- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Actions Have Consequences

- Image by reidmix via Flickr

Six months ago, my laptop quit charging. This particular model has a history of having the power jack come loose inside the laptop, so I ordered the part and waited. When it came, I disassembled the computer, carefully tracking where each screw went. I installed the part, the put it back together, with only a few extra pieces.

It didn’t work.

After spending the money and doing the work, I tested the external power cord. I could have saved myself a few hours of work if I would have done that first. It was trash, so I ordered a new one. That’s time and money down the drain due to my poor research.

As an adult, I know that I am responsible for my actions, even if the consequences aren’t readily apparent. If I tap another car in a parking lot, I am going to have to pay for the damages, even if I didn’t see the car. This has manifested itself in credit card statements I didn’t read, speed limits signs I didn’t notice(or ignored!), and–on occasion–my wife and I not communicating about how much money we’ve spent.

Kids have a much harder time grasping that concept.

My son enjoys playing games online. Some of the games are multiplayer games he plays online with his friends, others are flash games he plays at home while his friends watch. They like to take the laptop into the dining room where they can play without being in the way. A small herd of 10 and 11 year old kids hopping around expensive electronics can’t be a good idea.

Yesterday, we saw that the power cord was fraying at the computer end from being dragged all over the house and jerked by kids tripping on the cord. We got six months of life out of the cord because of kids who should have known better not acting appropriately around the cord and the computer. Not happy.

My son got grounded for a week and honored with the privilege of replacing the cord. Now he isn’t happy, but he understands that he needs to pay for the damage he causes, even if he didn’t know that what he was doing could cause the damage. If it was something he would have had no way of knowing, there would have been no punishment, but he should have known not to jerk on the cord of leave it where it can be tripped over.

What do you think?

3 Things You Need to Know About Homeowner’s Insurance

- Image by ecstaticist via Flickr

If you are a homeowner, you need homeowner’s insurance. Period. Protecting what is mostly likely the biggest investment of your life with a relatively small monthly payment is so important, that, if you disagree, I’m afraid we are so fundamentally opposed on the most basic elements of personal finance that nothing I say will register with you.

If, however, you have homeowner’s insurance, or–through some innocent lapse–need homeowner’s insurance and you just want some more information, welcome!

The basic principle of insurance is simple. You bet against the insurance company that you or your property are going to get hurt. If you’re right, you win whatever your policy limit is. If you’re wrong, the insurance company cleans up with your monthly premium. Insurance is gambling that something bad will happen to you. If you lose, you win!

Now, there are some things about homeowner’s insurance that you may not realize.

1. Homeowner’s insurance will not protect you against a flood. For that you need flood insurance. The easiest way to tell which policy covers water damage is to see if the water touched the ground before your house. An overflowing river, or heavy rain that seeps through the ground and your foundation are both considered flooding. On the other hand, hail breaking your windows and allowing the rain in or a broken pipe are both generally covered by your homeowner’s policy.

Do you need flood insurance? I would say that, if you live on the coast below sea level, you should have flood insurance. If you’re on a flood plain, you need flood insurance. If you’re not sure, use the handy tool at http://www.floodsmart.gov to rate your risk and get an estimate on premium costs. My home is in moderate-to-low risk of flooding, so full coverage starts at $120.

2. You can negotiate an insurance claim. When you have an insurance adjuster inspecting your home after you file a claim, most of the time they will lowball you. Generous adjusters don’t get brought in for the next round of claims. If you know the replacement costs are higher than they are offering, or even if you aren’t sure, don’t sign! Once you sign, you are locked into a contract with the insurance company. Take your time and do your research. Get a contractor out to give you a damage estimate, if you can.

3. Your deductible is too low. If you’ve built up an emergency fund, you can safely boost your deductible to a sizable percentage of that fund and save yourself a bunch of money. When we got our emergency fund up to about $2000, we raised our deductible from $500 to $1000 and saved a couple of hundred dollars per year. That change pays for itself every 2 years we don’t have a claim. I absolutely wouldn’t recommend this if you don’t have the money to cover your deductible, but, if you do, it can be a great money-saver.

Bonus tip: If you get angry that your homeowner’s insurance doesn’t cover flooding, even if you haven’t had to deal with a flood, and you cancel your insurance out of spite, and you subsequently have a ton of hail damage, your insurance company won’t cover the crap that happened during the window where you weren’t their customer.

Are you one of the misguided masses who prefer to trust their home to fate?

Do you have an insurance horror story?

How to Deal with Debt While You’re Out of a Job

This is a guest post from Marc Chase of My Credit Group.

Dealing with a lot of unpaid debt can be a hassle on its own. Having to pay those debts when you don’t even have a job to provide you with the money to do so can be a nightmare. While you’re hunting for a job to help make ends meet, your debts continue to pile up, leaving you scrambling to find a way to take care of them before they cause you to slip further into the poor house, and leave your finances needing credit repair services.

Since you’re likely more concerned about finding a job than anything else, we put together this handy checklist of what you should do to avoid your unpaid bills and debts getting the best of you while you search for a new job.

• Apply for unemployment benefits. This should be your first order of business after you’ve lost your job, especially if you’re one of the many Americans currently living paycheck to paycheck. Unemployment benefits go a long way towards helping consumers stay on top of their bills and credit accounts. Don’t make the mistake of thinking another job is just around the corner – there’s a good chance you can’t afford to wait.

• Keep paying the minimum balance. If you’re on the verge of drowning completely in unpaid debt, you may be tempted to stop paying your bills completely, at least until you get some additional funds in your account. Do this, and you’ll find yourself in need of credit score repair before you even get that call back for a follow-up interview.

Instead, do everything you can to at least pay the minimum balance on all of your credit accounts and bills. This will ensure that your credit history doesn’t take too much of a beating, and saves you from paying even more in interest fees down the line.

• Stop spending money like you have it. Because the sad truth is, while you’re still unemployed, you likely don’t have a lot of money to spare. If you’re still living your life as though you can afford to pay for everything – eating lunch and/or dinner out more than twice a week, generally buying things you don’t NEED – now’s the time to stop.

Stop charging every purchase you make to your credit card – break them out only in an emergency. This will help keep you from sinking further into debt while you’re out looking for a way to pay for your purchases.

• Eliminate and prioritize your bills. Now’s a great time to take a long look at some of the bills you’re paying, and deciding if they’re even worth the service. That doesn’t mean you should stop paying bills you consider “less important” than others; it means looking at some of the things that might have once been necessities (a land phone line if you primarily use a cell phone, a full package TV cable bill, etc.) and re-evaluating your stance on how important they are now that you can’t afford them all. In many cases, you can get in contact with your service provider(s) and talk about ways to reduce your bill (say, cancel cable but keep internet).

This is a guest post from Marc Chase, President of Product Development for My Credit Group, a website dedicated to helping consumers with managing their credit.

Checking Account for Punk

Punk is 13. He’s a good kid. He’s bright, well-mannered, hooked on MineCrack.

We just opened his first checking account.

It started when a friend called. He works at a bank and owed a banker a favor, so he asked me to open a new checking account. I’m overbanked, so we decided to open an account for Punk. He wouldn’t even have to know.

After we filled out the paperwork, I started thinking about it.

He’s been money-conscious since he figured out basic math. We’d offer to buy a $5 toy and he’d scour the toy aisles looking for the best deals, weighing the pros and cons of all of his options.

When he wants to buy something now, he doesn’t come to me without a compelling argument why I should let him.

He gets himself to school in the morning, and almost always does his homework without prompting.

He’s a pretty responsible kid. Teenagers are–by definition–stupid, but I generally trust his judgment.

We decided to let him have access to the account, then promptly forgot about the whole thing.

Last night, he asked if he could buy some package for some MineCraft server. That handy reminder made me actually take the steps to activate his debit card and have “the talk”. Money, not sex.

I taught him how to use a checkbook register and told him that if the balance on the bank’s site ever disagrees with his register, I was taking the card away.

I explained the pain of overdraft fees.

I taught him a bit about credit card fraud and how to avoid it.

I handed him the packet of documents and told him he has to read them all. All of them. My roommate laughed at me over that requirement.

From there, he opened a Paypal account, attached his card to it, and has free rein.

It’s his money, he can make these decisions. It’s low stakes, so there’s no need to stick my nose into it unless he asks. Even if he totally messes up, it can’t hurt too bad at this point, and he’ll learn an important lesson when his next meal isn’t on the line.

Next, we’ll take him down to get a state ID, so he won’t have a problem using the card in a store.

Welcome to adult finances, Punk.

What do you think is the right age for a checking account?

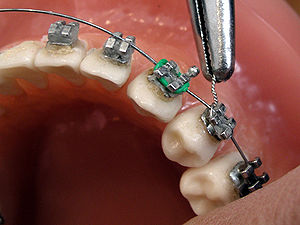

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.