I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

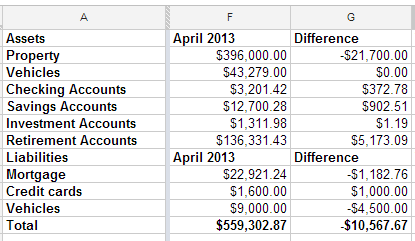

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

You have come so far! 🙂 And we sort of decided to pay off the mortgage 2 months early by stealing from our savings that was supposed to be for Roth IRA’s, so we cheated. 😉 But see you in Texas sometime anyway! 😀

Nice Net worth! I’ll be in the half-a million club soon 🙂

Just curious, why would have you $15,000 sitting in bank accounts when you owe $1,600 in credit card debt (probably charging close to 19% interest) and a $9,000 vehicle loan, when you could simply pay off those debts now?

I understand people like to have a safety cushion for their own comfort levels, but $15,000 just sitting there doing nothing in a bank? If you even just wiped out the credit card debt, that would eliminate added interest while keeping your net worth the same.

Everyone has different opinions on “emergency funds”. But personally, I would wipe out your easy credit card and car loan debt with the bank accounts. Then recoup your accounts after. What about your emergency fund? Get a 15,000 line of credit and your safety net is there if you need it. In the mean time, your money is working for you rather than the bank using to make money (by loaning it back to you for your mortgage) 😉

The credit card is easy to explain. There’s a scheduled payment each month to pay that off. Part of the $15,000 is already scheduled to take care of that. I don’t remember the last time I gave the credit card any interest money. I think it’s 9%, but it really doesn’t matter since I don’t pay it.

The rest is targeted for savings goals and necessities. We’ll be paying $5000 in property taxes next month. One of my kids will be getting braces this summer. We’re building a cushion for expenses at the rental property.

It doesn’t always make sense to zero out a bank account to eliminate debt. We are on a hyper-accelerated repayment schedule for the car loan. Our first payment on a $21,000 loan was in December. When tomorrow’s payment clears, we’ll be down to about $5600.