Welcome to the New Year. 2013 is the year we all get flying cars, right?

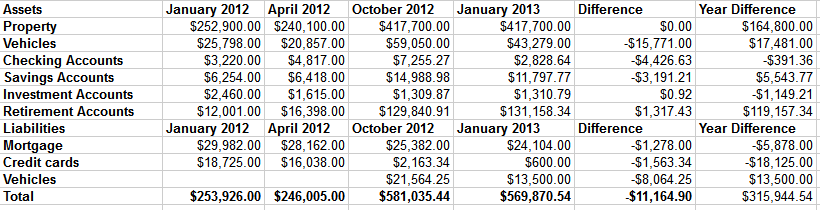

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

I think keeping the inherited property as an income property is an excellent idea. You can always sell it later (most properites go up in value), in the meantime you are making another income from the rent.

Wow, glad we made a mortgage payoff race bet and not one about Net Worths. 🙂 Ours is just above $300k. Good luck with the rental house!

Hi Jason, I certainly agree with the choice of renting if Warren Buffet has taught us anything it is never to sell unless absolutely necessary!