Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

It’s been a month since I’ve written a post for the budget series, so I’ll be continuing that today. See these posts for the history of this series.

This time, I’ll be reviewing my non-monthly bills. These are the bills that have to be paid, but aren’t due on a monthly basis. Some are annual, some are quarterly.

Reviewing this list, there doesn’t seem to be too much I can cut and accomplish any meaningful savings. Am I missing something?

It’s been a month(again!) since I’ve written a post for the budget series, so I’ll be continuing that today. See these posts for the history of this series.

This time, I’m looking at how to reduce my “set aside” funds. These are the categories that don’t have specific payout amounts and happen at irregular intervals. One of the convenient features of our set-aside funds–also a feature of our non-monthly bills–is that the money sits in our checking account, providing a buffer against overdrafts. The buffer is big enough that I can withdraw our entire month’s discretionary budget on the first of the month.

I’ve taken a hard look at most of the bills over time, so there isn’t always a lot to cut. Next time, I’ll be addressing our discretionary spending.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

Today we’re going to look at ways to boost your income.

People spend a lot of time talking about ways to reduce your expenses, but there is a better way to make ends meet. If you make more money, you will—naturally—have more money to work with, which will make it easier to balance your expenses. I’ve found it to be far less painful to make more money than to cut expenses I enjoy.

I can hear what you’re thinking. It’s easy to tell people to make more money, but what about telling them how? Guess what? I’m going to tell you how to make money because I rock.

By far, the simplest way to make more money is to convince whoever is paying you to pay you more for what you are already doing. In other words, get a raise. I know that’s easy to say. Money’s tight for a lot of companies and layoffs are common. None of that matters. Your company knows that hiring someone new will involve a lot of downtime during training. If you’ve been visibly doing your job, and the company isn’t on the brink of failure, it should be possible to get a bit of the budget tossed your way.

Another simple idea is to get a second job. Personally, I hate this idea, but it works wonders for some people. Gas stations and pizza stores offer flexible schedules and they are always hiring. If they aren’t willing to work with your schedule, or it doesn’t work out, you can always quit. This isn’t your main income, after all.

My favorite option is to create a new income stream. What can you do?

Take a piece of paper and a close friend and brainstorm how you can make some money. Write down every type of activity you have ever done or ever wanted to do. Then write down everything you can think of that other people who do those activities need or want. Remember, during a brainstorming session, there are no stupid ideas. Take those two lists and see if there is any product or service you can provide.

You can start a blog—although don’t expect to generate much money early—or try writing for some revenue-sharing article web sites, like hubpages or squidoo. Other options include affiliate marketing, garage sale arbitrage(buying “junk” at garage sales, fixing it up and selling it), or even doing yard work for other people.

One interesting business I’ve seen lately is a traveling poop-scooper. These people travel around and scoop poop out of ddog-owners’ yards. Business booms in the spring when the snow melts, but it can be an ongoing income, since dogs don’t stop pooping.

Raising your income can make it easier to pay your bills, pay off your debt, or even taking nice vacations. How have you made some extra cash?

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

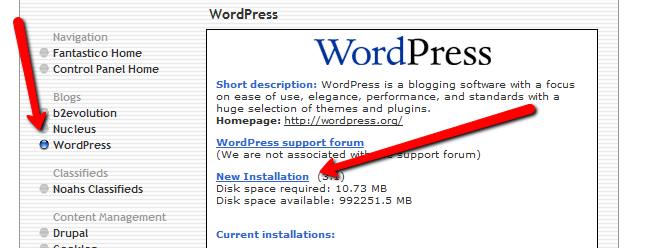

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

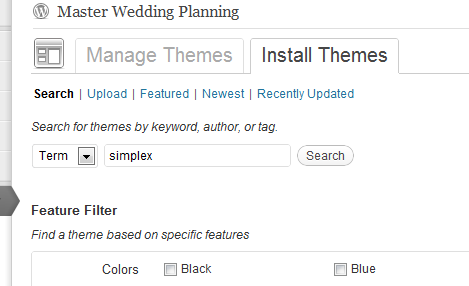

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

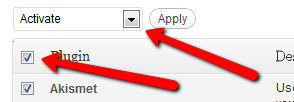

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

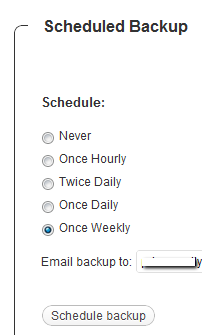

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

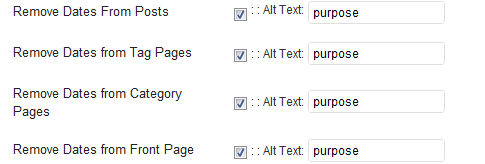

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

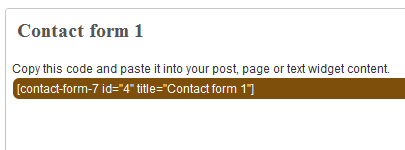

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 8, we’re going to talk about insurance.

What is insurance? Insurance is, quite simply a bet with your insurance company. You give them money on the assumption that something bad is going to happen to whatever you are insuring. After all, if you pay $10,000 for a life insurance policy and fail to die, the insurance company wins.

A more traditional definition would be something along the line of giving money to your insurance company so they will pay for any bad things that happen to your stuff. How do they make money paying to fix or replace anything that breaks, dies, or spontaneously combusts? Actuary tables. Huh? The insurance company sets a price for to insure—for example—your car. That price is based on the statistical likelihood of you mucking it up, based on your age, your gender, your driving history, and even the type of car you are insuring. What happens if a meteor falls on your car? That would shoot the actuary table to bits, but it doesn’t matter. They spread the risk across all of their customers and—statistically—the price is right.

What kinds of insurance should you get?

For most people, their home is, by far, the largest single purchase they will ever make. If your home is destroyed, by fire, tornado, or angry leprechauns, it’s gone, unless you have it insured. Without insurance, that $100, or 200, or 500 thousand dollars will be lost, and that’s not even counting the contents of your home.

Homeowner’s insurance can be expensive. One way to keep the cost down is to raise your deductible. If you’ve got a $1500 emergency fund, you can afford to have a $1000 deductible. That’s the part of your claim that the insurance company won’t cover. It also means that if you have less than $1000 worth of damage, the insurance company won’t pay anything.

You can get optional riders on your homeowner’s insurance, if you have special circumstances. You can get additional coverage for jewelry, firearms, computer equipment, furs, among other things. You base policy will cover some of this, but if you have a lot of any of that, you should look into the extra coverage.

Car insurance is required in most states. That’s because the kind caretakers in our governments, don’t want anyone able to hit you car without being able to pay for the damage they caused. To my mind, I think it would be more effective to just make whacking someone’s car without paying for it a felony. If someone is a careful driver or has the money to self-insure, more power to them.

Auto insurance comes with options like separate glass coverage, collision, total coverage (comprehensive), or just liability. Liability insurance is what you put on cheap, crappy cars. It will only pay for the damage you do to someone else.

I’ve never had rental insurance. The last time I rented, I could fit everything I owned in the back of a pickup truck with a small trailer, and it could all be replaced for $100. Heck, I had the couch I was conceived on. Err. Ignore that bit.

Almost everything you can get homeowner’s insurance to cover will also cover renter’s insurance, except for the building. It’s not your building, so it’s not your job to replace it.

If you care about your family, you need life insurance. This is the money that will be used to replace your income if you die. I am insured to about 5 times my annual salary. If that money gets used to pay off the last of the debt, it will be enough to supplement my wife’s income and support my family almost until the kids are in college. You should be sure to have enough to cover any family debt, and bridge the gap between your surviving family’s income and their expenses. At a minimum. Better, you’ll have enough to pay for college and a comfortable living.

Life insurance comes in two varieties: whole and term. Whole life…sucks. It’s expensive and overrated. The sales-weasels pushing it will tell you that it builds value over time, but it’s usually only about 2%. It’s a lousy investment. You’re far better off to get a term life policy and sock the price difference in a mutual fund that’s earning a 5-6% return.

Term life is insurance that is only good for 5, 10, or 20 years, then the policy evaporates. If you live, the money was wasted at the end of the term. The fact that it’s a bad bet makes it far more affordable than whole life. It doesn’t pretend to be an investment; it’s just insurance. Pure and simple

An umbrella policy is lawsuit insurance. If someone trips and hurts themselves in your yard, and decides to sue, this will pay your legal bills. If you get sued for almost anything that was not deliberate(by you!) or business related, this policy can be used to cover the bill.

If you call your insurance company to get an umbrella policy, they will force you to raise the limits on your homeowner’s and auto insurance. Generally, those limits will be raised to $500,000, and the umbrella coverage will be there to pick up any costs beyond the new limit.

A little-known secret about umbrella policies: They set the practical limit of a lawsuit against you. Most ambulance chasers know better than to sue you for 10 million dollars if you only have a policy to cover 1 million. They will never see the other 9 million, so why bother? They’ll go for what they know they can get.

The flipside to that is that you should not talk about your umbrella policy. Having a million dollars in insurance is a sign of “deep pockets”. It’s a sign that it’s worthwhile to sue you. You don’t want to look extra sue-able, so keep it quiet.

Insurance is a great way to protect yourself if something bad happens. Today, you should take a look at your policies and see where you may have gaps in coverage, or where you may be paying too much.