Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

It’s the end of a month, so it’s time to announce my new 30 Day Project. Last February, in 22 days, I went from having my abs cramp after doing 15 push-ups to doing a set of 100. Yes, really.

The problem is that the push-ups weren’t perfect. Funny things happen to your body when you are doing 100 push-ups. It’s hard to tell what your body is doing. I had good form for the first 80, but after that, my body wasn’t perfectly straight. I looked like a typical second grader in gym class. But I did it. They were push-ups.

I haven’t done a push-up since.

In March, I am going to get myself back up to 100 push-ups, only this time, I will only be doing perfect push-ups.

Here’s the plan, based on what worked last year:

This weekend, I established my baseline. I did as many push-ups as I could, until the point of failure. Failure for this purpose is defined as either my form faltering or me collapsing. I went until I couldn’t hold my body straight.

Starting on the first, I will be doing 5 sets of push-ups, twice a day.

Set 1: One half of my baseline. Starting from 24 push-ups, this set will be 12 push-ups. As I progress, this set will never be more than 20 push-ups. It is the warm-up set, after all.

Sets 2-4: ¾ of my baseline, so 18 to start.

Set 5: Go to failure. Once again, failure is defined as faulty from. This will establish my baseline for the next session.

If I don’t progress for 3 days, I will take a day off to recover and–given previous experience–come back with some serious improvement.

This is a self-correcting progression. If I can’t meet the previous day’s baseline, my last set will be lower, which will lower the baseline for the following session.

An interesting question I have is how it will affect my diet. I haven’t been exercising at all, to see how well the slow carb diet does on it’s own. Now, I’m going to be adding an aggressive exercise plan on top of it. A plan that involves a bit of muscle bulking. I’m guessing that my weight loss will slow down a lot, but I will shed inches like mad. I will be tracking my progression, and my weight and measurements. The graphs should be fun.

I am on the Slow Carb Diet. At the end of the month, I’ll see what the results were and decide if it’s worth continuing. For those who don’t know, the Slow Carb Diet involves cutting out potatoes, rice, flour, sugar, and dairy in all their forms. My meals consist of 40% proteins, 30% vegetables, and 30% legumes(beans or lentils). There is no calorie counting, just some specific rules, accompanied by a timed supplement regimen and some timed exercises to manipulate my metabolism. The supplements are NOT effedrin-based diet pills, or, in fact, uppers of any kind. There is also a weekly cheat day, to cut the impulse to cheat and to avoid letting my body go into famine mode.

I’m measuring two metrics, my weight and the total inches of my waist , hips, biceps, and thighs. Between the two, I should have an accurate assessment of my progress.

Weight: I have lost 33 pounds since January 2nd! That’s 3 pounds since last week. Only 9 more to meet my goal for February. Oh wait. I won’t be hitting it this month.

Total Inches: I have lost 17 inches in the same time frame, down half an inch since last week.

I’ve got some codes for H&R Block Premium Online. It’s federal only and the state return costs an extra $35, but that’s still a screaming deal. Premium handles small business and investment tax issues. If you want to get it, leave a comment saying so. First come, first serve, until I’m out of codes.

Yes, I Am Cheap has a post about growing up poor.

Public Service Announcement: Liquidation sales are rarely good deals. When one store in a chain closes, the profitable merchandise always gets shipped to another store. The rest of it will often get marked up, in anticipation of people shutting off their critical thinking skills in the face of big “On Sale” signs.

I’ve found a new life goal: underground glowworm cave tubing. Wow.

OpenLibrary is offering up 80,000 ebooks to borrow, for free. 10,000 of them are still in copyright. I need a kindle.

This is where I review the posts I wrote a year ago. Did you miss them then?

A few years ago, I sold a truck(on payments) to a friend, who promptly quit paying me and disappeared. I ended up playing repossessing the truck.

There was also a story about how I convinced two big companies that collecting on me for a bill of more than $800 wasn’t worth the effort. It was good, because I didn’t make the call.

Slow Carb Diet: How to Avoid Going Bat-**** Crazy was included in the Festival of Frugality.

Three Alternatives to a Budget was included in the Totally Money Carnival.

Protect your home was included in the Carnival of Personal Finance.

Budgets Are Sexy ran my post, Side Hustle Series: I’m a Gun Permit Instructor. I forgot to link back to this, last week.

Prairie EcoThrifter ran my post, The Luxury of Vacation for the Yakezie Blog Swap.

Thank you! If I missed anyone, please let me know.

Eric hosted the Yakezie Blog Swap, which is a bunch of bloggers writing on the same topic and sharing the posts with each other. Here is his list of the participants this round.

I wrote about my journey to become a DJ at Beating Broke.

Beating Broke wrote about shoe shopping at Narrow Bridge.

Barbara Friedberg got a really nice couch and shared the experience at Wealth Informatics.

Suba doesn’t think the rent is too damn high, in fact, Suba thinks it is worth it and shares at Barbara Friedberg Personal Finance.

Mr. and Mrs. BP spent a lot when they got a dog. Read about it at 101 Centavos.

101 Centavos went nuts on an anniversary, but you know what that can get you… Read about it at Broke Professionals.

Latisha Styles’ post at Bucksome Boomer is I Spent How Much?! My Birthday Trip to the Bahamas.

Kay Lynn spent her heart out on a new car with all the bells and whistles and you can read about it at Financial Success for Young Adults.

Derek got a sweet new digital camera and tells us about it at My Personal Finance Journey.

Jacob has splurged a couple of times on travel and outdoor gear and has no regrets and shares the experiences at My Life and Finances.

Miss T. likes to splurge on travel. We have something in common. The difference? She wrote about it at Live Real Now.

Jason is a fan of the luxury of vacation. You can read about it at the Prairie EcoThrifter.

Squirrelers went to Europe for three weeks. Totally worth it! Read about it at Money Sanity.

Money Sanity likes good champagne. I can’t judge, I like good Scotch. Read about why at Squirrelers.

Melissa took 10 days and took the trip of a lifetime to visit a friend in China. Read about it at The Saved Quarter.

The Saved Quarter bought a Blendtec blender. Yes, the blender from “will it blend.” The story is at Mom’s Plan. (In case you were wondering, this blender can blend anything. Well, anything but Chuck Norris.)

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great week!

Welcome to the November 1, 2010 edition of the Carnival of Money Stories. One thing I didn’t do when volunteering to host this was to check my calendar. Did you know that November 1 follows October 31, every year? On Saturday, I had 30 people over for my annual Halloween party. On Sunday, I ran a haunt in my yard and coordinated to get a dozen kids out begging for candy while using my house as a base of operations. I’ve had guest from out-of-town since Friday. Halloween weekend is, by far, the busiest weekend of the year at my house.

J. Savings presents Side Hustle Series: I’m a Restaurant Server posted at Budgets Are Sexy, saying, “Is serving tables thankless work? Yes. Are customers sometimes unpleasant? Of course. But the benefits are plenty!”

Wenchypoo presents Marketing, Marketing Everywhere–There’s No Escape! posted at Wisdom From Wenchypoo’s Mental Wastebasket.

The Wise Squirrel presents Does it Matter Who is the Main Provider Between Husband and Wife? posted at Squirrelers, saying, “Money story about a dual-income couple in which the husband had the opportunity for a big promotion that would have required a move, AND his wife to leave her job. Their different viewpoints are discussed.”

Ryan @ CML presents Get a Tax Deduction for a Working Vacation posted at Cash Money Life, saying, “Tips on how to write off a business trip as a tax deduction.”

Jeff Rose, CFP presents How to Pass the CPA Exam and Become a Certified Public Accountant posted at Jeff Rose, saying, “If you are interested in becoming a CPA, here are some of the experiences of someone who just recently passed the CPA exam.”

Jason @ Redeeming Riches presents What Sam Walton Teaches Us About Money, Success, and Family posted at Redeeming Riches, saying, “Sam Walton had it all – or did he? Find out the biggest regret he had on his death bed.”

Mr Credit Card presents Cash Vs. Credit, A Real World Experiment posted at Ask Mr Credit Card.

The Family CEO presents Debt Snowflakes: Or How I Made $821.73 in Extra Credit Card Payments This Month posted at The Family CEO.

Kaye presents Stuck in the Middle posted at Mrs Nespy’s World, saying, “The beginning of the journey was excited, the end will be exhilarating, but this “in the middle” stuff is for the birds.”

Kate Kashman presents Why Not To Bounce Checks posted at The Paycheck Chronicles, saying, “An accidental bounced check in college is still causing trouble, 20 years later.”

Michael Pruser presents Managing $225,000 in Debt Is Starting to Ware on Me posted at The Dough Roller, saying, “My struggles on managing a ton of debt!”

PT presents 5 Lessons Learned From Filing Bankruptcy posted at Prime Time Money, saying, “Lessons learned from an actual account of going through a bankruptcy.”

Silicon Valley Blogger presents Should You Pay Off Loans or Invest Your Money? posted at The Digerati Life, saying, “So you’ve got some money. Should you pay off your debt with it or invest the money? Here’s a personal account on what I’ve done.”

BWL presents Success Story: Paying Off A House In 5 Years While Tithing posted at Christian Personal Finance, saying, “This is an encouraging story of a woman who stuck to her convictions about giving 10% of her income and still managed to pay off her house in less than 5 years!”

Miranda presents Do I Really Want to Rent Out My House? posted at Personal Dividends – Money+Lifestyle.

2 Cents presents What Would Make Me Invest in the Stock Market? posted at Balance Junkie, saying, “We have not invested in the markets for a while now. A reader recently asked what it would take for us to get back in. Here’s my answer!”

FIRE Getters presents Early Retirement Case Study – Sandy Aldridge and Dale Lugenbehl posted at FIRE Finance, saying, “At times the fast pace of our city lives appear stifling making us long for a slower pace of life with more exposure to clean air and green vegetation. Our souls yearn for a simple life which is in greater harmony with Mother Nature. Of late our work related health problems have been making us yearn, almost every morning, for a more relaxed life with greater freedom. So we were thrilled to read about Sandy Aldridge and Dale Lugenbehl who retired early (at ages 48 and 47 respectively) more than a dozen years ago to their eight-acre farm in Cottage Grove, Oregon …”

Neal Frankle presents Find A High Paying 2nd Job Using Craigslist posted at Wealth Pilgrim: Money Management Advice, Financial Stess Management, Addiction Recovery Plan & Resources, saying, “You Can Find A High Paying 2nd Job Using Craigs List If you’re looking for high paying 2nd jobs, look no further than your computer screen.”

Super Saver presents Retiree Financial Lessons from the Recession posted at My Wealth Builder, saying, “Although I wish this recession had not happened, I am glad that it happened early in our retirement, while we were better able to meet the financial challenges.”

Craig Ford presents Medi-Share Medical Sharing | A Health Insurance Substitue posted at Money Help For Christians, saying, “Medical sharing is a great way to reduce your health insurance costs.”

passive family income presents Cutting Out Wasted Expenses to Save More Income posted at Passive Family Income, saying, “How many wasted expenses are you paying for? After sorting through my family’s past years credit card and bank statements, I have found several small money leaks in our personal finances.”

Kristina presents Our Parents Estate posted at Dual Income No Kids, saying, “If your parents are divorced, how has their separation affect the way you have planned your estate?”

Donna Freedman presents Rockin’ the surveys — when it’s worth it. posted at Surviving and Thriving, saying, “Online surveys can be a nice source of extra income — except when they aren’t.”

Joe Plemon presents My Car Needs an Engine. Should I Sell it, Fix it or Junk it? posted at Personal Finance By The Book, saying, “What do you do when your beloved car needs an engine: sell it, fix it or junk it? This post explores the options.”

FMF presents My Type of Couple posted at Free Money Finance, saying, “Story of a couple who collected 400k cans to pay for their wedding.”

Lindy presents Once Upon a Time…I Used an Iron posted at Minting Nickels, saying, “One of the likely first stops in expense-slashing is the luxury of paying for laundered shirts. This is a tale of my ironing saga (yes, it qualifies as a saga). And it’s not as boring as this description sounds. Thanks!”

Sandy presents One Disaster Away posted at Yes, I Am Cheap, saying, “We sometimes pass judgment on others for the financial situation, but most of us need to realize that all it takes is one disaster to be in the same situation.”

Bucksome presents Top 7 Ways I Budget My Time posted at Buck$ome Boomer’s Journey to Retirement, saying, “Budgets are needed for more than money in this story about 7 ways to budget time.”

Tom @ Canadian Finance Blog presents How to Watch Cheap and Free TV in Canada posted at The Canadian Finance Blog, saying, “Want to know how to see free TV in Canada? You have a few options with over the air free HDTV, broadcaster’s websites and cheap services like Netflix!”

Lauren Mendel presents A Very Scary Money Story posted at Richly Reasonable – Successes and failures, all in the name of living reasonably., saying, “This Halloween week read the true, terrifying tale of how Husband and I almost lost literally every important document that we have. Muahahaha! You might want to lock your doors and close the blinds before reading this one…”

Sun presents What’s in My Wallet? posted at The Sun’s Financial Diary.

Money Beagle presents Costco Coupon Policies – Truth or Fiction? You Decide posted at Money Beagle.

ctreit presents Our family budget has to accommodate this chocolate snob posted at Money Obedience, saying, “Name brands versus store brands.”

Rachel presents Sometimes Less Is More | MomVesting posted at MomVesting, saying, “Melinda talks about how the value of many things isn’t necessarily determined by their cost.”

That concludes this edition. Submit your blog article to the next edition of Carnival of Money Stories using the carnival submission form. Past posts and future hosts can be found on the blog carnival index page. Thank you, everyone, for participating!

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

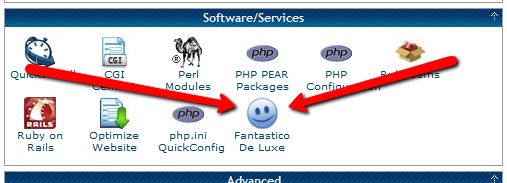

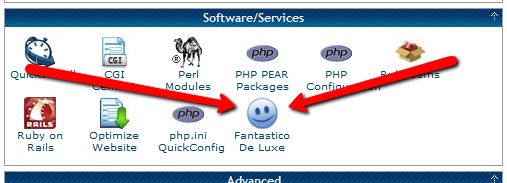

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

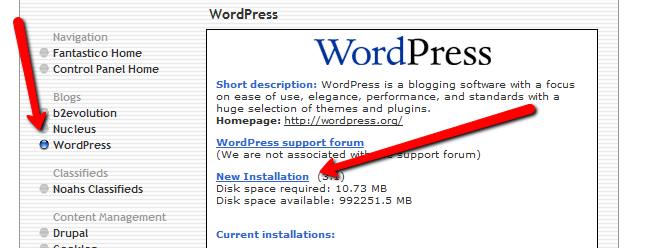

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

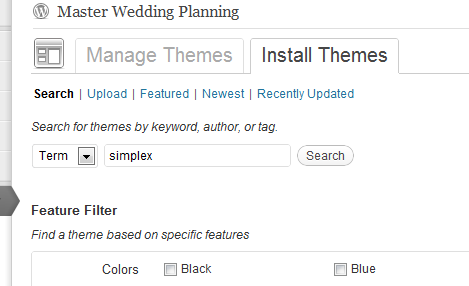

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

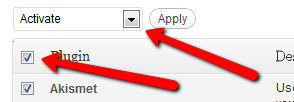

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

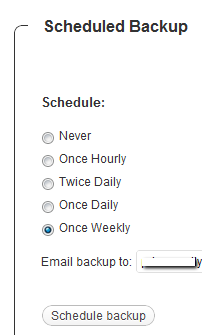

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

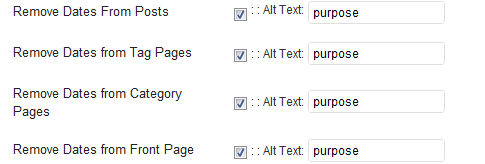

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 7, we’re going to talk about paying off debt.

Until you pay off your debts, you are living with an anchor around your neck, keeping you from doing the things you love. Take a look at the amount you are paying to your debt-holders each month. How could you better use that money, now? A vacation, private school for your kids, a reliable car?

If you’ve got a ton of debt, the real cost is in missed opportunities. For example, with my son’s vision therapy being poorly covered by our insurance plan, we are planning a much smaller vacation this summer–a “staycation”–instead of a trip to the Black Hills. If we didn’t have a debt payment to worry about, we’d have a much larger savings and would have been able to absorb the cost without canceling other plans. The way it is, our poor planning and reliance on debt over the last 10 years have cost us the opportunity to go somewhere new.

The only way to regain the ability to take advantage of future opportunities is to get out of debt, which tends to be an intimidating thought. When we started on our journey out of debt, we were buried 6 figures deep, with a credit card balance that matched our mortgage. It looked like an impossible obstacle, but we’ve been making it happen. The secret is to make a plan and stick with it. Pick some kind of plan, and follow it until you are done. Don’t give up and don’t get discouraged.

What kind of plan should you pick? That’s a personal choice. What motivates you? Do you want to see quick progress or do you like seeing the effects of efficient, long-term planning? These are the most common options:

Popularized by Dave Ramsey, this is the plan with the greatest emotional effect. It’s bad math, but that doesn’t matter, if the people using it are motivated to keep at it long enough to get out of debt.

To prepare your debt snowball, take all of your debts–no matter how small–and arrange them in order of balance. Ignore the interest rate. You’re going to pay the minimum payment on each of your debts, except for the smallest balance. That one will get every spare cent you can throw at it. When the smallest debt is paid off, that payment and every spare cent you were throwing at it(your “snowball”) will go to the next smallest debt. As the smallest debts are paid off, your snowball will grow and each subsequent debt will be paid off faster that you will initially think possible. You will build up a momentum that will shrink your debts quickly.

This is the plan I am using.

A debt avalanche is the most efficient repayment plan. It is the plan that will, in the long-term, involve paying the least amount of interest. It’s a good thing. The downside is that it may not come with the “easy wins” that you get with the debt snowball. It is the best math; you’ll get out of debt fastest using this plan, but it’s not the most emotionally motivating.

To set this one up, you’ll take all of your bills–again–and line them up, but this time, you’ll do it strictly by interest rate. You’re going to make every minimum payment, then you’ll focus on paying the bill with the highest interest rate, first, with every available penny.

This is the plan promoted by David Bach. It stands for Done On Last Payment. With this plan, you’ll pay the minimum payment on each debt, except for bill that is scheduled to be paid off first. You calculate this by dividing the balance of each debt by the minimum payment. This gives you an estimate of the number of months it will take to pay off each debt.

This system is less efficient than the debt avalanche–by strict math–but is better than the snowball. It give you “quick wins” faster than the snowball, but will cost a bit more than the avalanche. It’s a compromise between the two, blending the emotional satisfaction of the snowball with the better math of the avalanche.

For each of these plans, you can give them a little steroid injection by snowflaking. Snowflaking is the art of making some extra cash, and throwing it straight at your debt. If you hold a yard sale, use the proceeds to make an extra debt payment. Sell some movies at the pawn shop? Make an extra car payment. Every little payment you make means fewer dollars wasted on interest.

Paying interest means you are paying for everything you buy…again. Do whatever it takes to make debt go away, and you will find yourself able to take advantage of more opportunities and spend more time doing the things you want to do. Life will be less stressful and rainbows will follow you through your day. Unicorns will guard your home and leprechauns will chase away evil-doers. The sun will always shine and stoplights will never show red. Getting out of debt is powerful stuff.

Your task today is to pick a debt plan, and get on it. Whichever plan works best for you is the right one. Organize your bills, pick one to focus on, and go to it.

Assuming you are in debt, how are you paying it off?

Today is the 33rd anniversary of the death of Elvis, so I’m bringing you the “Elvis is Dead” edition of the Carnival of Personal Finance.

What can the King teach us about finance? The immediate lesson is, of course, to not let success destroy you or your life. Always remember what is important.

“Adversity is sometimes hard upon a man; but for one man who can stand prosperity, there are a hundred that will stand adversity.” -Elvis Presley

Before we get into the carnival, please take a moment to subscribe, either by rss or by email. If you are on twitter, please follow me at @LiveRealNow.

“When I was a child, ladies and gentlemen, I was a dreamer. I read comic books, and I was the hero of the comic book. I saw movies, and I was the hero in the movie. So every dream I ever dreamed has come true a hundred times…I learned very early in life that: ‘Without a song, the day would never end; without a song, a man ain’t got a friend; without a song, the road would never bend – without a song.’ So I keep singing a song. Goodnight. Thank you.”

-From his acceptance speech for the 1970 Ten Outstanding Young Men of the Nation Award. Given at a ceremony on January 16, 1971

Craig Ford from Money Help For Christians presents How to Buy Cars With Cash. This is great advice. My car will be paid off in the next few months and I will be doing exactly this.

FMF from Free Money Finance presents Are Tattoos at Work Really That Acceptable? Do tattoos limit your career? I reference this graphic when thinking about a tattoo.

Pop from Pop Economics presents Getting a raise: The negotiation. It’s always best to raise your top line as high as possible. Bringing in more money is far more effective that simply reducing your expenses.