cold as it sounds, is to wait it out. Nature will take its course, eventually. Can you wait that long, while maintaining your sanity and emotional equilibrium?

Professional toxic people include customers, vendors, and coworkers, none of whom are easy to get rid of.

If you own the business, you can fire your problem customers if the hassle outweighs the benefits you get from the relationship. You can find a new vendor, and you can fire the problem employees.

What happens if you are an employee?

If the problem is your boss, your options are to suck it up, talk to his boss, or find a new job. If the first is intolerable, and the second is impossible, it’s time to polish your resume.

If the problem is a vendor, you’ve got some options. Document the problems, first. Does he make inappropriate jokes, or badmouth you to your customers? Then, research the alternatives. Does one of his competitors offer an equivalent product or service? Take the documentation and research to your boss, or whoever makes that decision, and see if you can get your company to make the switch. The other option, is to request someone new to deal with at the vendor’s company, but that may not always be possible.

Finally, we come to the problem of toxic coworkers.

Some coworkers have the same problems as a toxic boss. Is the company vice-president the boss’s baby brother? You’re probably not going to find a win there. You’ll have to suck it up or move on.

Is the problem person working in an unrelated department doing unrelated tasks? It may be possible to start taking breaks at different times and leave him where he belongs: in the past.

Is the difficult individual sharing an office with you, demanding everything be done his way, and throwing daily tantrums? This is the one that has to be dealt with. He’s the one sucking the life out of you every single day.

First, start making use of a voice recorder. If you’ve got a smartphone, you’ve probably already got one. Otherwise, drop the $20 to buy one. This lets you document the evil. When his behavior goes hinky, record it.

Second, stand up for yourself. If he’s making unreasonable demands, tell him it’s inappropriate. He’s a bully, and bullies tend to back down when they are confronted.

Third, make sure the boss knows about the behavior. Yes, this is tattling. Get over it. If he wasn’t acting like he was a spoiled 4 year old, you wouldn’t have to tell the boss that he was. If the boss doesn’t know there’s a problem, he can’t deal with it.

Fourth, for any problem that isn’t directly aimed at you, ignore it. If he makes a habit of throwing a tantrum because somebody emptied the coffee pot, or because the company switched health plans, let him. Only get in the way if it’s directed at you. Over time, the tantrums will get more noticeable and out of hand, forcing the boss to deal with it, preferably by handing him a pink slip.

Your goal is documentation, awareness, and avoidance. Make the worst of it go elsewhere so you can be as productive as possible, document what you can, and let the boss become aware of the situation and how bad it has become. And be patient. This isn’t an overnight fix.

How do you deal with the toxic people in your life?

Saturday Roundup

- Image via Wikipedia

Don’t miss a thing! Please take a moment to subscribe to Live Real, Now by email.

Holiday weeks are supposed to be short, aren’t they?

I’m 11 days into my 30 Day “Compact”. So far, it has gone well. Unfortunately, there have been a couple of books launched that I’d love to own, and a friend keeps showing me new gadgets that I’d love to get. Not shopping at all is harder than it sounds.

The Best Posts of the Week:

Brian Wood, without a doubt, understood the responsibility he took on as a father. The story makes me get all misty.

On Wise Bread, they asked if you are saving too much. Don’t save as an excuse to stop living your life.

Free Money Finance will help you save money on travel.

Parent Hacks has a great use for a Google Voice number. I have a spare, so I think I’ll start using it.

I’m a big fan of selling on Craigslist. I’ve never sold a car there, so this was informative.

Finally, a list of the carnivals I’ve participated in:

5 Reasons to Quit Saving and Start Living was included in the Carnival of Personal Finance.

Bonding Relationships was in the Carnival of Wealth.

Hippy Month was the Editor’s Pick in the Festival of Frugality!

If I missed a carnival, please let me know. Thanks to those who have included me!

Delayed Gratification

I work daily to raise my kids to be more financially responsible than I have been. One of the most difficult pieces has been to explain the benefits of delayed gratification to my children. It’s hard enough, as an adult, to take delayed gratification to heart. For a child? It seems to be almost impossible.

My son wants an XBox 360 Elite. Good for him. He wants to renegotiate the terms of his allowance to get it faster. Currently, every other time he gets an allowance paid out, it goes into his bank account, to be mostly untouched. The other times he can do as he pleases with his money. We are enforcing a 50% long term savings plan. Now, with a medium-term goal in mind, he wants to keep all of his money, and only put gift money into the bank account.

Should we let him tap his bank account for a shiny new bauble? It’s been building for a while, so it’s delayed, right? I don’t think that would accomplish much. Like any other 10-year-old, his interests change often.

Should we let him change the terms of our agreement, speeding a medium-term goal at the expense of his long-term savings? My wife and I haven’t had a chance to discuss this, but my initial reaction is not to allow it. His savings has the potential to turn into a decent car in a few years, if he wants. That would be a car he knows he earned.

Last week, when we were at the store, he asked if he could borrow some money to buy a game. I don’t expect him to carry his money around everywhere, so I would have allowed it, if he would have had the money at home. He didn’t. His plan was to pay me what he did have as soon as we got home, then work his butt off for a few days to earn enough extra to pay it back. I won’t be a credit agency for my kids, so I said no. He was disappointed, but, by the time he had earned the money, he no longer wanted the game. I consider that a win, but I don’t know that he learned any lesson other than “Dad’s a jerk.”

Someday, when his life launch is smooth due to a lack of debt-dependence, he’ll look back on these lessons and smile.

I hope.

My New Windfall

Tax season is over.

This year, TurboTax and Amazon teamed up to offer me a 10% on up to $1200 of my refund if I took it as an Amazon gift card.

$120 free if I spend that money with a company I’m going to spend money with anyway?

Yes, please.

I spend lots of money with Amazon. I subscribe to many of my household items there, because I use them and I don’t want to have to think about buying them. I get my soap, shampoo, toilet paper, paper towels, and garbage bags automatically delivered. There’s a bunch of other stuff, too, but that’s what I remember off the top of my head. If I have 5 items in a monthly delivery, I get 20% off.

Free money, free shipping, and none of the hassles of shopping?

Yes, please.

So now I have a $1320 credit with the company I use for most of my non-grocery shopping.

I also have 962 items on my wishlist with Amazon.

To recap: $1320 burning a hole in my metaphorical pocket and 962 items that I have wanted at some time in the past, begging me to bring them home.

That’s a dilemma.

The smart answer is, of course, to let that money hide in Amazon’s system and slowly drain out to pay for the things I actually need.

The fun answer is to stock up on games and books and toys and gadgets and cameras and, and, and….

Some days, it’s hard being a responsible adult.

I think I’m going to compromise with myself. I’ll leave the vast majority of the money where it is, but I’ll spend a little bit of it on fun stuff, and a little bit more on stuff I don’t quite need, but would be useful, but not so useful that I’ve already bought it.

A new alarm clock to replace the one next to my bed that automatically adjusts for daylight savings time but was purchased before they changed the day daylight savings time hit so I have to adjust the time 4 times per year instead of never. That’s on the list of not-quite-needs.

The volume 2 book of paracord knots is on the list of wants that can’t possibly be considered a need, but it’s going to come home, anyway.

I figure, if I spend a couple of hundred dollars on things I really, really want, I’ll scratch that itch and leave most of the money alone.

What would you do with a $1300 gift card at a store you shop at every week that sells every conceivable thing? Spend it right away, or stretch it out, or something else?

Avoid Getting Ripped Off On Ebay

My son, at 10 years old, is a deal-finder. His first question when he finds something he wants is “How much?”, followed closely by “Can I find it cheaper?” I haven’t–and won’t–introduced him to Craigslist, but he knows to check Amazon and eBay for deals. We’ve been working together to make sure he understands everything he is looking at on eBay, and what he needs to check before he even thinks about asking if he can get it.

The first thing I have him check is the price. This is a fast check, and if it doesn’t pass this test, the rest of the checks do not matter. If the price isn’t very competitive, we move on. There are always risks involved with buying online, so I want him to mitigate those risks as much as possible. Pricing can also be easily scanned after you search for an item.

The next thing to check is the shipping cost. I don’t know how many times I’ve seen “Low starting price, no reserve!” in the description only to find a $40 shipping and handling fee on a 2 ounce item. The price is the price + shipping.

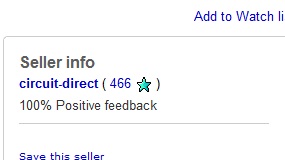

Next, we look at the seller’s feedback. The feedback rating has a couple of pieces to examine. First, what is the raw score? If it’s under 100, it needs to be examined closer. Is it all buyer feedback? Has the seller sold many items? Is everything from the last few weeks? People just getting into selling sometimes get in over their heads. Other people are pumping up their ratings until they have a lot of items waiting to ship, then disappear with the money. Second, what is the percent positive? Under 95% will never get a sale from me. For ratings between 95% and 97%, I will examine the history. Do they respond to negative feedback? Are the ratings legit? Did they get negative feedback because a buyer was stupid or unrealistic? Did they misjudge their time and sell more items than they could ship in a reasonable time? If that’s the case, did they make good on the auctions? How many items are they selling at this second?

[ad name=”inlineright”] After that, we look at the payment options. If the seller only accepts money orders or Western Union, we move on. Those are scam auctions. Sellers, if you’ve been burned and are scared to get burned again, I’m sorry, but if you only accept the scam payment options, I will consider you a scammer and move on.

Finally, we look at the description. If it doesn’t come with everything needed to use the item(missing power cord, etc.), I want to know. If it doesn’t explicitly state the item is in working condition, the seller will get asked about the condition before we buy. We also look closely to make sure it’s not a “report” or even just a picture of the item.

Following all of those steps, it’s hard to get ripped off. On the rare occasion that the legitimate sellers I’ve dealt with decide to suddenly turn into ripoff-artists, I’ve turned on the Supreme-Ninja Google-Fu, combined with some skip-tracing talent, and convinced them that it’s easier to refund my money than explain to their boss why they’ve been posting on the “Mopeds & Latex” fetish sites while at work. Asking Mommy to pretty-please pass a message about fraud seems to be a working tactic, too. It’s amazing how many people forget that the lines between internet and real life are blurring more, every day.

If sending them a message on every forum they use and every blog they own under several email addresses doesn’t work and getting the real-life people they deal with to pass messages also doesn’t work, I’ll call Paypal and my credit card company to dispute the charges. I only use a credit card online. I never do a checking account transfer through Paypal. I like to have all of the possible options available to me.

My kids are being raised to avoid scams wherever possible. Hopefully, I can teach them to balance the line between skeptical and cynical better than I do.