- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

Making Extra Money Part 3: Product Selection

When you’re setting up a niche site, you need to monetize it. You need to have a way to make money, or it’s a waste of time.

There are two main ways to do that: AdSense or product promotion. To set up an AdSense site, you write a bunch of articles, post them on a website with some Google ads, and wait for the money to roll in.

I don’t do that.

I don’t own a single AdSense site and have never set one up. This article is not about setting up an Adsense site.

My niches site are all product-promotion sites. I pick a product–generally an e-book or video course–and set up a site dedicated to it.

Naturally, picking a good product is an important part of the equation.

The most important part of product selection is that the product has an affiliate program. Without that, there’s no money to be made. There are a lot of places to find affiliate programs. Here are a few:

- Amazon. If you don’t live in one of the states that Amazon has dropped in retaliation for passing laws that attempt to circumvent the Supreme Court’s ruling on collecting sales tax, you can sign up as an associate and collect a commission on every referral you send that turns into a purchase. That means you have a lot of product to choose from. Unfortunately, your commission is small, so you need to promote fairly expensive products to get a decent return. On the other hand, people trust Amazon, so that’s one less hurdle to making a sale.

- Commission Junction. These are the people managing affiliate programs for a large number of credit cards and banks. If you’ve opened an account with INGDirect through one of my links, I got a commission for the referral. (Thank you!) They have a lot of other products, too.

- e-Junkie. This one is a popular distribution system for bloggers. It’s likely that, if you’ve bought an ebook from a blogger, e-Junkie handled the fulfillment process. A lot of the products available there have an affiliate program, but that is up to the owner of the product.

- ClickBank. My favorite. This is one of the largest affiliate networks specializing in electronic products, whether that’s membership sites, ebooks, or video courses. Commissions are good, often 50-75%. They also offer a 60 day guarantee of every product sold through their site, which helps soothe the wary customer. This is the site I’ll be using for this series.

The first thing you need to do is sign up for whichever program you intend to use.

If you’re not going with Clickbank, feel free to skip ahead to the section on keyword research.

Once you are signed up and logged in, click on the “Marketplace” link at the top of the screen.

From here, it’s just a matter of finding a good product to sell. Here are the niches we’re going to be looking for:

- Back pain

- Bankruptcy

- Conflict resolution at work

- Detox diets

- Fat kids

- Foreclosure avoidance

- Job hunting

- Weddings

- Writing sales copy

I’m going to look for one or two good products in each niche. When that’s done we’ll narrow it down by consumer demand.

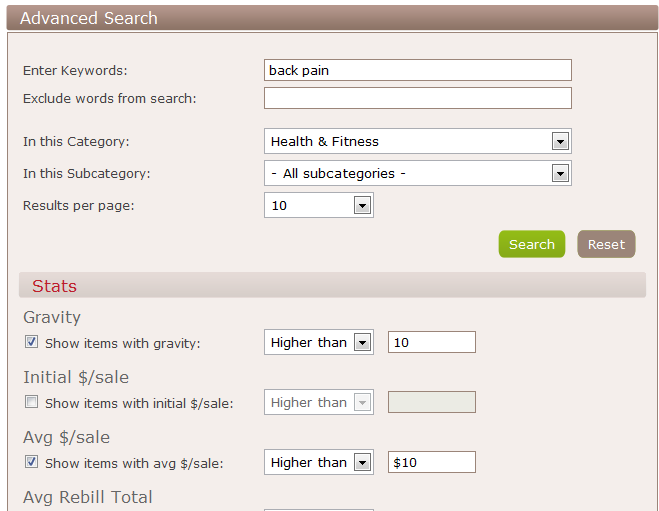

For now, go to advanced search.

Enter your keyword, pick the category and set the advanced search stats. Gravity is the number of affiliates who have made sales in the last month. I don’t like super-high numbers, but I also want to make sure that the item is sellable. Over 10 and under 50 or so seems to be a good balance.

The average sale just ensures that I’ll make a decent amount of money when someone buys the product. I usually aim for $25 or more in commissions per sale. Also, further down, check the affiliate tools box. That means the seller will have some resources for you to use.

This combination will give us 36 products to check out for back pain, unfortunately, none of the results are for back pain products. After unchecking the affiliate tools and setting the gravity to greater than 1, I’ve got 211 results. Sorting by keyword relevance, I see three products, two of which look like something I’d be interested in promoting. One has a 45% commission, the other is 55%. The X-Pain Method has an initial commission of $34 and claims a 5% refund rate. Back Pain, Sciatica, and Bulging Disc Relief pays $16, which will make it a potentially easier sale. I’ll add both to the list for further research.

I’m not going to detail the search for the rest of the niches. That would be repetitive. You can see my selections here:

- Back pain – X-Pain Method; Back Pain, Sciatica, and Bulging Disc Relief

- Bankruptcy – I’m dropping this one from the list. It’s too complicated and deserves an attorney. I don’t know enough about the topic to make sure it is up to date.

- Conflict resolution at work – Management Training: By the Book; Anger Management for the 21st Century

- Detox diets – Master Cleanse Secrets: 10 Day Diet; Master Cleanse Insider; Eating for Energy: Raw Food Diet for Weight Loss

- Fat kids – I’m dropping this one, too. A kid’s health is too important. I don’t want to sell a dangerous or unethical product.

- Foreclosure avoidance – How to Stop Foreclosure in 7 Days Flat; Foreclosure Defense Secrets

- Job hunting – Guerrilla Resumes; Amazing Cover Letters

- Weddings – All Types of Wedding Speeches; The Master Wedding Planning Guide; Amazing Wedding Planning

- Writing sales copy – Instant Swipe File; Ad Copy Creator Pro; How to Write Killer Copy

Now we’re going to go through a few steps for each of these products.

The Sales Page

We need to make sure the sales page doesn’t suck. If the site doesn’t work, is hard to read or navigate, has a hard-to-find order button, or just doesn’t look professional, it’s getting cut.

- Raw Foods is eliminated. The sales video is horrible and the order link is at the bottom of several screens worth of nothing. It’s a crap site.

- The 7 day foreclosure-avoidance product is out. Site’s down today. I want reliability.

- Management Training By The Book is out. I don’t like typos on the sales page, especially in the page title.

The Email List

If it has an email subscription form, we’ll need to subscribe, then double-check to make sure our affiliate information isn’t getting dropped in the emails. If it is, the seller is effectively stealing commissions. In the interest of time and laziness, I’m going to eliminate anyone pushing for an email subscription. It’s harder–and time-consuming–to monitor that. On of my niche site had a seller completely drop their product. Instead, they pushed for email subscriptions so they could promote other products as an affiliate. Absolutely unethical.

- Wedding speeches is eliminated for throwing a mandatory email entry into the order process. There’s no guarantee they are up to anything shady, but I’m taking the simple route.

Checkout and Credit

Finally, we’re going to visit the checkout page. You need to do this from every links in the newsletter and the links on the sales page, just to make sure you’ll get your money.

The way to tell who’s being credited is to look at the bottom of the order page, under the payment information. It should say [affiliate = xxx] where xxxis your ClickBank ID. Anything else, and the product gets cut from the list.

When you are checking these, don’t click on every possible link at once. That confuses the cookies. Do one at a time. I tried to do it in one batch for this post and lost half of the cookies. If it weren’t for the fact that I already own one of the products and bought it through my own link and got credited, I would have been talking undeserved trash about thieving companies.

Other Factors

Sometimes, when you’re examining a product, it just doesn’t feel right. When that happens, drop it. There are millions of other products you can promote. In this case, I’m dropping the anger management program because, in my experience, angry people don’t think they are the problem. Here’s a life tip: If everyone else is a jerk, the problem probably isn’t everyone else.

- Another important factor is the sales page itself. If it doesn’t make you want to buy the product, why would anyone else?

- Amazing Cover Letters is eliminated because it’s too easy to overlook the buy link. If I have to hunt for it, it’s losing customers.

- Amazing Wedding Planning is getting eliminated because I don’t like the sales page. The buy link is easy to overlook, and it doesn’t compel me to buy.

Now we’re down to 10 products in 6 niches. At this point, we’re comfortable with the sales pages and we know that they are crediting commissions. As it stands right now, all of the products are worth promoting.

- Back pain – X-Pain Method; Back Pain, Sciatica, and Bulging Disc Relief

- Detox diets – Master Cleanse Secrets: 10 Day Diet; Master Cleanse Insider

- Foreclosure avoidance – Foreclosure Defense Secrets

- Job hunting – Guerrilla Resumes

- Weddings – The Master Wedding Planning Guide;

- Writing sales copy – Instant Swipe File; Ad Copy Creator Pro; How to Write Killer Copy

We’ll make the final determination after doing some heavy keyword research in the next installment. That’s where we’ll find out how hard it is to compete.

Any questions?

Black Friday Mayhem

On Friday, I pepper-sprayed a small crowd of people so I could get a cheap XBox 360.

On Friday, I slept in a bit, had some breakfast, and played with my kids. I only shopped at stored whose name ended in “.com”, and didn’t do much of that.

My wife, on the other hand, couldn’t resist the siren call of the sales. Not that I fought it.

We’ve been planning to replace an old, failing TV for a while. Friday turned into a good day to pick up a high-definition, widescreen(not a big screen) TV. The paper said that sale started at 10PM, so my wife got there early enough to get in line and find out the sale actually started at midnight. She and my brother took turns standing in line while the other shopped.

In my mind, shopping major sales early in the morning with 5000 people who wish they’d have thought of bringing pepper spray is just an example of Hell beta-testing a new level of pain.

At one store, she said the customers were elbowing each other out of the way to get some scrapbooking gadget hanging on a display, so my wife ducked down to grab the extras off of the bottom shelf, reaching between people’s legs to do so. Certainly smarter than the competition, but still nuts.

She left the house at 9, shopped until about 2, came home to sleep for a couple of hours, then went out to hit the 5AM sales for round 2. She left with a budget of a few hundred dollars to pick up our new TV, finish our Christmas shopping, a bunch of scrapbooking stuff, and a new winter jacket for one of our brats.

12 hours and $830 later, she was done.

That was just under twice our budget.

That’s like going out for cocktails and waking up in the bathroom of a Tijuana cathouse, covered in ice, with a new social disease and no kidneys. Sure, you probably had a good time, but was it worth it?

Thankfully, we are at a place where this money is coming out of our debt snowball, not accumulating more debt.

Unfortunately, this is going to cost us a month of our debt repayment plan.

Black Friday just isn’t worth it. Yes, you can find some huge deals, but you’ve got to fight rude crowds and the risk of buying more than you intended is very real. Next year, it’s not going to happen at our house. If my wife insists, she’ll do the shopping with cash. We can’t afford to do it this way again.

How did your Black Friday go?

Getting Out of Debt: The Prime Rule

The American Dream has been perverted. Life, liberty, and the pursuit of happiness has been cruelly warped to mean

“Toys, free stuff provided at the expense of others, and the ability to buy and do anything I want without regard for the consequences.” To fund this horrible new dream, the people who can’t convince a government program to finance it for them often turn to credit. Credit is the art of putting your future into hock for something that you probably don’t need or want and that won’t work by the time you are finished making payments.

Ick. I’ve chosen not to live my life that way. Every day, more people are waking from the consumerism fog and deciding to reel their lifestyles back in and take control of their lives. They take a look at the world around them, compare it to their check register, and realize that it’s just not sustainable. You can’t survive on credit forever. Eventually, you will realize that there isn’t enough money to continue to buy things today on tomorrow’s paycheck.

What’s the first thing you should do when you decide that a “normal” life—a life in debt—isn’t the way you are going to live your life?

Well, when you find yourself standing in a grave, stop digging. You can’t dig yourself out of a hole and you can’t borrow your way out of debt. If you want to get out of debt, you need to stop using more debt. Period.

It may seem impossible, and the people around you may try to convince you that you are crazy. It is not impossible, just time-consuming. Short of finding an insane amount of money hiding under your front step or a winning lottery ticket blowing across the sidewalk, there are no shortcuts to getting out of debt. It’s just a matter of making the payments and not using more credit.

As far as the haters, screw ‘em. They are brainwashed into thinking their unsustainable and insane lifestyle is not only normal, but necessary. You don’t get life advice in a padded room, and you don’t plan your finances with a debt-addict.

Getting out of debt is a simple process, but that doesn’t make it easy. It only has two real steps: stop using debt, and keep making the payments.

3 Reasons You Hate Your Budget

- Image via Wikipedia

One of the first steps in clearing up your financial mess is to set up a budget. You need to figure out how much money you are making, how much you are spending, and what you can do to keep one of those numbers smaller than the other. If your income is smaller than your expenses, you’ve got work to do. If not, yay!

Even if you don’t obsessively cling to your spreadsheets and calculator, you need to spend the time to establish a budget–at least once–to know where you stand. When you do, you’ll find out it sucks. With good reason.

1. It takes too long to set up. Setting up a budget can be a long, drawn-out pain in the butt. Fortunately, it doesn’t have to be, but you won’t know that until after you make your first budget, then see some fairly drastic changes, and make a second budget. That one will be easier. For the first one, just concentrate on making a list of all of you regular bills and how often they are due. Don’t be surprised when you miss some. I missed a couple of our quarterly bills. All told, it took a year to get our budget completely done.

2. It doesn’t lie. Once you have all of your expenses down on paper, you are done hiding. You can’t tell yourself it’s all puppy dogs and ice cream when you are staring at the giant red pit that is the negative balance of your bad decisions. Nobody likes the messenger who brings bad news. When your budget shows you how big the hole is, you are going to hate it. That’s when it’s time to confront the problem head on and get out of the hole. Find the problems and rip ’em out. Cancel the cable, taxidermize the cats, and start buying generic underpants. It’s time to take an honest look at your situation. If you can’t handle where you are, how are you going to get where you want to be?

3. It’s not fun. When your friends go out, but you stay home because you’re broke, you will hate it. Y’ou’re also gonna hate comparing your old cell phone to the iPhone in the hands of the d-bag contemplating bankruptcy. Like Dave Ramsey says, “Live like no one else, so that later you can live like no one else.” Skipping some of the fun now will turn into security later. When you get to that point, it will have all been worth it.

Why do you hate your budget?

Budgeting tips – sticking to your budget

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.