- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

First 3 Things to Do in the New Year

- Image by iowa_spirit_walker via Flickr

With the new year looming, it’s the perfect time to review the things that may not have gone as well as planned in the current year, and plan ahead for the coming year, to make sure things go well from now on.

To get a good start in the new year, you should focus on three things.

1. Budget.

A good budget is the basis of every successful financial plan. If you don’t have a budget, you have now way of knowing how much money you have to spend on your necessities or you luxuries. Do you really want to guess about whether or not you can afford to get your car fixed, or braces for your kid? I’ve gone over all of the essentials to make a budget before. Now is the perfect time to review that series and make sure your own budget is functional and ready for the new year.

At the same time, spend some time thinking about how your what has gone wrong with your budget over the previous year. In my case, when we got back from vacation in August, our mindset had changed a bit about spending money, and we got out of the habit of staying strictly on budget. By the time we got back on track, it was Christmas and our plans got shot, again. If it weren’t for my side hustles–money that I don’t track in the budget because the money isn’t consistent, yet–we would have had some serious problems this fall. Where have you gone wrong, and what could you do to improve next year?

2. Credit Cards and New Debt.

In the new year, if you haven’t already done so, make sure you throw your credit cards away. The most basic law of debt reduction is, “If you don’t stop using debt, you’ll never be out of debt.” That’s why you need to set up your budget first. Make sure that your expenses are less than your income, so you can make ends meet without having to charge the difference.

How has your debt use worked out over the last year? Have you used it at all, or have you eliminated the desire to pay interest? What have you used your credit cards for? How much of that could you have done without?

3. Estate Planning.

Now is the time to make sure that all affairs are in order, if the worst should happen. If you die, what happens to your money? Your kids? I’ve gone over everything you need in an estate plan before, so I won’t beat that horse again. You owe it to your family to make sure they are taken care of if something should happen to you. At a bare minimum, write a will and get it notarized.

Have you putting off writing your will? You know you need one, but it’s a morbid thought, so it’s easy to put off, right? Get over it. If you love your family, you’ll do better and get your affairs together next year.

That’s a good financial start for 2011. What are you missing in your financial life?

How to Cut Costs on Legal Fees

Occasionally, life goes truly pear-shaped and you’re forced to enter the legal system.

Even if you’re not embroiled in a tawdry, tabloid-fodder divorce, there are still legal issues that everyone needs to address, without exception.

The problem? Or rather, one of many, if you’re having legal problems?

Lawyers are expensive.

Before I go any further:

- If you are having criminal court issues, get a lawyer. Get the best possible lawyer. Really. The cost does not compare to a lifetime in jail, or even 10 years. If you’re facing jail, get the best dang attorney you can find.

- I am not only not an attorney, but I’ve never even played one on TV. I have driven past a law school a couple of times, but never stopped in. I do know several attorney, carry the business cards of a couple and have a couple on my speed dial, just in case. If any of them thought I was giving legal advice, I’d be in trouble. To reiterate: I am not an attorney. This is not legal advice.

- Don’t do a prenuptual agreement at home. A prenup will almost always be found unenforceable if both parties don’t have an attorney.

Where was I? Ah, yes. Lawyers are expensive, but there are ways to mitigate that.

There a couple of things you can handle yourself.

Small claims court, also known as conciliation court. Typical cases in conciliation court include cases involving sums under $7500(varies by state) that involve unpaid debts or wages, claims by tenants to get a security deposit, claims by landlords for property damage, or claims about possession or ownership of property. Fees and procedures vary by state, but generally cost less than $100 to file. The procedures for your state can be found by googling “small claims court” and the name of your state.

Small worker’s compensation cases can be handled yourself, if they don’t involve a demotion or termination related to the injury.

Apartment and car leases are usually simple and straightforward. Read them carefully, but you probably won’t need a lawyer.

You can probably handle your own estate planning and will writing with some decent software. I love Quicken Willmaker. It walked me through a detailed will that takes care of my kids, and gave me advice on financing their futures in the horrible event that I am tragically killed before my wonderousness can fully permeate the world. It also contains forms for promissory notes, bills of sale, health care directives and more. If you have extensive property, I’d still seek an attorney’s advice, but I’d bring the Willmaker will with me to save some time and money.

Purchase agreements. A few years ago, I sold a truck to a friend and accepted payments. I made a promissory note and payment schedule. When he quit paying or calling me, that paperwork was enough to get the state to accept the repossession when I took the truck back.

A simple no-fault divorce is actually pretty painless, on the scale of divorce pain. Again, the procedures vary heavily by state.

Other resources for finding legal information free or cheap include www.legalzoom.com and www.nolo.com.

Have you had to do any of your own legal work? How did it work out?

Saturday Roundup – No More Car

- Image via Wikipedia

…err, no more car loan. I paid off my car this week, a year early! Now I’m down to 2 debts: a credit card with an embarrassingly high balance and my mortgage. We’re rocking the debt snowball!

Free Money Tip

INGDirect is having a sweet promotion. Open a checking account, use it three times in 45 days, and get $50 free. Free money is the best kind. I love my ING account and keep all of my savings there. If you don’t have an account there, yet, now is a great time to open one.

30 Day Project Update

This month, I am trying to establish the Slow Carb Diet as a habit. At the end of the month, I’ll see what the results were and decide if it’s worth continuing. For those who don’t know, the Slow Carb Diet involves cutting out potatoes, rice, flour, sugar, and dairy in all their forms. My meals consist of 40% proteins, 30% vegetables, and 30% legumes(beans or lentils). There is no calorie counting, just some specific rules, accompanied by a timed supplement regimen and some timed exercises to manipulate my metabolism. The supplements are NOT effedrin-based diet pills, or, in fact, uppers of any kind. There is also a weekly cheat day, to cut the impulse to cheat and to avoid letting my body go into famine mode.

I’m measuring two metrics, my weight and the total inches of my waist , hips, biceps, and thighs. Between the two, I should have an accurate assessment of my progress.

Weight: I have lost 17 pounds since January 2nd. That’s 6 pounds since last week. I cheated this week and had a slice of toast and 6 croutons with my grilled chicken-but-no-cheese salad.

Total Inches: I have lost 9 inches in the same time frame, down 3.5 since last week.

Naturally, the first week is the most dramatic. That’s when my body was flushing most of the garbage I’d been eating, including holiday feasts. I’ll have a hard time complaining about 6 pounds in a week. My guess is that I drop another 10-15 pounds by the end of the month, bringing the average to about 1 pound per day. Over time, that will drop as my base caloric burn drops to match my new weight.

Best Posts

Realized Returns is giving away a Kindle. I would greatly appreciate it if you didn’t enter, because I’d love to get a Kindle.

Maximizing Money has put together a stellar list of financial blogs. If I’m not enough to keep you going, take a look at that list.

Mystery shopping sounds like it could be such a sweet deal for some people. Always try to make money doing what you love.

Here is another list of sites that can make you some money. I love side hustles.

And finally, here is Lifehacker, showing you how to make better cocoa.

LRN Timewarp

This is where I review the posts I wrote one year ago.

I wrote a post on saving money while cooking. This post has easily withstood the test of time. We keep getting better at stretching our budget. Over the last year, we’ve actually reduced our food budget by an additional $50 per month, while the quality of our meals has gone up.

This was the first week I posted a 30 Day Project update. My first goal was to start waking up at 5AM. That worked well for almost the entire year, but I’ve let that slack off over the last few months. On the weekends, I don’t set an alarm or try to get up early, but I’m still up by 7:30, usually. During the week, my alarm goes off at 5:10, but I let myself snooze it. I’ve discovered that I do better at attending to my personal projects(like blogging) late at night instead of early in the morning. So, I’m going with what works, instead of trying to force what doesn’t.

I also reviewed the bills I pay that aren’t paid monthly in my third budget lesson.

Carnivals I’ve Rocked and Guest Posts I’ve Rolled

First 3 Things to Do in the New Year was included in Crystal’s rockin’ new Total Money Carnival.

4 Ways We Keep Wasting Money was included in the Festival of Frugality.

Living the XBox Life on an Atari Income was included in the Carnival of Personal Finance.

Swamp Finance was hosted by Squirrelers.

I ran the guest post, The Best Financial Advice I Ever Received for Saving Money Today.

Thank you! If I missed anyone, please let me know.

Get More Out of Live Real, Now

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

That’s all for today. Have a great weekend!

5 Pain-Free Ways to Save Your Money

Everyone needs an emergency fund. More than that, you will eventually need retirement savings, a new car, a big-screen TV, or maybe just a new kidney. Whatever the reason, one day, have a comfortable savings account will make your life easier.

But, Jason, you say, it’s hard to save money! How can I start saving when I can’t make ends meet? I’ve got rent, 9 kids, and a DVD addiction that won’t quit. My mortgage is underwater, my Mercedes still has 8 years on the loan, and the Shoe-of-the-Month Club only carries Christian Louboutin’s. What can I do?

Well, I’ll reply, since I am Jason and you asked for me by name, you need to find a way to make it happen. I’d never recommend someone give up their diamond-studded kicks, but something’s gotta give. In the meantime, there are some ways you can save money without feeling the sting of delayed gratification.

1. Save your raise. When you get your next raise, pretend you didn’t. Set up an automatic transfer to stick that new 5% straight into a savings account. Don’t give yourself an opportunity to spend it.

2. Find it, hide it. When your Aunt Gertrude dies and leaves your her extensive collection of California Raisins figurines, sell them and save the money. If you find a $20 bill on the ground, throw it right into your savings account. When your 30th lottery ticket of the week gives you a $10 prize, save it! Don’t waste found money on luxuries. Use it to build your future.

3. Let it lapse. Do you have magazine subscriptions you never read? Or a gym membership you haven’t used since last winter? Panty-of-the-Month? Crack dealer who delivers? Stop paying them! Let those wasted services fall to the wayside and put the money to better use. I don’t mean flipping QVC products on eBay, either. Save the money.

4. Jar of 1s. Roughly once a week, I dig through my pockets and my money clip looking for one dollar bills. Any that I find go in a box to be forgotten. I use that box as walking-around money for our annual vacation, but it could easily get repurposed as a temporary holding tank for money I haven’t gotten to the bank, yet.

5. Round it up. Do you balance your checkbook? If you don’t, start. If you do, start doing it wrong. Round up all of your entries to the nearest dollar. $1.10 gets recorded as $2. $25.75 goes in as $26. If you use your checkbook or debit card 100 times a month, that’s going to be close to $75 saved with absolutely no effort. It even makes recording your spending easier.

There you have it, 5 easy ways to save money that won’t cause you a moment’s pain.

Do you have any tricks to help you save money?

Make Extra Money Part 2: Niche Selection

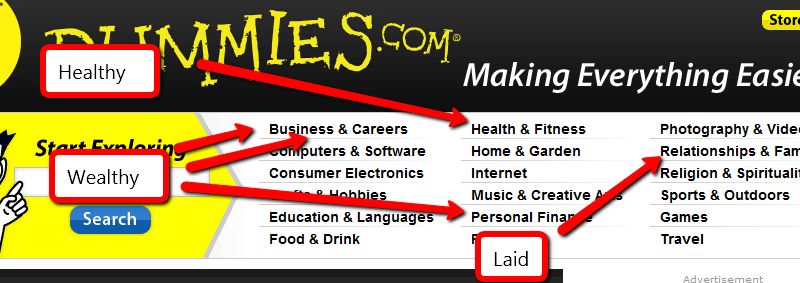

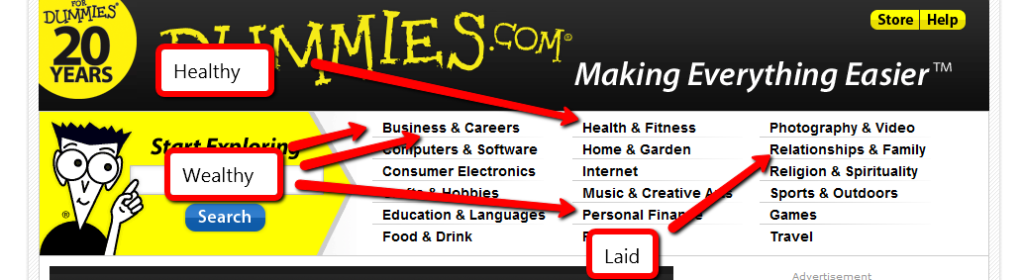

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

- Back pain

- Bankruptcy

- Conflict resolution at work

- Detox diets

- Fat kids

- Foreclosure avoidance

- Job hunting

- Weddings

- Writing copy

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.