- Happy Independence Day! Be thankful for what you've been given by those who have gone before! #

- Waiting for fireworks with the brats. Excitement is high. #

- @PhilVillarreal Amazing. I'm really Cringer. That makes me feel creepy. in reply to PhilVillarreal #

- Built a public life-maintenance calendar in GCal. https://liverealnow.net/y7ph #

- @ericabiz makes webinars fun! Even if her house didn't collapse in the middle of it. #

- BOFH + idiot = bad combination #

Investments are a Gamble

- Image via Wikipedia

Or a scam.

If you’ve been reading Live Real, Now for long, you’ll know I hate scammers. I particularly loathe scammers who prey on the hopes of the naive. There is a special corner of hell reserved for those who live to steal the futures of the innocent.

For many people, especially day-traders, it is absolutely true that stocks are the same as gambling. For too many other people, investments are an opening for con-men to ply their trade.

People invest their money to secure their futures. They put their life saving into some investment vehicle and, hopefully, it grows to bring financial security. Properly done, it’s not a gamble.

In the worst case, you get investment advice from a slimy, scum-sucking 3-card-monte dealer. These blood-suckers–at best–don’t care about your future. They only care about their commissions. Others will do anything possible to run away with your nest egg.

So how do you avoid the karmicly-destined-to-be-cockroach fraudsters?

First, never invest more then you can afford to lose. Gambling rules apply. If you can’t afford to lose it, you need to keep your money someplace absolutely secure. Your mattress, buried mayonnaise jars, or a simple savings account come to mind.

Do your research. Is the person selling the investment licensed to do so? What is the historic return? Can you independently verify that? If you run across anything that looks too good to be true, it probably is. Run away.

Don’t fall for a time crunch. If something is a good investment today, it will still be a good investment tomorrow. Take you time, do the research, get the details in writing, and get a second opinion. If you are supposed to keep the investment a secret, it’s either a scam or a crime. Always cover your own butt.

Be safe. Keep your money.

For more information, see the SEC, the FTC, the CFTC and FINRA.

Funeral Costs: How to Keep it Inexpensive, Without Being Cheap

The average funeral costs $6500. Many people die with absolutely no savings. Even if there is life insurance, it takes weeks to get the money, while a funeral is completed within a week.

Funeral homes have an easy sales pitch. Nobody wants to sully the memory of their loved ones. The tiniest hint of a guilt trip will have most families upgrading to the silk pillow in a second. Here’s a secret: Your loved one doesn’t care. I’m not recommending using garbage bags and a dumpster. By all means, treat your loved ones with care, but don’t go overboard.

Not everyone is comfortable with cremation, and some religions don’t permit it, but it is probably the least expensive way to process a body. It costs approximately $1400 to cremate a body and you can get very attractive urns for under $100. Compare that to a $3500 casket and storage & transportation fees, and–from a strictly monetary standpoint–the choice is clear.

Don’t worry too much about decorating. Flowers aren’t cheap and florists don’t tend to offer discounts to people who aren’t emotionally prepared to negotiate and who are in a time crunch to find the flowers they need. Get a few bouquets for a small display around the casket or urn, and let the rest take care of itself. Many of the guests will bring flowers, so the entrance will soon be decorated for free, and that’s the part that makes the first impression.

Corporate Bankruptcy Hurts Employee’s Most

This is a guest post from Hunter Montgomery. He writes for Financially Consumed on every-day personal finance issues. He is married to a Navy meteorologist, proud father of 3, a mad cyclist, and recently graduated with a Master’s degree in Family Financial Planning. Read his blog at financiallyconsumed.com.

Bankruptcy has evolved from something that people and businesses were deeply ashamed of a few decades ago, to a seemingly acceptable path to restructuring; towards a more sustainable future. Bankruptcy is so common in corporate America that it is referred to by some as an acceptable and necessary business tool.

This bothers me on a number of levels, but mainly because corporate bankruptcies hurt the humble employee the most. The laws are supposedly designed to help the company stay in business, and continue to provide jobs. But at what cost to those employees?

When a company declares bankruptcy, they are essentially admitting to the world that they failed to compete. Their business model was flawed, they were poorly managed, and they simply did not organize their resources appropriately to meet their consumer needs.

Given this failure, it shocks me, that bankruptcy laws are designed to allow management to get together with their bankers. They essentially protect each other. Management is obsessed with holding on to power. The bankers are obsessed with avoiding a loss.

The bankruptcy produces a document called first-day-orders. This is a blueprint for guiding the organization towards future prosperity. But this is essentially drafted by the existing company management, and their bankers. Do you see any conflict of interest emerging here?

Bankers are given super-priority claims to the money they have loaned the company. Even before employee pension fund obligations. This is absurd. Surely if they loaned money to an enterprise that failed, they deserve to lose their money.

Management generally rewards itself with large bonuses, after declaring failure, paying off their bankers, shafting the employees, and finally re-emerging with a vastly smaller company. This is ridiculous.

The humble employee pays the highest price. Assuming there is even a job to return to after restructuring they have likely given up pay, working conditions, healthcare benefits, and pension benefits.

This is exactly what happened at United Airlines in 2002 after they filed for chapter 11 bankruptcy protections. The CEO received bonuses, and was entitled to the full retirement package. The banker’s enjoyed super-priority claims over company assets to cover their loans. Meanwhile, the employees lost wages, working conditions, healthcare benefits, and a 30% reduction in pension benefits.

An adjustment like this would force a serious re-evaluation of retirement plans. For most people, it would require additional years in the workforce before retirement could even be considered a real possibility.

Employees of General Motors, which recently went through bankruptcy proceedings, also had to give up significant healthcare benefits, and life insurance benefits. Entering bankruptcy, it was the objective to reduce retiree obligations by two-thirds. That’s a massive cut.

The warning to all of us here is that we must do everything possible not to fall victim to corporate restructuring. Save all you can, outside of your expected pension plan, because you never know when poor management, or a terrible economy, will force your employer to file bankruptcy. Always plan for the worst possible outcome.

It’s a competitive world and it’s quite possible that the traditional American system of benefits is uncompetitive, and unsustainable in the global market place. The tragedy of adjusting to a more sustainable system is that the employee suffers the most.

Making Extra Money Part 3: Product Selection

When you’re setting up a niche site, you need to monetize it. You need to have a way to make money, or it’s a waste of time.

There are two main ways to do that: AdSense or product promotion. To set up an AdSense site, you write a bunch of articles, post them on a website with some Google ads, and wait for the money to roll in.

I don’t do that.

I don’t own a single AdSense site and have never set one up. This article is not about setting up an Adsense site.

My niches site are all product-promotion sites. I pick a product–generally an e-book or video course–and set up a site dedicated to it.

Naturally, picking a good product is an important part of the equation.

The most important part of product selection is that the product has an affiliate program. Without that, there’s no money to be made. There are a lot of places to find affiliate programs. Here are a few:

- Amazon. If you don’t live in one of the states that Amazon has dropped in retaliation for passing laws that attempt to circumvent the Supreme Court’s ruling on collecting sales tax, you can sign up as an associate and collect a commission on every referral you send that turns into a purchase. That means you have a lot of product to choose from. Unfortunately, your commission is small, so you need to promote fairly expensive products to get a decent return. On the other hand, people trust Amazon, so that’s one less hurdle to making a sale.

- Commission Junction. These are the people managing affiliate programs for a large number of credit cards and banks. If you’ve opened an account with INGDirect through one of my links, I got a commission for the referral. (Thank you!) They have a lot of other products, too.

- e-Junkie. This one is a popular distribution system for bloggers. It’s likely that, if you’ve bought an ebook from a blogger, e-Junkie handled the fulfillment process. A lot of the products available there have an affiliate program, but that is up to the owner of the product.

- ClickBank. My favorite. This is one of the largest affiliate networks specializing in electronic products, whether that’s membership sites, ebooks, or video courses. Commissions are good, often 50-75%. They also offer a 60 day guarantee of every product sold through their site, which helps soothe the wary customer. This is the site I’ll be using for this series.

The first thing you need to do is sign up for whichever program you intend to use.

If you’re not going with Clickbank, feel free to skip ahead to the section on keyword research.

Once you are signed up and logged in, click on the “Marketplace” link at the top of the screen.

From here, it’s just a matter of finding a good product to sell. Here are the niches we’re going to be looking for:

- Back pain

- Bankruptcy

- Conflict resolution at work

- Detox diets

- Fat kids

- Foreclosure avoidance

- Job hunting

- Weddings

- Writing sales copy

I’m going to look for one or two good products in each niche. When that’s done we’ll narrow it down by consumer demand.

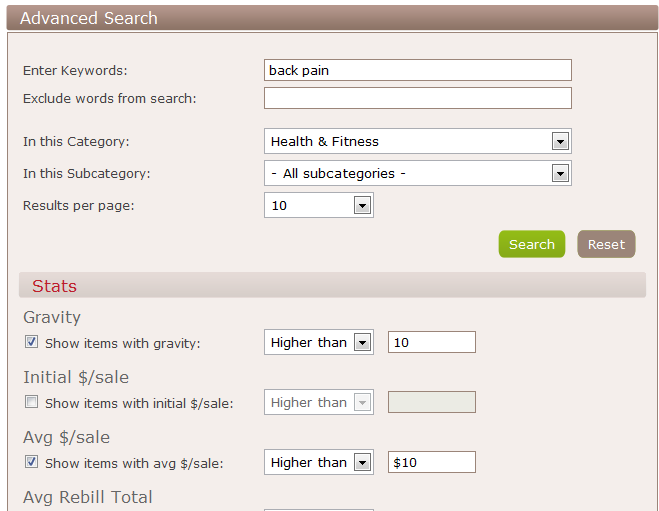

For now, go to advanced search.

Enter your keyword, pick the category and set the advanced search stats. Gravity is the number of affiliates who have made sales in the last month. I don’t like super-high numbers, but I also want to make sure that the item is sellable. Over 10 and under 50 or so seems to be a good balance.

The average sale just ensures that I’ll make a decent amount of money when someone buys the product. I usually aim for $25 or more in commissions per sale. Also, further down, check the affiliate tools box. That means the seller will have some resources for you to use.

This combination will give us 36 products to check out for back pain, unfortunately, none of the results are for back pain products. After unchecking the affiliate tools and setting the gravity to greater than 1, I’ve got 211 results. Sorting by keyword relevance, I see three products, two of which look like something I’d be interested in promoting. One has a 45% commission, the other is 55%. The X-Pain Method has an initial commission of $34 and claims a 5% refund rate. Back Pain, Sciatica, and Bulging Disc Relief pays $16, which will make it a potentially easier sale. I’ll add both to the list for further research.

I’m not going to detail the search for the rest of the niches. That would be repetitive. You can see my selections here:

- Back pain – X-Pain Method; Back Pain, Sciatica, and Bulging Disc Relief

- Bankruptcy – I’m dropping this one from the list. It’s too complicated and deserves an attorney. I don’t know enough about the topic to make sure it is up to date.

- Conflict resolution at work – Management Training: By the Book; Anger Management for the 21st Century

- Detox diets – Master Cleanse Secrets: 10 Day Diet; Master Cleanse Insider; Eating for Energy: Raw Food Diet for Weight Loss

- Fat kids – I’m dropping this one, too. A kid’s health is too important. I don’t want to sell a dangerous or unethical product.

- Foreclosure avoidance – How to Stop Foreclosure in 7 Days Flat; Foreclosure Defense Secrets

- Job hunting – Guerrilla Resumes; Amazing Cover Letters

- Weddings – All Types of Wedding Speeches; The Master Wedding Planning Guide; Amazing Wedding Planning

- Writing sales copy – Instant Swipe File; Ad Copy Creator Pro; How to Write Killer Copy

Now we’re going to go through a few steps for each of these products.

The Sales Page

We need to make sure the sales page doesn’t suck. If the site doesn’t work, is hard to read or navigate, has a hard-to-find order button, or just doesn’t look professional, it’s getting cut.

- Raw Foods is eliminated. The sales video is horrible and the order link is at the bottom of several screens worth of nothing. It’s a crap site.

- The 7 day foreclosure-avoidance product is out. Site’s down today. I want reliability.

- Management Training By The Book is out. I don’t like typos on the sales page, especially in the page title.

The Email List

If it has an email subscription form, we’ll need to subscribe, then double-check to make sure our affiliate information isn’t getting dropped in the emails. If it is, the seller is effectively stealing commissions. In the interest of time and laziness, I’m going to eliminate anyone pushing for an email subscription. It’s harder–and time-consuming–to monitor that. On of my niche site had a seller completely drop their product. Instead, they pushed for email subscriptions so they could promote other products as an affiliate. Absolutely unethical.

- Wedding speeches is eliminated for throwing a mandatory email entry into the order process. There’s no guarantee they are up to anything shady, but I’m taking the simple route.

Checkout and Credit

Finally, we’re going to visit the checkout page. You need to do this from every links in the newsletter and the links on the sales page, just to make sure you’ll get your money.

The way to tell who’s being credited is to look at the bottom of the order page, under the payment information. It should say [affiliate = xxx] where xxxis your ClickBank ID. Anything else, and the product gets cut from the list.

When you are checking these, don’t click on every possible link at once. That confuses the cookies. Do one at a time. I tried to do it in one batch for this post and lost half of the cookies. If it weren’t for the fact that I already own one of the products and bought it through my own link and got credited, I would have been talking undeserved trash about thieving companies.

Other Factors

Sometimes, when you’re examining a product, it just doesn’t feel right. When that happens, drop it. There are millions of other products you can promote. In this case, I’m dropping the anger management program because, in my experience, angry people don’t think they are the problem. Here’s a life tip: If everyone else is a jerk, the problem probably isn’t everyone else.

- Another important factor is the sales page itself. If it doesn’t make you want to buy the product, why would anyone else?

- Amazing Cover Letters is eliminated because it’s too easy to overlook the buy link. If I have to hunt for it, it’s losing customers.

- Amazing Wedding Planning is getting eliminated because I don’t like the sales page. The buy link is easy to overlook, and it doesn’t compel me to buy.

Now we’re down to 10 products in 6 niches. At this point, we’re comfortable with the sales pages and we know that they are crediting commissions. As it stands right now, all of the products are worth promoting.

- Back pain – X-Pain Method; Back Pain, Sciatica, and Bulging Disc Relief

- Detox diets – Master Cleanse Secrets: 10 Day Diet; Master Cleanse Insider

- Foreclosure avoidance – Foreclosure Defense Secrets

- Job hunting – Guerrilla Resumes

- Weddings – The Master Wedding Planning Guide;

- Writing sales copy – Instant Swipe File; Ad Copy Creator Pro; How to Write Killer Copy

We’ll make the final determination after doing some heavy keyword research in the next installment. That’s where we’ll find out how hard it is to compete.

Any questions?

Time vs Money

In this corner, weighing in at the only thing you have in this life that you can’t possibly get more of: Time!

And in this corner, weighing in at the thing people think they need to be happy: Money!

Keep it clean. No biting, scratching or hitting your opponents with a chair unless my back is turned. Fight!

Yesterday was Jimmy John’s customer appreciation day. They had subs for $1, but you had to go there in person to get it. At noon, there were more than 50 people standing in line. If it takes 1 minute to make a sandwich, that’s almost an hour in line. To save $5.

Good for Jimmy John’s. They brought thousands of extra people into the restaurant and had a huge line running down the sidewalk. That makes them look great to everyone driving by.

But, the people? Really? Would you work, at any job, for anyone(excluding charitable work) for $5 per hour?

Round 1: Time!

My mother-in-law regularly drive 6 miles out of her way to save 5 cent per gallon on gas. If usually takes 10-15 minutes to get there, if the stoplights behave and traffic is decent. If she arrive with her gas gauge on “E”, she gets to put 15 gallons of gas in her car, for a savings of 75 cents. That’s an effective rate of $2.25 per hour, not counting the gas used to drive there. However, if I ask her to give her $2 to stand in her driveway doing nothing for an hour, she looks at me like I’m nuts!

Round 2: Time!

My wife will occasionally make a shopping list that includes coupons and items spanning three grocery stores. If that were to happen, there would be an extra hour wasted, just traveling between the stores, minimum. Then another hour wasted walking past the items in the first store that were slated to be purchased at the second, or third store. Add another 15 minutes per store to check out, and we’re looking at 2 and a half hours down the tubes to save a possible $20?

No freaking way.

Round 3: Time!

My time is valuable. No matter what I do, or how hard I work, I can never get more than my allotment. Why would I waste it to save a fraction of what I can earn by using it in other ways?

And the winner is….Time!

What’s the craziest thing you’ve done to save a few bucks?